| – Highly Confidential; For Discussion Purposes Only – November 4, 2024 Discussion Materials Project Telluride |

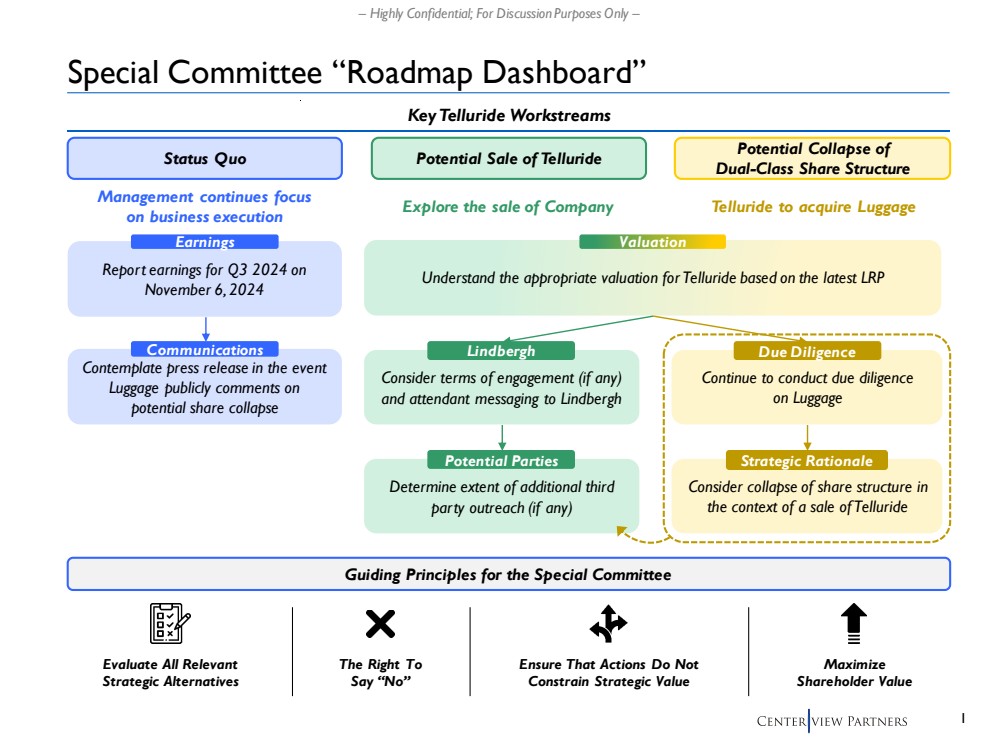

| 1 – Highly Confidential; For Discussion Purposes Only – Special Committee “Roadmap Dashboard” Status Quo Potential Sale of Telluride Potential Collapse of Dual-Class Share Structure Understand the appropriate valuation for Telluride based on the latest LRP Management continues focus on business execution Explore the sale of Company Telluride to acquire Luggage Report earnings for Q3 2024 on November 6, 2024 Earnings Determine extent of additional third party outreach (if any) Potential Parties Continue to conduct due diligence on Luggage Due Diligence Key Telluride Workstreams Valuation Contemplate press release in the event Luggage publicly comments on potential share collapse Communications Consider terms of engagement (if any) and attendant messaging to Lindbergh Lindbergh Consider collapse of share structure in the context of a sale of Telluride Strategic Rationale Guiding Principles for the Special Committee The Right To Say “No” Ensure That Actions Do Not Constrain Strategic Value Maximize Shareholder Value Evaluate All Relevant Strategic Alternatives |

