| – Preliminary Working Draft Subject to Material Revision – Project Telluride Discussion Materials October 11, 2024 |

| 1 – Preliminary Working Draft Subject to Material Revision – Disclaimer This presentation has been prepared by Centerview Partners LLC (“Centerview”) for use solely by the Special Committee of the Board of Directors of Telluride, Inc. (“Telluride” or the “Company”) in connection with its evaluation of proposed strategic alternatives for Telluride and for no other purpose. The information contained herein is based upon information supplied by or on behalf of Telluride and publicly available information, and portions of the information contained herein may be based upon statements, estimates and forecasts provided by Telluride. Centerview has relied upon the accuracy and completeness of the foregoing information, and has not assumed any responsibilityfor any independent verification of such information or for any independent evaluation or appraisal of any of the assets or liabilities (contingent or otherwise) of Telluride or any other entity, or concerning the solvency or fair value of Telluride or any other entity. With respect to financial forecasts, Centerview has assumed that such forecasts have been reasonably prepared on bases reflecting the best currently available estimates and judgments of the management of Telluride as to the future financial performance of Telluride, and at your direction Centerview has relied upon such forecasts, as provided by Telluride’s management, with respect to Telluride. Centerview assumes no responsibility for and expresses no view as to such forecasts or the assumptions on which they are based. The information set forth herein is based upon economic, monetary, market and other conditions as in effect on, and the information made available to us as of, the date hereof, unless indicated otherwise and Centerview assumes no obligation to update or otherwise revise these materials. The financial analysis in this presentation is complex and is not necessarily susceptible to a partial analysis or summary description. In performing this financial analysis, Centerview has considered the results of its analysis as a whole and did not necessarily attribute aparticular weight to any particular portion of the analysis considered. Furthermore, selecting any portion of Centerview’s analysis, without considering the analysis as a whole, would create an incomplete view of the process underlying its financial analysis. Centerview may have deemed various assumptions more or less probable than other assumptions, so the reference ranges resulting from any particular portion of the analysis described above should not be taken to be Centerview’s view of the actual value of Telluride. These materials and the information contained herein are confidential, were not prepared with a view toward public disclosure, and may not be disclosed publicly or made available to third parties without the prior written consent of Centerview. These materials and any other advice, written or oral, rendered by Centerview are intended solely for the benefit and use of the Special Committee of the Board of Directors of Telluride (in its capacity as such) in its consideration of strategic alternatives, and are not for the benefit of, and do not convey any rights or remedies for any holder of securities of Telluride or any other person. Centerview will not be responsible for and has not provided any tax, accounting, actuarial, legal or other specialist advice. These materials are not intended to provide the sole basis for evaluating strategic alternatives, and this presentation does not represent a fairness opinion, recommendation, valuation or opinion of any kind, and is necessarily incomplete and should be viewed solely in conjunction with the oral presentation provided by Centerview. |

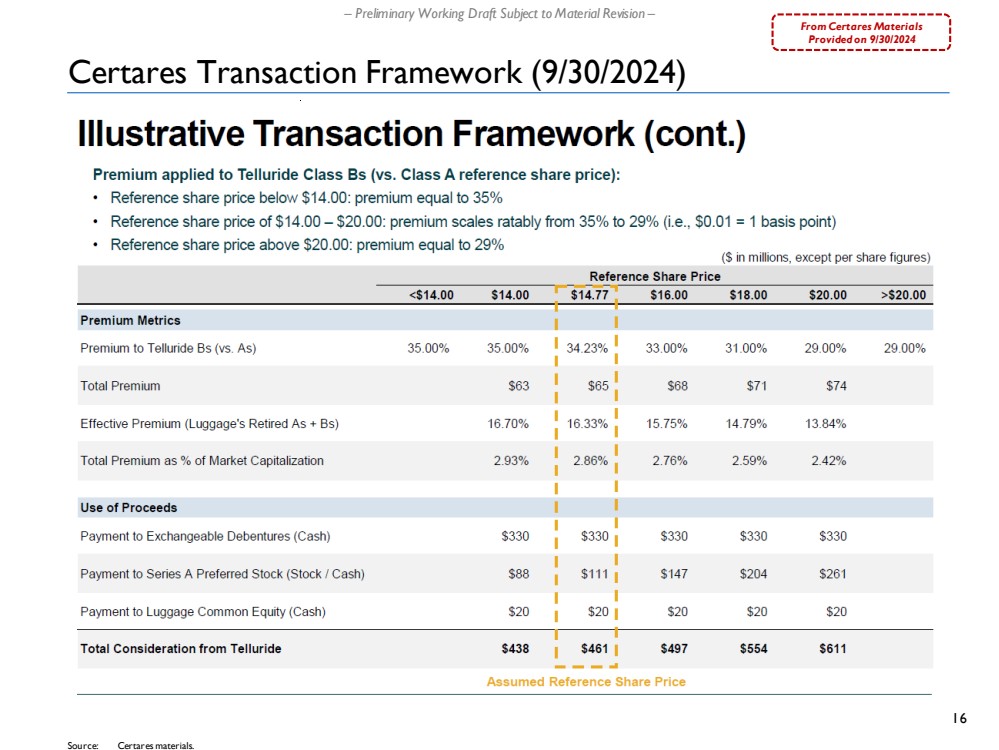

| 2 – Preliminary Working Draft Subject to Material Revision – Executive Summary ▪ Since the July Board update, discussions have continued between Telluride, Luggage and Certaresregarding a potential transaction whereby Telluride would acquire Luggage and eliminate its dual-class share structure – Addresses questions regarding impact of Luggage control – Aligns voting and economic ownership for all shareholders with potential to expand the shareholder base ▪ On September 30, Certares provided a framework assuming premia as a function of Telluride’s share price – At Telluride share prices below $14, assumed fixed premium for Telluride’s Class B shares of 35% – At Telluride share prices between $14 and $20, assumed the premium for Telluride’s Class B shares steps down by (100 bps) per every $1 increase in Telluride’s share price; fixed premium of 29% above $20/sh – Consideration to Certares of 50% / 50% cash / stock, subject to a cap on the amount of stock issued that would result in Certares owning no more than 5% of pro forma Telluride ▪ Based on discussions between the Special Committee and advisors, a counter-framework has been drafted with a preference to: – Limit total cash outlay by Telluride to $435mm (excluding transaction fees) – Limit new share issuance to Certaresto less than 5% of Telluride basic shares outstanding |

