| – Preliminary Working Draft Subject to Material Revision – October 30, 2024 Discussion Materials Project Telluride |

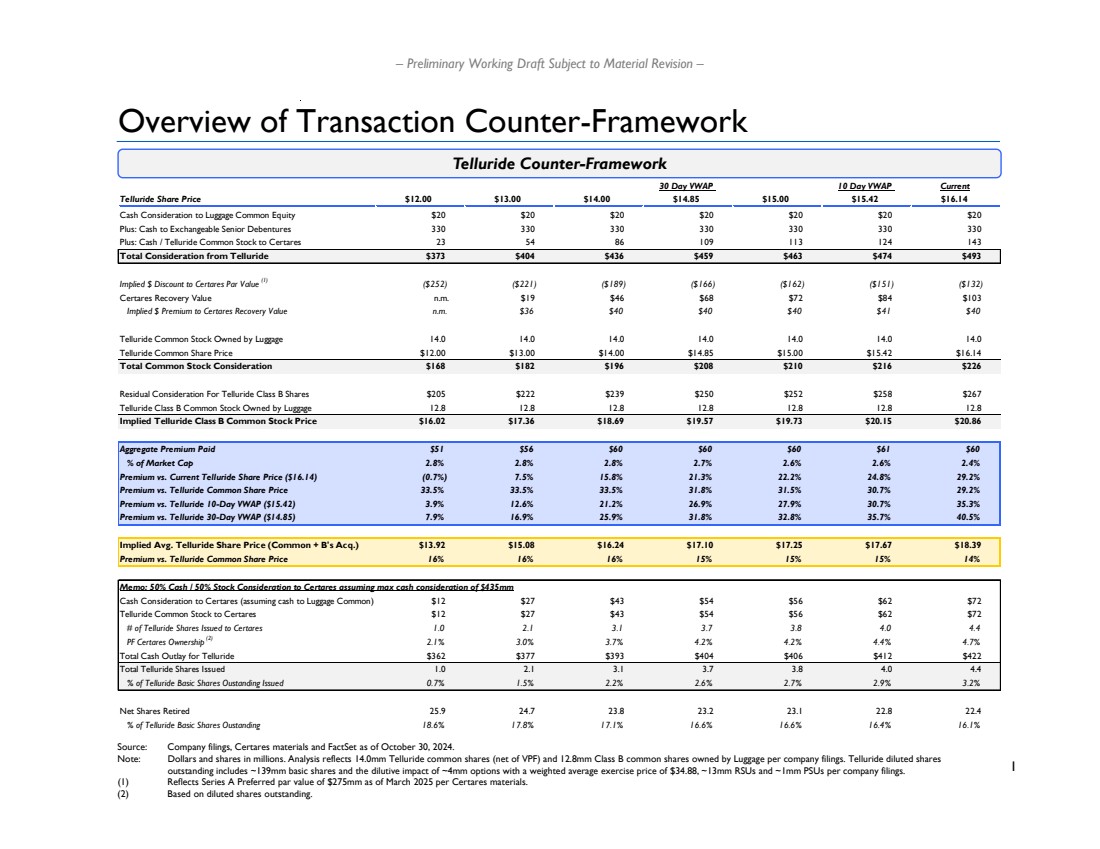

| 1 – Preliminary Working Draft Subject to Material Revision – Overview of Transaction Counter-Framework Source: Company filings, Certares materials and FactSet as of October 30, 2024. Note: Dollars and shares in millions. Analysis reflects 14.0mm Telluride common shares (net of VPF) and 12.8mm Class B common shares owned by Luggage per company filings. Telluride diluted shares outstanding includes ~139mm basic shares and the dilutive impact of ~4mm options with a weighted average exercise price of $34.88, ~13mm RSUs and ~1mm PSUs per company filings. (1) Reflects Series A Preferred par value of $275mm as of March 2025 per Certares materials. (2) Based on diluted shares outstanding. Telluride Counter-Framework 30 Day VWAP 10 Day VWAP Current Telluride Share Price $12.00 $13.00 $14.00 $14.85 $15.00 $15.42 $16.14 Cash Consideration to Luggage Common Equity $20 $20 $20 $20 $20 $20 $20 Plus: Cash to Exchangeable Senior Debentures 330 330 330 330 330 330 330 Plus: Cash / Telluride Common Stock to Certares 23 54 86 109 113 124 143 Total Consideration from Telluride $373 $404 $436 $459 $463 $474 $493 Implied $ Discount to Certares Par Value (1) ($252) ($221) ($189) ($166) ($162) ($151) ($132) Certares Recovery Value n.m. $19 $46 $68 $72 $84 $103 Implied $ Premium to Certares Recovery Value n.m. $36 $40 $40 $40 $41 $40 Telluride Common Stock Owned by Luggage 14.0 14.0 14.0 14.0 14.0 14.0 14.0 Telluride Common Share Price $12.00 $13.00 $14.00 $14.85 $15.00 $15.42 $16.14 Total Common Stock Consideration $168 $182 $196 $208 $210 $216 $226 Residual Consideration For Telluride Class B Shares $205 $222 $239 $250 $252 $258 $267 Telluride Class B Common Stock Owned by Luggage 12.8 12.8 12.8 12.8 12.8 12.8 12.8 Implied Telluride Class B Common Stock Price $16.02 $17.36 $18.69 $19.57 $19.73 $20.15 $20.86 Aggregate Premium Paid $51 $56 $60 $60 $60 $61 $60 % of Market Cap 2.8% 2.8% 2.8% 2.7% 2.6% 2.6% 2.4% Premium vs. Current Telluride Share Price ($16.14) (0.7%) 7.5% 15.8% 21.3% 22.2% 24.8% 29.2% Premium vs. Telluride Common Share Price 33.5% 33.5% 33.5% 31.8% 31.5% 30.7% 29.2% Premium vs. Telluride 10-Day VWAP ($15.42) 3.9% 12.6% 21.2% 26.9% 27.9% 30.7% 35.3% Premium vs. Telluride 30-Day VWAP ($14.85) 7.9% 16.9% 25.9% 31.8% 32.8% 35.7% 40.5% Implied Avg. Telluride Share Price (Common + B's Acq.) $13.92 $15.08 $16.24 $17.10 $17.25 $17.67 $18.39 Premium vs. Telluride Common Share Price 16% 16% 16% 15% 15% 15% 14% Memo: 50% Cash / 50% Stock Consideration to Certares assuming max cash consideration of $435mm Cash Consideration to Certares (assuming cash to Luggage Common) $12 $27 $43 $54 $56 $62 $72 Telluride Common Stock to Certares $12 $27 $43 $54 $56 $62 $72 # of Telluride Shares Issued to Certares 1.0 2.1 3.1 3.7 3.8 4.0 4.4 PF Certares Ownership (2) 2.1% 3.0% 3.7% 4.2% 4.2% 4.4% 4.7% Total Cash Outlay for Telluride $362 $377 $393 $404 $406 $412 $422 Total Telluride Shares Issued 1.0 2.1 3.1 3.7 3.8 4.0 4.4 % of Telluride Basic Shares Oustanding Issued 0.7% 1.5% 2.2% 2.6% 2.7% 2.9% 3.2% Net Shares Retired 25.9 24.7 23.8 23.2 23.1 22.8 22.4 % of Telluride Basic Shares Oustanding 18.6% 17.8% 17.1% 16.6% 16.6% 16.4% 16.1% |

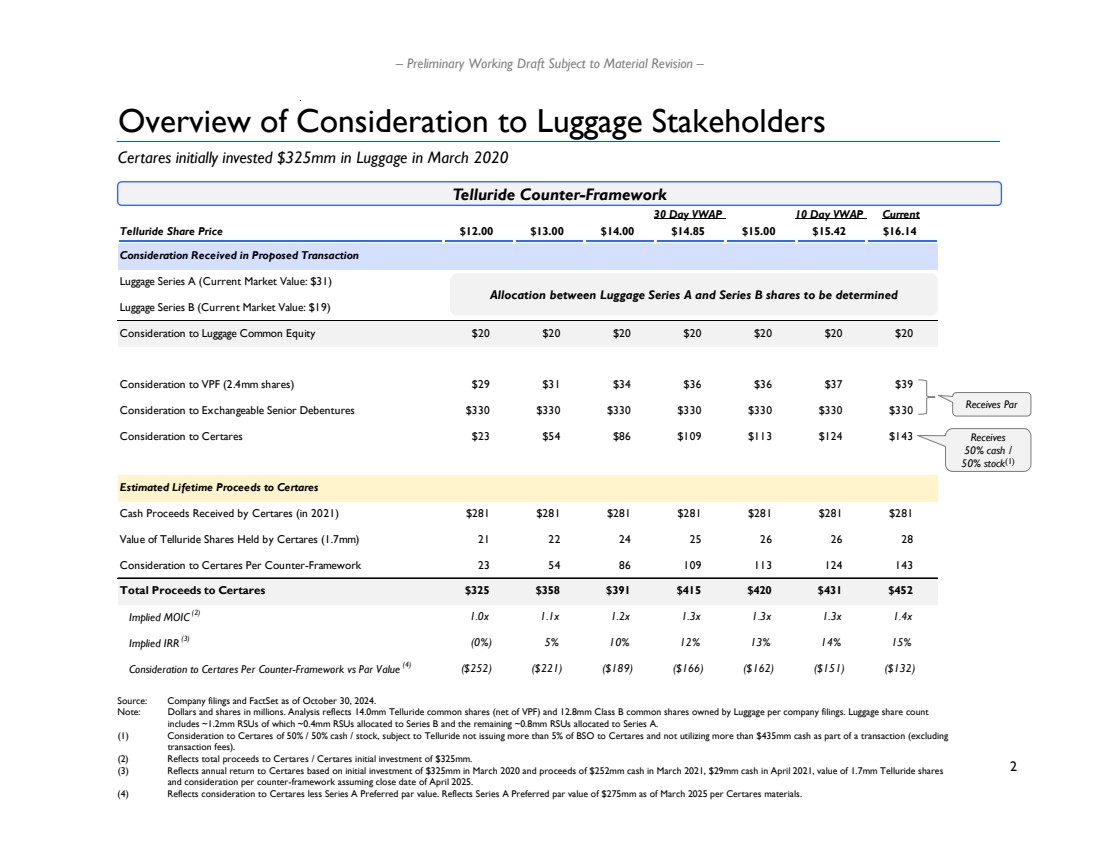

| 2 – Preliminary Working Draft Subject to Material Revision – Overview of Consideration to Luggage Stakeholders Source: Company filings and FactSet as of October 30, 2024. Note: Dollars and shares in millions. Analysis reflects 14.0mm Telluride common shares (net of VPF) and 12.8mm Class B common shares owned by Luggage per company filings. Luggage share count includes ~1.2mm RSUs of which ~0.4mm RSUs allocated to Series B and the remaining ~0.8mm RSUs allocated to Series A. (1) Consideration to Certares of 50% / 