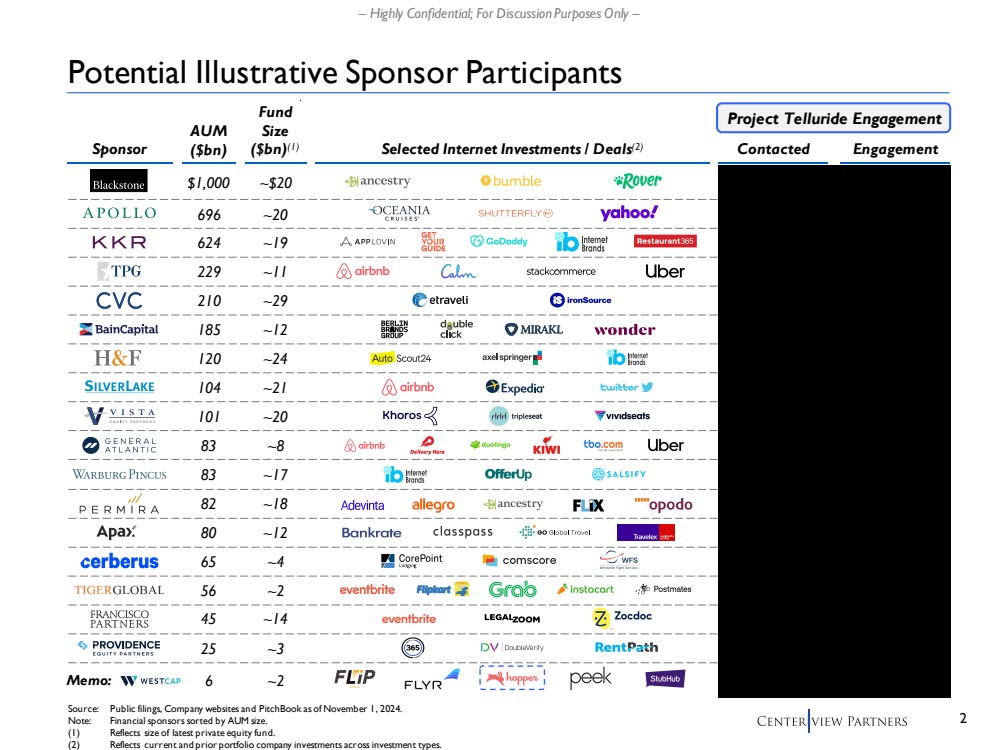

| 2 – Highly Confidential; For Discussion Purposes Only – Potential Illustrative Sponsor Participants AUM ($bn) Selected Internet Investments / Deals(2) Fund Size ($bn)(1) 696 624 229 210 185 104 101 83 83 82 65 56 45 25 6 Sponsor Source: Public filings, Company websites and PitchBook as of November 1, 2024. Note: Financial sponsors sorted by AUM size. (1) Reflects size of latest private equity fund. (2) Reflects current and prior portfolio company investments across investment types. Contacted Engagement Project Telluride Engagement Memo: $1,000 120 80 ~20 ~19 ~11 ~29 ~12 ~21 ~20 ~8 ~17 ~18 ~4 ~2 ~14 ~3 ~2 ~$20 ~24 ~12 |