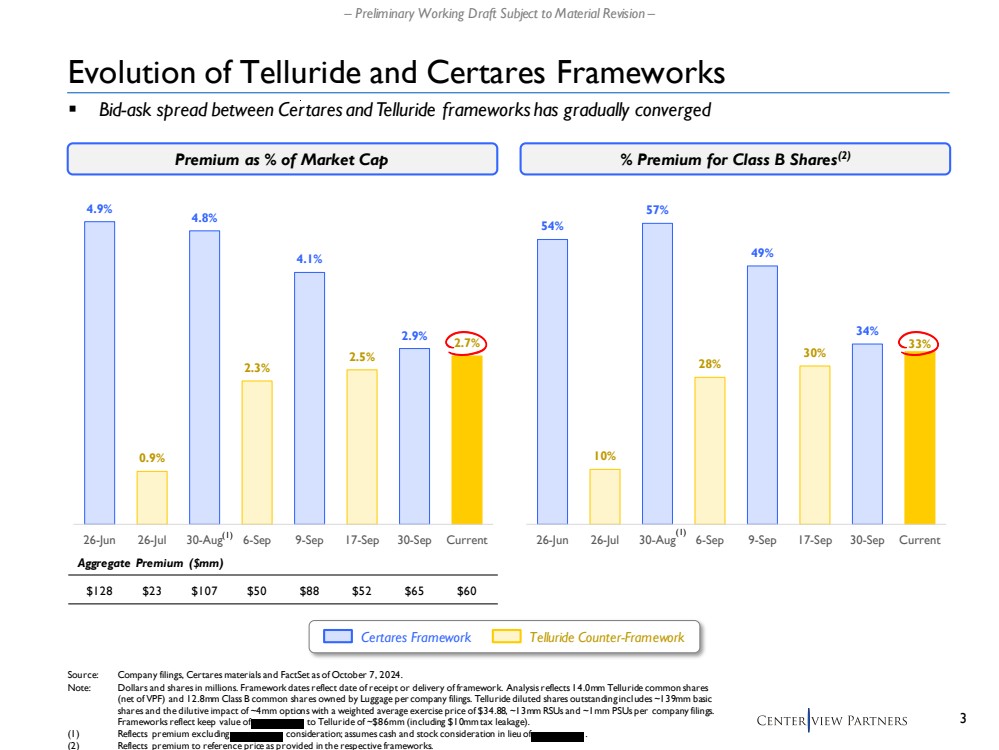

| 3 – Preliminary Working Draft Subject to Material Revision – 54% 57% 49% 34% 10% 28% 30% 33% 26-Jun 26-Jul 30-Aug 6-Sep 9-Sep 17-Sep 30-Sep Current 4.9% 4.8% 4.1% 2.9% 0.9% 2.3% 2.5% 2.7% 26-Jun 26-Jul 30-Aug 6-Sep 9-Sep 17-Sep 30-Sep Current Evolution of Telluride and Certares Frameworks Premium as % of Market Cap % Premium for Class B Shares(2) Source: Company filings, Certares materials and FactSet as of October 7, 2024. Note: Dollars and shares in millions. Framework dates reflect date of receipt or delivery of framework. Analysis reflects 14.0mm Telluride common shares (net of VPF) and 12.8mm Class B common shares owned by Luggage per company filings. Telluride diluted shares outstanding includes ~139mm basic shares and the dilutive impact of ~4mm options with a weighted average exercise price of $34.88, ~13mm RSUs and ~1mm PSUs per company filings. Frameworks reflect keep value of to Telluride of ~$86mm (including $10mm tax leakage). (1) Reflects premium excluding consideration; assumes cash and stock consideration in lieu of . (2) Reflects premium to reference price as provided in the respective frameworks. ▪ Bid-ask spread between Certares and Telluride frameworks has gradually converged (1) (1) Certares Framework Telluride Counter-Framework Aggregate Premium ($mm) $128 $23 $107 $50 $88 $52 $65 $60 |