50% cash / stock, subject to Telluride not issuing more than 5% of BSO to Certares and not utilizing more than $435mm cash as part of a transaction (excluding transaction fees). (2) Reflects total proceeds to Certares / Certares initial investment of $325mm. (3) Reflects annual return to Certares based on initial investment of $325mm in March 2020 and proceeds of $252mm cash in March 2021, $29mm cash in April 2021, value of 1.7mm Telluride shares and consideration per counter-framework assuming close date of April 2025. (4) Reflects consideration to Certares less Series A Preferred par value. Reflects Series A Preferred par value of $275mm as of March 2025 per Certares materials. Receives Par Receives 50% cash / 50% stock(1) Telluride Counter-Framework 30 Day VWAP 10 Day VWAP Current Telluride Share Price $12.00 $13.00 $14.00 $14.85 $15.00 $15.42 $16.14 Consideration Received in Proposed Transaction Luggage Series A (Current Market Value: $31) Luggage Series B (Current Market Value: $19) Consideration to Luggage Common Equity $20 $20 $20 $20 $20 $20 $20 Consideration to VPF (2.4mm shares) $29 $31 $34 $36 $36 $37 $39 Consideration to Exchangeable Senior Debentures $330 $330 $330 $330 $330 $330 $330 Consideration to Certares $23 $54 $86 $109 $113 $124 $143 Estimated Lifetime Proceeds to Certares Cash Proceeds Received by Certares (in 2021) $281 $281 $281 $281 $281 $281 $281 Value of Telluride Shares Held by Certares (1.7mm) 21 22 24 25 26 26 28 Consideration to Certares Per Counter-Framework 23 54 86 109 113 124 143 Total Proceeds to Certares $325 $358 $391 $415 $420 $431 $452 Implied MOIC (2) 1.0x 1.1x 1.2x 1.3x 1.3x 1.3x 1.4x Implied IRR (3) (0%) 5% 10% 12% 13% 14% 15% Consideration to Certares Per Counter-Framework vs Par Value (4) ($252) ($221) ($189) ($166) ($162) ($151) ($132) Certares initially invested $325mm in Luggage in March 2020 Allocation between Luggage Series A and Series B shares to be determined |