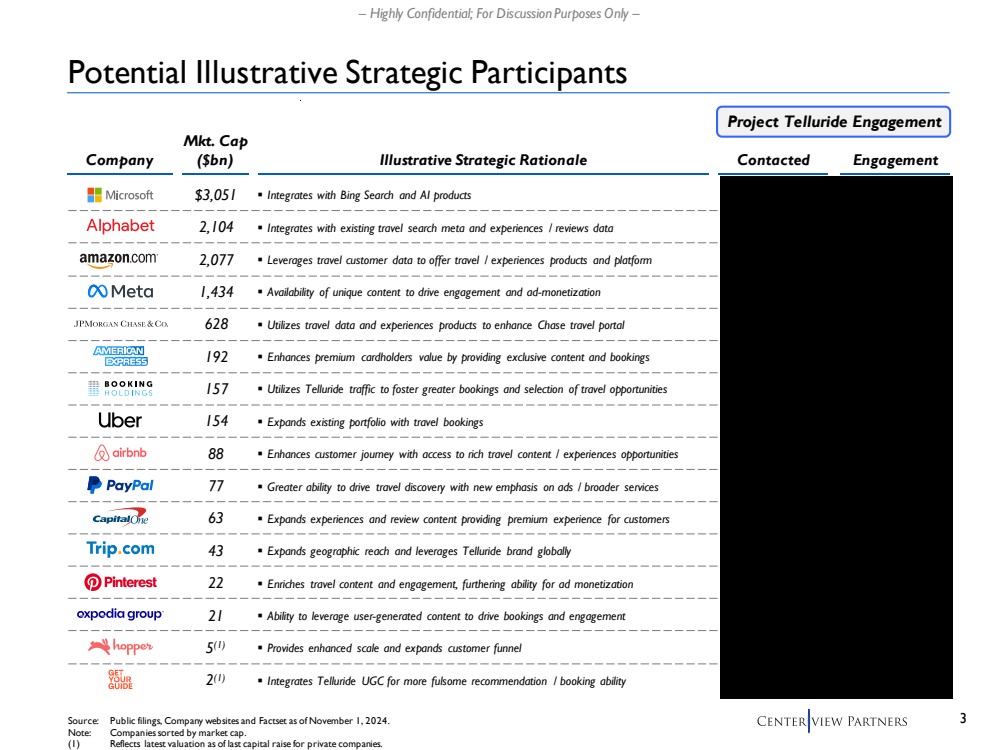

| 3 – Highly Confidential; For Discussion Purposes Only – Potential Illustrative Strategic Participants Mkt. Cap ($bn) $3,051 2,104 2,077 1,434 628 192 157 154 88 77 63 43 22 21 5 (1) 2 (1) Illustrative Strategic Rationale ▪ Integrates with Bing Search and AI products ▪ Integrates with existing travel search meta and experiences / reviews data ▪ Leverages travel customer data to offer travel / experiences products and platform ▪ Availability of unique content to drive engagement and ad-monetization ▪ Utilizes travel data and experiences products to enhance Chase travel portal ▪ Enhances premium cardholders value by providing exclusive content and bookings ▪ Utilizes Telluride traffic to foster greater bookings and selection of travel opportunities ▪ Expands existing portfolio with travel bookings ▪ Enhances customer journey with access to rich travel content / experiences opportunities ▪ Greater ability to drive travel discovery with new emphasis on ads / broader services ▪ Expands experiences and review content providing premium experience for customers ▪ Expands geographic reach and leverages Telluride brand globally ▪ Enriches travel content and engagement, furthering ability for ad monetization ▪ Ability to leverage user-generated content to drive bookings and engagement ▪ Provides enhanced scale and expands customer funnel ▪ Integrates Telluride UGC for more fulsome recommendation / booking ability Source: Public filings, Company websites and Factset as of November 1, 2024. Note: Companies sorted by market cap. (1) Reflects latest valuation as of last capital raise for private companies. Contacted Engagement Project Telluride Engagement Company |