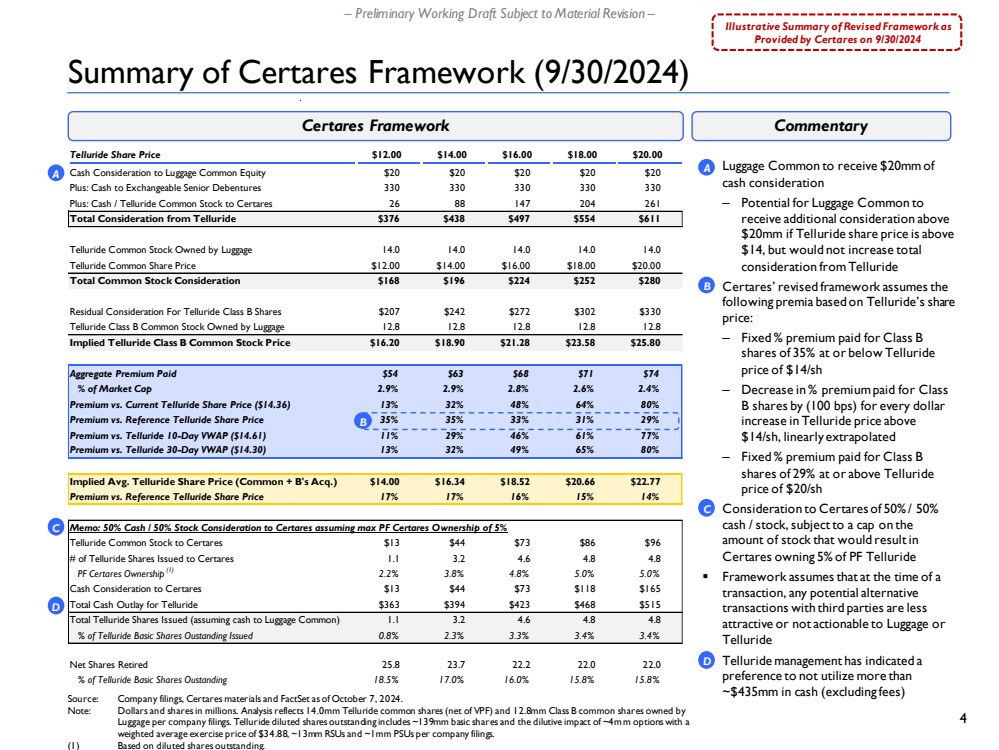

| 4 – Preliminary Working Draft Subject to Material Revision – ▪ Luggage Common to receive $20mm of cash consideration – Potential for Luggage Common to receive additional consideration above $20mm if Telluride share price is above $14, but would not increase total consideration from Telluride ▪ Certares’ revised framework assumes the following premia based on Telluride’s share price: – Fixed % premium paid for Class B shares of 35% at or below Telluride price of $14/sh – Decrease in % premium paid for Class B shares by (100 bps) for every dollar increase in Telluride price above $14/sh, linearly extrapolated – Fixed % premium paid for Class B shares of 29% at or above Telluride price of $20/sh ▪ Consideration to Certaresof 50% / 50% cash / stock, subject to a cap on the amount of stock that would result in Certares owning 5% of PF Telluride ▪ Framework assumes that at the time of a transaction, any potential alternative transactions with third parties are less attractive or not actionable to Luggage or Telluride ▪ Telluride management has indicated a preference to not utilize more than ~$435mm in cash (excluding fees) Summary of Certares Framework (9/30/2024) Source: Company filings, Certares materials and FactSet as of October 7, 2024. Note: Dollars and shares in millions. Analysis reflects 14.0mm Telluride common shares (net of VPF) and 12.8mm Class B common shares owned by Luggage per company filings. Telluride diluted shares outstanding includes ~139mm basic shares and the dilutive impact of ~4mm options with a weighted average exercise price of $34.88, ~13mm RSUs and ~1mm PSUs per company filings. (1) Based on diluted shares outstanding. Certares Framework Commentary Telluride Share Price $12.00 $14.00 $16.00 $18.00 $20.00 Cash Consideration to Luggage Common Equity $20 $20 $20 $20 $20 Plus: Cash to Exchangeable Senior Debentures 330 330 330 330 330 Plus: Cash / Telluride Common Stock to Certares 2 6 8 8 147 204 261 Total Consideration from Telluride $376 $438 $497 $554 $611 Telluride Common Stock Owned by Luggage 14.0 14.0 14.0 14.0 14.0 Telluride Common Share Price $12.00 $14.00 $16.00 $18.00 $20.00 Total Common Stock Consideration $168 $196 $224 $252 $280 Residual Consideration For Telluride Class B Shares $207 $242 $272 $302 $330 Telluride Class B Common Stock Owned by Luggage 12.8 12.8 12.8 12.8 12.8 Implied Telluride Class B Common Stock Price $16.20 $18.90 $21.28 $23.58 $25.80 Aggregate Premium Paid $54 $63 $68 $71 $74 % of Market Cap 2.9% 2.9% 2.8% 2.6% 2.4% Premium vs. Current Telluride Share Price ($14.36) 13% 32% 48% 64% 80% Premium vs. Reference Telluride Share Price 35% 35% 33% 31% 29% Premium vs. Telluride 10-Day VWAP ($14.61) 11% 29% 46% 61% 77% Premium vs. Telluride 30-Day VWAP ($14.30) 13% 32% 49% 65% 80% Implied Avg. Telluride Share Price (Common + B's Acq.) $14.00 $16.34 $18.52 $20.66 $22.77 Premium vs. Reference Telluride Share Price 17% 17% 16% 15% 14% Memo: 50% Cash / 50% Stock Consideration to Certares assuming max PF Certares Ownership of 5% Telluride Common Stock to Certares $13 $44 $73 $86 $96 # of Telluride Shares Issued to Certares 1.1 3.2 4.6 4.8 4.8 PF Certares Ownership (1) 2.2% 3.8% 4.8% 5.0% 5.0% Cash Consideration to Certares $13 $44 $73 $118 $165 Total Cash Outlay for Telluride $363 $394 $423 $468 $515 Total Telluride Shares Issued (assuming cash to Luggage Common) 1.1 3.2 4.6 4.8 4.8 % of Telluride Basic Shares Oustanding Issued 0.8% 2.3% 3.3% 3.4% 3.4% Net Shares Retired 25.8 23.7 22.2 22.0 22.0 % of Telluride Basic Shares Oustanding 18.5% 17.0% 16.0% 15.8% 15.8% B Illustrative Summary of Revised Framework as Provided by Certares on 9/30/2024 A A B C C D D |

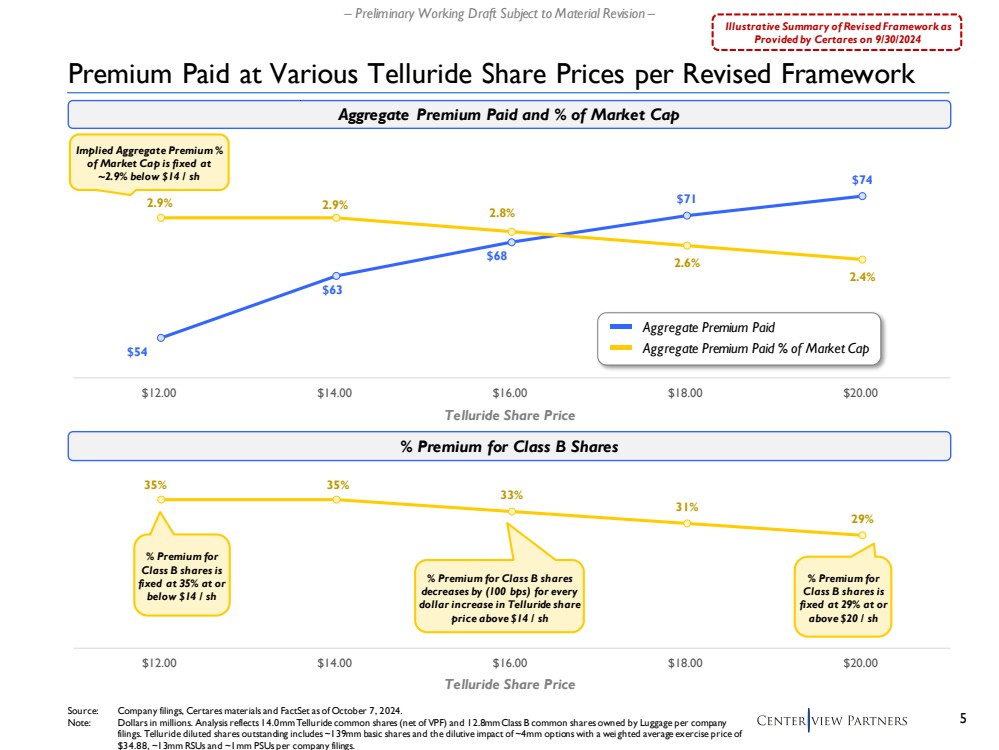

| 5 – Preliminary Working Draft Subject to Material Revision – Premium Paid at Various Telluride Share Prices per Revised Framework Source: Company filings, Certares materials and FactSet as of October 7, 2024. Note: Dollars in millions. Analysis reflects 14.0mm Telluride common shares (net of VPF) and 12.8mm Class B common shares owned by Luggage per company filings. Telluride diluted shares outstanding includes ~139mm basic shares and the dilutive impact of ~4mm options with a wei ghted average exercise price of $34.88, ~13mm RSUs and ~1mm PSUs per company filings. Aggregate Premium Paid and % of Market Cap $54 $63 $68 $71 $74 2.9% 2.9% 2.8% 2.6% 2.4% $12.00 $14.00 $16.00 $18.00 $20.00 Telluride Share Price % Premium for Class B Shares 35% 35% 33% 31% 29% $12.00 $14.00 $16.00 $18.00 $20.00 Telluride Share Price Aggregate Premium Paid Aggregate Premium Paid % of Market Cap Implied Aggregate Premium % of Market Cap is fixed at ~2.9% below $14 / sh % Premium for Class B shares is fixed at 35% at or below $14 / sh % Premium for Class B shares decreases by (100 bps) for every dollar increase in Telluride share price above $14 / sh Illustrative Summary of Revised Framework as Provided by Certares on 9/30/2024 % Premium for Class B shares is fixed at 29% at or above $20 / sh |