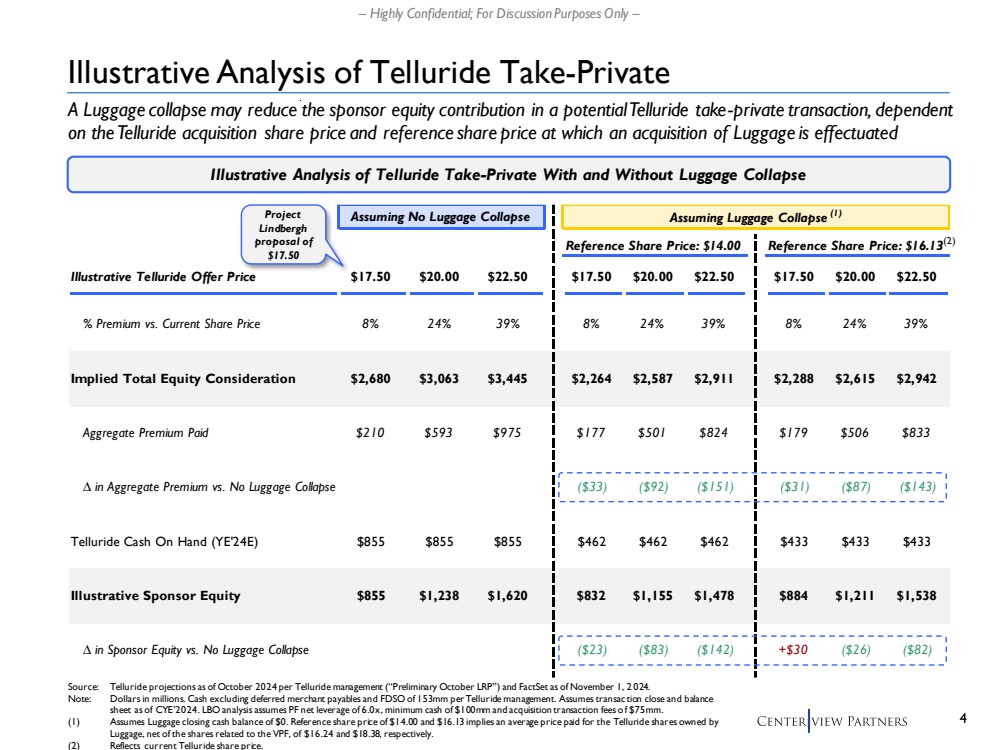

| 4 – Highly Confidential; For Discussion Purposes Only – Illustrative Analysis of Telluride Take-Private Illustrative Analysis of Telluride Take-Private With and Without Luggage Collapse Source: Telluride projections as of October 2024 per Telluride management (“Preliminary October LRP”) and FactSet as of November 1, 2 024. Note: Dollars in millions. Cash excluding deferred merchant payables and FDSO of 153mm per Telluride management. Assumes transac tion close and balance sheet as of CYE’2024. LBO analysis assumes PF net leverage of 6.0x, minimum cash of $100mm and acquisition transaction fees of $75mm. (1) Assumes Luggage closing cash balance of $0. Reference share price of $14.00 and $16.13 implies an average price paid for the Telluride shares owned by Luggage, net of the shares related to the VPF, of $16.24 and $18.38, respectively. (2) Reflects current Telluride share price. Project Lindbergh proposal of $17.50 (2) Assuming No Luggage Collapse Assuming Luggage Collapse (1) Reference Share Price: $14.00 Reference Share Price: $16.13 Illustrative Telluride Offer Price $17.50 $20.00 $22.50 $17.50 $20.00 $22.50 $17.50 $20.00 $22.50 % Premium vs. Current Share Price 8 % 24% 39% 8 % 24% 39% 8 % 24% 39% Implied Total Equity Consideration $2,680 $3,063 $3,445 $2,264 $2,587 $2,911 $2,288 $2,615 $2,942 Aggregate Premium Paid $210 $593 $975 $177 $501 $824 $179 $506 $833 ∆ in Aggregate Premium vs. No Luggage Collapse ($33) ($92) ($151) ($31) ($87) ($143) Telluride Cash On Hand (YE'24E) $855 $855 $855 $462 $462 $462 $433 $433 $433 Illustrative Sponsor Equity $855 $1,238 $1,620 $832 $1,155 $1,478 $884 $1,211 $1,538 ∆ in Sponsor Equity vs. No Luggage Collapse ($23) ($83) ($142) +$30 ($26) ($82) A Luggage collapse may reduce the sponsor equity contribution in a potential Telluride take-private transaction, dependent on the Telluride acquisition share price and reference share price at which an acquisition of Luggage is effectuated |

| 5 – Highly Confidential; For Discussion Purposes Only – Disclaimer This presentation has been prepared by Centerview Partners LLC (“Centerview”) for use solely by the Special Committee of the Board of Directors of Telluride, Inc. (“Telluride” or the “Company”) in connection with its evaluation of proposed strategic alternatives for Telluride and for no other purpose. The information contained herein is based upon information supplied by or on behalf of Telluride and publicly available information, and portions of the information contained herein may be based upon statements, estimates and forecasts provided by Telluride. Centerview has relied upon the accuracy and completeness of the foregoing information, and has not assumed any responsibilityfor any independent verification of such information or for any independent evaluation or appraisal of any of the assets or liabilities (contingent or otherwise) of Telluride or any other entity, or concerning the solvency or fair value of Telluride or any other entity. With respect to financial forecasts, Centerview has assumed that such forecasts have been reasonably prepared on bases reflecting the best currently available estimates and judgments of the management of Telluride as to the future financial performance of Telluride, and at your direction Centerview has relied upon such forecasts, as provided by Telluride’s management, with respect to Telluride. Centerview assumes no responsibility for and expresses no view as to such forecasts or the assumptions on which they are based. The information set forth herein is based upon economic, monetary, market and other conditions as in effect on, and the information made available to us as of, the date hereof, unless indicated otherwise and Centerview assumes no obligation to update or otherwise revise these materials. The financial analysis in this presentation is complex and is not necessarily susceptible to a partial analysis or summary description. In performing this financial analysis, Centerview has considered the results of its analysis as a whole and did not necessarily attribute aparticular weight to any particular portion of the analysis considered. Furthermore, selecting any portion of Centerview’s analysis, without considering the analysis as a whole, would create an incomplete view of the process underlying its financial analysis. Centerview may have deemed various assumptions more or less probable than other assumptions, so the reference ranges resulting from any particular portion of the analysis described above should not be taken to be Centerview’s view of the actual value of Telluride. These materials and the information contained herein are confidential, were not prepared with a view toward public disclosure, and may not be disclosed publicly or made available to third parties without the prior written consent of Centerview. These materials and any other advice, written or oral, rendered by Centerview are intended solely for the benefit and use of the Special Committee of the Board of Directors of Telluride (in its capacity as such) in its consideration of strategic alternatives, and are not for the benefit of, and do not convey any rights or remedies for any holder of securities of Telluride or any other person. Centerview will not be responsible for and has not provided any tax, accounting, actuarial, legal or other specialist advice. These materials are not intended to provide the sole basis for evaluating strategic alternatives, and this presentation does not represent a fairness opinion, recommendation, valuation or opinion of any kind, and is necessarily incomplete and should be viewed solely in conjunction with the oral presentation provided by Centerview. |