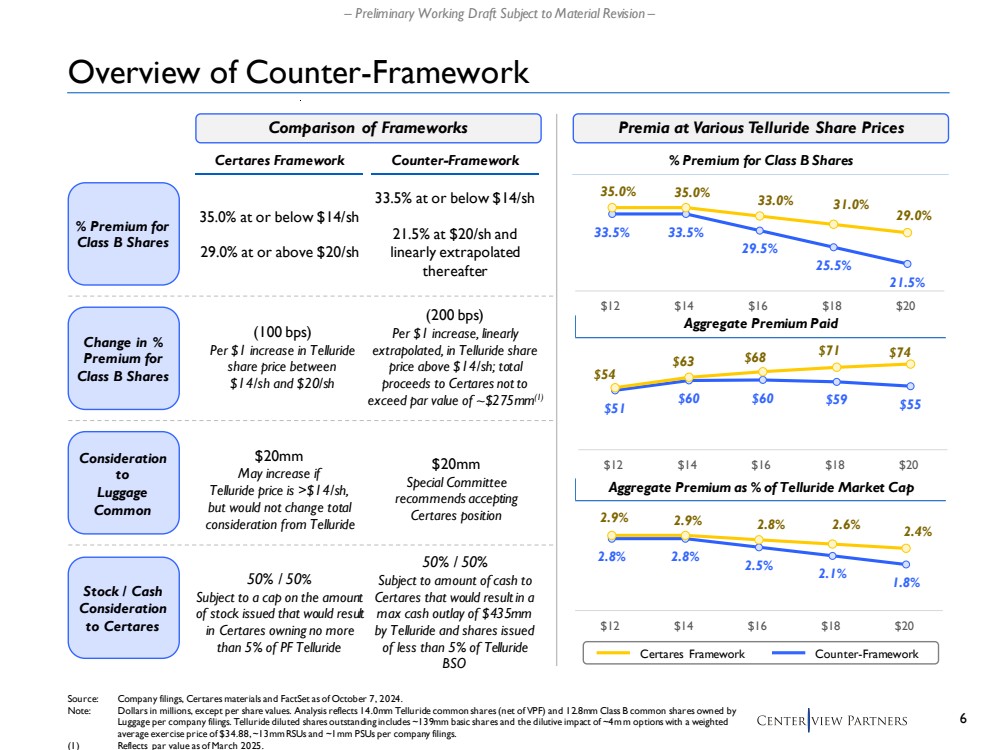

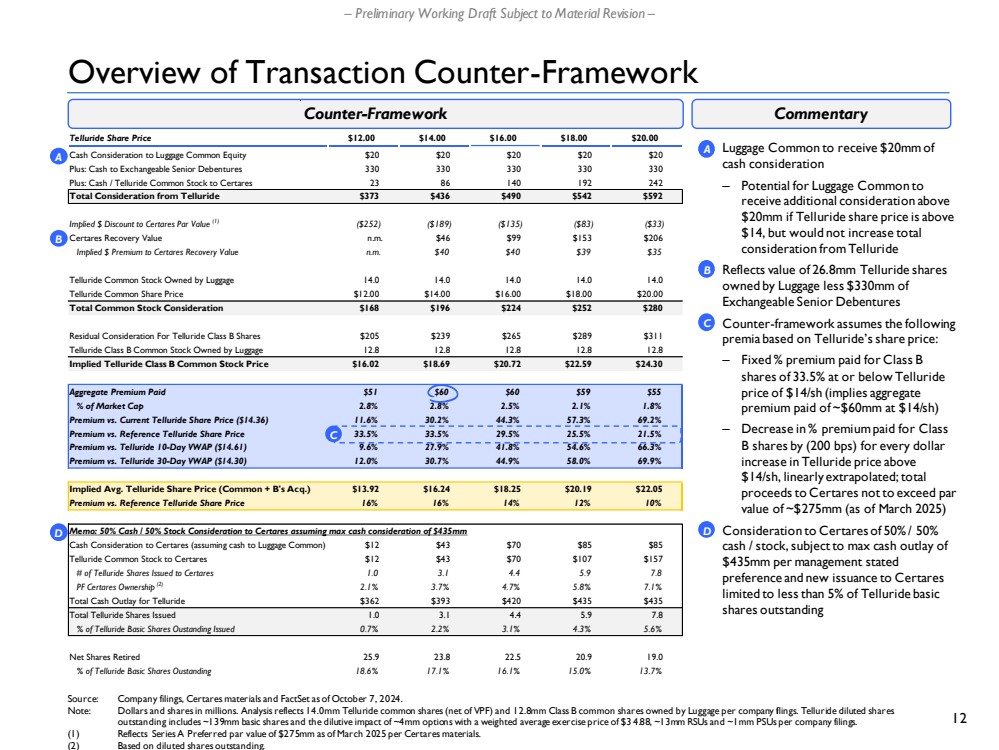

| 6 – Preliminary Working Draft Subject to Material Revision – Overview of Counter-Framework Certares Framework Counter-Framework % Premium for Class B Shares 35.0% at or below $14/sh 29.0% at or above $20/sh 33.5% at or below $14/sh 21.5% at $20/sh and linearly extrapolated thereafter Change in % Premium for Class B Shares (100 bps) Per $1 increase in Telluride share price between $14/sh and $20/sh $51 $60 $60 $59 $55 $54 $63 $68 $71 $74 $12 $14 $16 $18 $20 33.5% 33.5% 29.5% 25.5% 21.5% 35.0% 35.0% 33.0% 31.0% 29.0% $12 $14 $16 $18 $20 (200 bps) Per $1 increase, linearly extrapolated, in Telluride share price above $14/sh; total proceeds to Certares not to exceed par value of ~$275mm(1) Consideration to Luggage Common 2.8% 2.8% 2.5% 2.1% 1.8% 2.9% 2.9% 2.8% 2.6% 2.4% $12 $14 $16 $18 $20 $20mm May increase if Telluride price is >$14/sh, but would not change total consideration from Telluride $20mm Special Committee recommends accepting Certares position Stock / Cash Consideration to Certares 50% / 50% Subject to a cap on the amount of stock issued that would result in Certares owning no more than 5% of PF Telluride 50% / 50% Subject to amount of cash to Certares that would result in a max cash outlay of $435mm by Telluride and shares issued of less than 5% of Telluride BSO Premia at Various Telluride Share Prices Source: Company filings, Certares materials and FactSet as of October 7, 2024. Note: Dollars in millions, except per share values. Analysis reflects 14.0mm Telluride common shares (net of VPF) and 12.8mm Class B common shares owned by Luggage per company filings. Telluride diluted shares outstanding includes ~139mm basic shares and the dilutive impact of ~4mm options with a weighted average exercise price of $34.88, ~13mm RSUs and ~1mm PSUs per company filings. (1) Reflects par value as of March 2025. Comparison of Frameworks % Premium for Class B Shares Aggregate Premium Paid Aggregate Premium as % of Telluride Market Cap Certares Framework Counter-Framework |

| Draft of Counter-Framework |

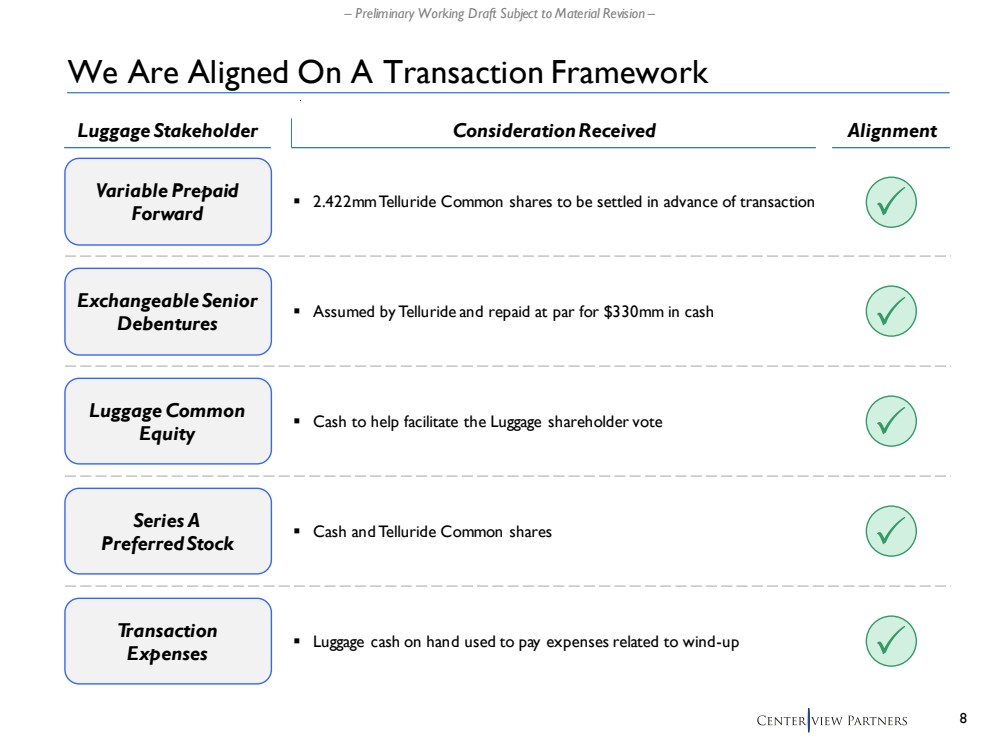

| 8 – Preliminary Working Draft Subject to Material Revision – We Are Aligned On A Transaction Framework Exchangeable Senior Debentures Variable Prepaid Forward Luggage Common Equity ▪ Cash to help facilitate the Luggage shareholder vote ▪ 2.422mm Telluride Common shares to be settled in advance of transaction ▪ Assumed by Telluride and repaid at par for $330mm in cash Series A Preferred Stock ▪ Cash and Telluride Common shares Luggage Stakeholder Consideration Received Alignment Transaction Expenses ▪ Luggage cash on hand used to pay expenses related to wind-up |

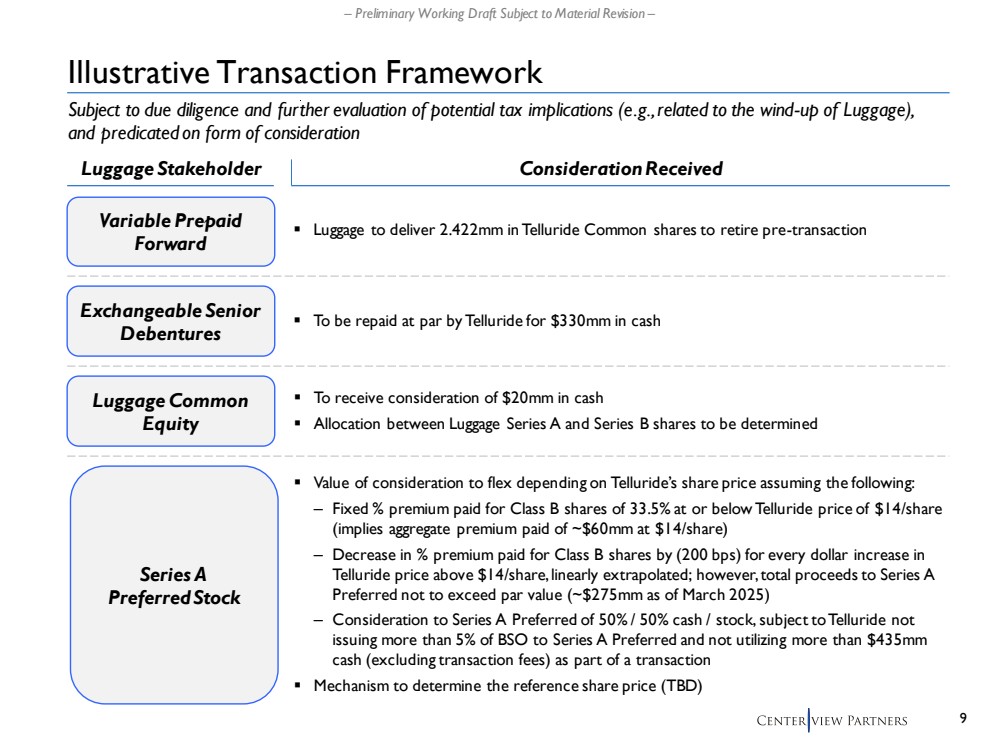

| 9 – Preliminary Working Draft Subject to Material Revision – Illustrative Transaction Framework Subject to due diligence and further evaluation of potential tax implications (e.g., related to the wind-up of Luggage), and predicated on form of consideration Consideration Received Luggage Common Equity ▪ To receive consideration of $20mm in cash ▪ Allocation between Luggage Series A and Series B shares to be determined Exchangeable Senior Debentures ▪ To be repaid at par by Telluride for $330mm in cash Variable Prepaid Forward ▪ Luggage to deliver 2.422mm in Telluride Common shares to retire pre-transaction Series A Preferred Stock ▪ Value of consideration to flex depending on Telluride’s share price assuming the following: – Fixed % premium paid for Class B shares of 33.5% at or below Telluride price of $14/share (implies aggregate premium paid of ~$60mm at $14/share) – Decrease in % premium paid for Class B shares by (200 bps) for every dollar increase in Telluride price above $14/share, linearly extrapolated; however, total proceeds to Series A Preferred not to exceed par value (~$275mm as of March 2025) – Consideration to Series A Preferred of 50% / 50% cash / stock, subject to Telluride not issuing more than 5% of BSO to Series A Preferred and not utilizing more than $435mm cash (excluding transaction fees) as part of a transaction ▪ Mechanism to determine the reference share price (TBD) Luggage Stakeholder |

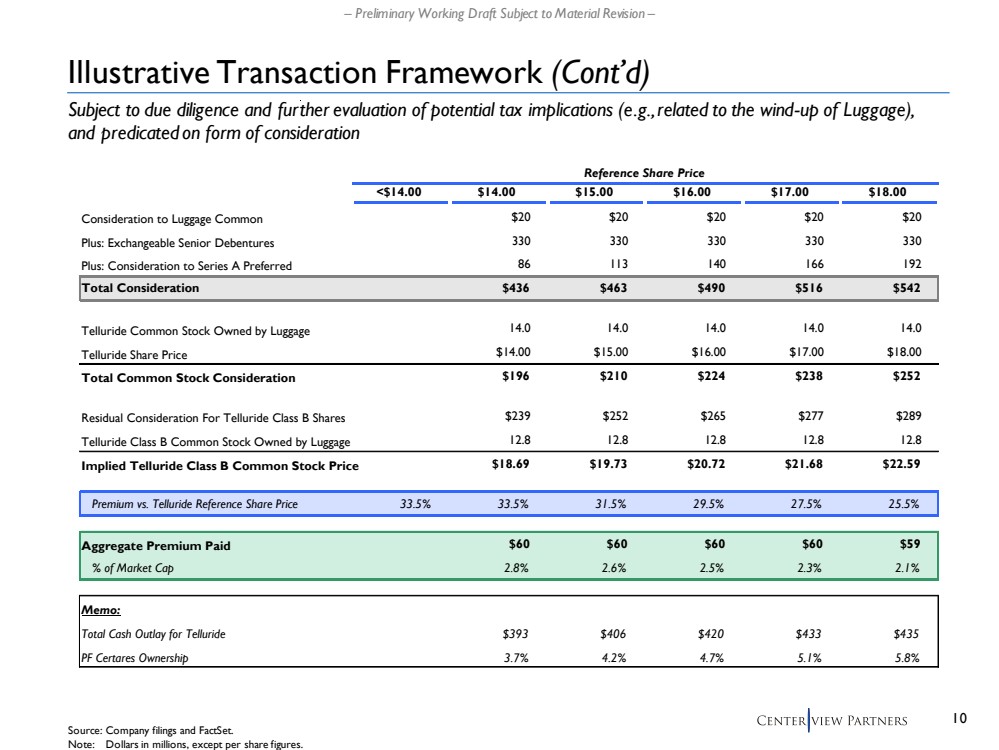

| 10 – Preliminary Working Draft Subject to Material Revision – Reference Share Price <$14.00 $14.00 $15.00 $16.00 $17.00 $18.00 Consideration to Luggage Common $20 $20 $20 $20 $20 Plus: Exchangeable Senior Debentures 330 330 330 330 330 Plus: Consideration to Series A Preferred 86 113 140 166 192 Total Consideration $436 $463 $490 $516 $542 Telluride Common Stock Owned by Luggage 14.0 14.0 14.0 14.0 14.0 Telluride Share Price $14.00 $15.00 $16.00 $17.00 $18.00 Total Common Stock Consideration $196 $210 $224 $238 $252 Residual Consideration For Telluride Class B Shares $239 $252 $265 $277 $289 Telluride Class B Common Stock Owned by Luggage 12.8 12.8 12.8 12.8 12.8 Implied Telluride Class B Common Stock Price $18.69 $19.73 $20.72 $21.68 $22.59 Premium vs. Telluride Reference Share Price 33.5% 33.5% 31.5% 29.5% 27.5% 25.5% Aggregate Premium Paid $60 $60 $60 $60 $59 % of Market Cap 2.8% 2.6% 2.5% 2.3% 2.1% Memo: Total Cash Outlay for Telluride $393 $406 $420 $433 $435 PF Certares Ownership 3.7% 4.2% 4.7% 5.1% 5.8% Illustrative Transaction Framework (Cont’d) Subject to due diligence and further evaluation of potential tax implications (e.g., related to the wind-up of Luggage), and predicated on form of consideration Source: Company filings and FactSet. Note: Dollars in millions, except per share figures. |

| Appendix Supplementary Materials |

| 12 – Preliminary Working Draft Subject to Material Revision – Telluride Share Price $12.00 $14.00 $16.00 $18.00 $20.00 Cash Consideration to Luggage Common Equity $20 $20 $20 $20 $20 Plus: Cash to Exchangeable Senior Debentures 330 330 330 330 330 Plus: Cash / Telluride Common Stock to Certares 2 3 8 6 140 192 242 Total Consideration from Telluride $373 $436 $490 $542 $592 Implied $ Discount to Certares Par Value (1) ($252) ($189) ($135) ($83) ($33) Certares Recovery Value n.m. $46 $99 $153 $206 Implied $ Premium to Certares Recovery Value n.m. $40 $40 $39 $35 Telluride Common Stock Owned by Luggage 14.0 14.0 14.0 14.0 14.0 Telluride Common Share Price $12.00 $14.00 $16.00 $18.00 $20.00 Total Common Stock Consideration $168 $196 $224 $252 $280 Residual Consideration For Telluride Class B Shares $205 $239 $265 $289 $311 Telluride Class B Common Stock Owned by Luggage 12.8 12.8 12.8 12.8 12.8 Implied Telluride Class B Common Stock Price $16.02 $18.69 $20.72 $22.59 $24.30 Aggregate Premium Paid $51 $60 $60 $59 $55 % of Market Cap 2.8% 2.8% 2.5% 2.1% 1.8% Premium vs. Current Telluride Share Price ($14.36) 11.6% 30.2% 44.3% 57.3% 69.2% Premium vs. Reference Telluride Share Price 33.5% 33.5% 29.5% 25.5% 21.5% Premium vs. Telluride 10-Day VWAP ($14.61) 9.6% 27.9% 41.8% 54.6% 66.3% Premium vs. Telluride 30-Day VWAP ($14.30) 12.0% 30.7% 44.9% 58.0% 69.9% Implied Avg. Telluride Share Price (Common + B's Acq.) $13.92 $16.24 $18.25 $20.19 $22.05 Premium vs. Reference Telluride Share Price 16% 16% 14% 12% 10% Memo: 50% Cash / 50% Stock Consideration to Certares assuming max cash consideration of $435mm Cash Consideration to Certares (assuming cash to Luggage Common) $12 $43 $70 $85 $85 Telluride Common Stock to Certares $12 $43 $70 $107 $157 # of Telluride Shares Issued to Certares 1.0 3.1 4.4 5.9 7.8 PF Certares Ownership (2) 2.1% 3.7% 4.7% 5.8% 7.1% Total Cash Outlay for Telluride $362 $393 $420 $435 $435 Total Telluride Shares Issued 1.0 3.1 4.4 5.9 7.8 % of Telluride Basic Shares Oustanding Issued 0.7% 2.2% 3.1% 4.3% 5.6% Net Shares Retired 25.9 23.8 22.5 20.9 19.0 % of Telluride Basic Shares Oustanding 18.6% 17.1% 16.1% 15.0% 13.7% ▪ Luggage Common to receive $20mm of cash consideration – Potential for Luggage Common to receive additional consideration above $20mm if Telluride share price is above $14, but would not increase total consideration from Telluride ▪ Reflects value of 26.8mm Telluride shares owned by Luggage less $330mm of Exchangeable Senior Debentures ▪ Counter-framework assumes the following premia based on Telluride’s share price: – Fixed % premium paid for Class B shares of 33.5% at or below Telluride price of $14/sh (implies aggregate premium paid of ~$60mm at $14/sh) – Decrease in % premium paid for Class B shares by (200 bps) for every dollar increase in Telluride price above $14/sh, linearly extrapolated; total proceeds to Certares not to exceed par value of ~$275mm (as of March 2025) ▪ Consideration to Certaresof 50% / 50% cash / stock, subject to max cash outlay of $435mm per management stated preference and new issuance to Certares limited to less than 5% of Telluride basic shares outstanding Overview of Transaction Counter-Framework Source: Company filings, Certares materials and FactSet as of October 7, 2024. Note: Dollars and shares in millions. Analysis reflects 14.0mm Telluride common shares (net of VPF) and 12.8mm Class B common shares owned by Luggage per company filings. Telluride diluted shares outstanding includes ~139mm basic shares and the dilutive impact of ~4mm options with a weighted average exercise price of $3 4.88, ~13mm RSUs and ~1mm PSUs per company filings. (1) Reflects Series A Preferred par value of $275mm as of March 2025 per Certares materials. (2) Based on diluted shares outstanding. Counter-Framework Commentary B A A C D D B C |

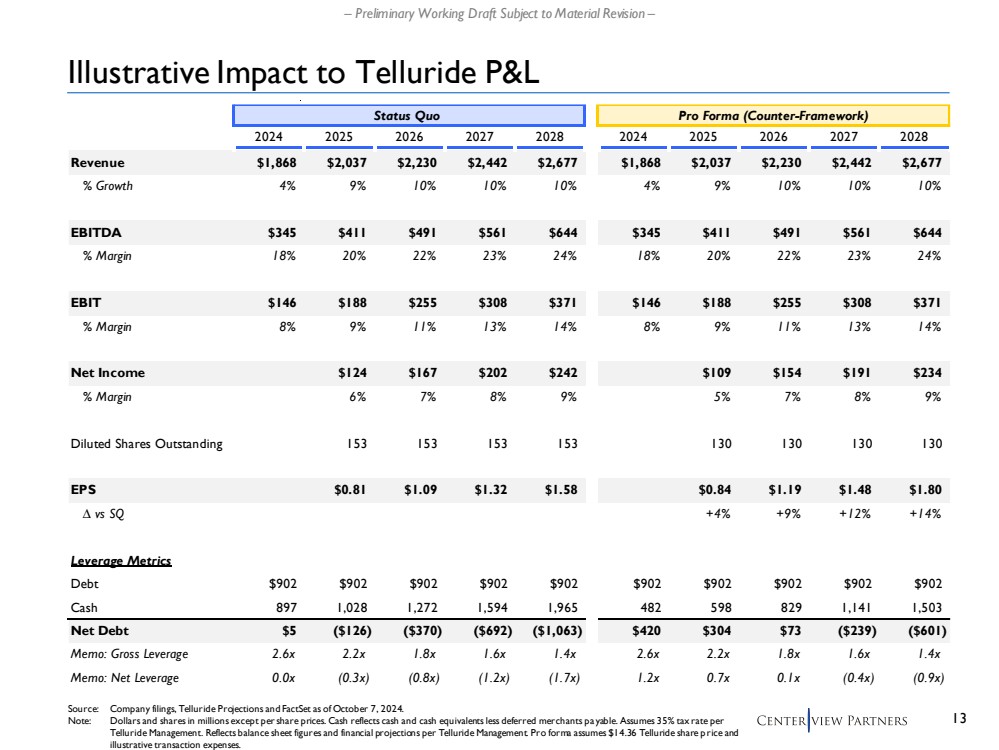

| 13 – Preliminary Working Draft Subject to Material Revision – Illustrative Impact to Telluride P&L Source: Company filings, Telluride Projections and FactSet as of October 7, 2024. Note: Dollars and shares in millions except per share prices. Cash reflects cash and cash equivalents less deferred merchants pa yable. Assumes 35% tax rate per Telluride Management. Reflects balance sheet figures and financial projections per Telluride Management. Pro forma assumes $14.36 Telluride share p rice and illustrative transaction expenses. Status Quo Pro Forma (Counter-Framework) ∆ 2024 2025 2026 2027 2028 2024 2025 2026 2027 2028 Revenue $1,868 $2,037 $2,230 $2,442 $2,677 $1,868 $2,037 $2,230 $2,442 $2,677 % Growth 4 % 9 % 10% 10% 10% 4 % 9 % 10% 10% 10% EBITDA $345 $411 $491 $561 $644 $345 $411 $491 $561 $644 % Margin 18% 20% 22% 23% 24% 18% 20% 22% 23% 24% EBIT $146 $188 $255 $308 $371 $146 $188 $255 $308 $371 % Margin 8 % 9 % 11% 13% 14% 8 % 9 % 11% 13% 14% Net Income $124 $167 $202 $242 $109 $154 $191 $234 % Margin 6 % 7 % 8 % 9 % 5 % 7 % 8 % 9 % Diluted Shares Outstanding 153 153 153 153 130 130 130 130 EPS $0.81 $1.09 $1.32 $1.58 $0.84 $1.19 $1.48 $1.80 ∆ vs SQ +4% +9% +12% +14% Leverage Metrics Debt $902 $902 $902 $902 $902 $902 $902 $902 $902 $902 Cash 897 1,028 1,272 1,594 1,965 482 598 829 1,141 1,503 Net Debt $5 ($126) ($370) ($692) ($1,063) $420 $304 $73 ($239) ($601) Memo: Gross Leverage 2.6x 2.2x 1.8x 1.6x 1.4x 2.6x 2.2x 1.8x 1.6x 1.4x Memo: Net Leverage 0.0x (0.3x) (0.8x) (1.2x) (1.7x) 1.2x 0.7x 0.1x (0.4x) (0.9x) |

| Certares Transaction Framework Supplementary Materials |

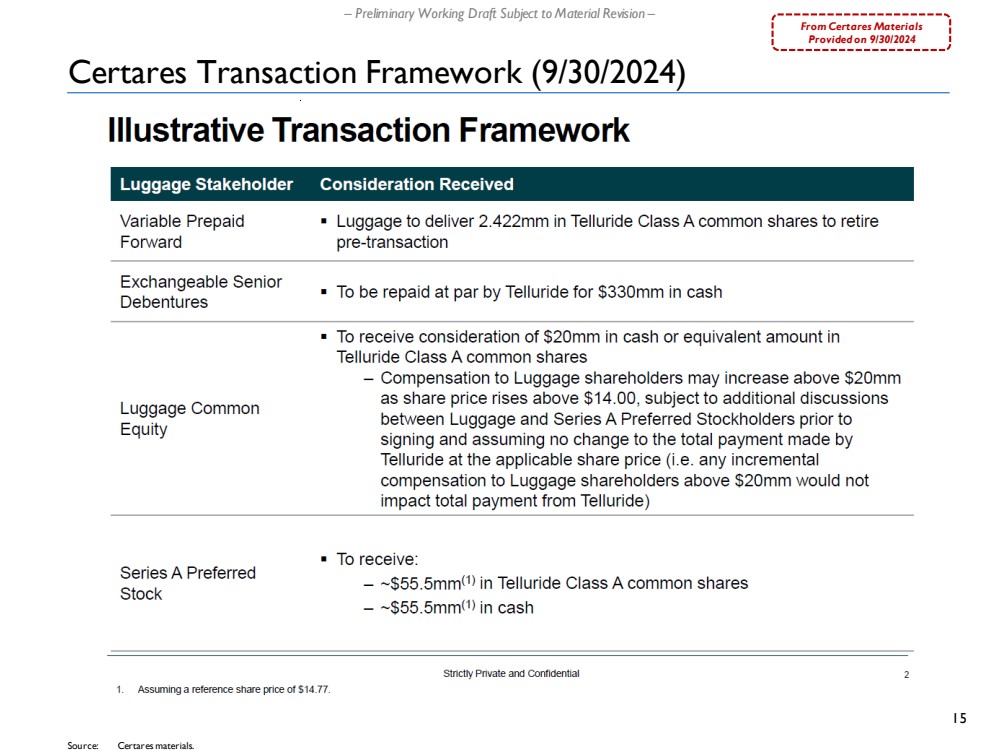

| 15 – Preliminary Working Draft Subject to Material Revision – Certares Transaction Framework (9/30/2024) Source: Certares materials. From Certares Materials Provided on 9/30/2024 |

| 16 – Preliminary Working Draft Subject to Material Revision – Certares Transaction Framework (9/30/2024) Source: Certares materials. From Certares Materials Provided on 9/30/2024 |