| – Highly Confidential; For Discussion Purposes Only – Highly Confidential; For Discussion Purposes Only December 2024 Discussion Materials Project Telluride indicates that confidential information has been omitted, pursuant to Rule 24b-2 of the Securities and Exchange Act of 1934, as amended, and filed separately with the Securities and Exchange Commission. |

| 1 – Highly Confidential; For Discussion Purposes Only – Disclaimer This presentation has been prepared by Centerview Partners LLC (“Centerview”) for use solely by the Special Committee of the Board of Directors of Telluride, Inc. (“Telluride” or the “Company”) in connection with Centerview advising the Special Committee in its evaluation of proposed strategic alternatives for Telluride and for no other purpose. The information contained herein is based upon information supplied by or on behalf of Telluride and publicly available information, and portions of the information contained herein may be based upon statements, estimates and forecasts provided by Telluride. Centerview has relied upon the accuracy and completeness of the foregoing information, and has not assumed any responsibility for any independent verification of such information or for any independent evaluation or appraisal of any of the assets or liabilities (contingent or otherwise) of Telluride or any other entity, or concerning the solvency or fair value ofTelluride or any other entity. With respect to financial forecasts, Centerview has assumed that such forecasts have been reasonably prepared on bases reflecting the best currently available estimates and judgments of the management of Telluride as to the future financial performance of Teluride, and at your direction Centerview has relied upon such forecasts, as provided by Telluride’s management, with respect to Telluride. Centerview assumes no responsibility for and expresses no view as to such forecasts or the assumptions on which they are based. The information setforth herein is based upon economic, monetary, market and other conditions as in effect on, and the information made available to us as of, the date hereof, unless indicated otherwise and Centerview assumes no obligation to update or otherwise revise these materials. The financial analysis in this presentation is complex and is not necessarily susceptible to a partial analysis or summary description. In performing this financial analysis, Centerview has considered the results of its analysis as a whole and did not necessarily attribute aparticular weight to any particular portion of the analysis considered. Furthermore, selecting any portion of Centerview’s analysis, without considering the analysis as a whole, would create an incomplete view of the process underlying its financial analysis. Centerview may have deemed various assumptions more or less probable than other assumptions, so the reference ranges resulting from any particular portion of the analysis described above should not be taken to be Centerview’s view of the actual value of Telluride. These materials and the information contained herein are confidential, were not prepared with a view toward public disclosure, and may not be disclosed publicly or made available to third parties without the prior written consent of Centerview. These materials and any other advice, written or oral, rendered by Centerview are intended solely for the benefit and use of the Special Committee of the Board of Directors of Telluride (in its capacity as such) in its consideration of strategic alternatives, and are not for the benefit of, and do not convey any rights or remedies for any holder of securities of Telluride or any other person. Centerview will not be responsible for and has not provided any tax, accounting, actuarial, legal or other specialist advice. These materials are not intended to provide the sole basis for evaluating strategic alternatives, and this presentation does not represent a fairness opinion, recommendation, valuation or opinion of any kind, and is necessarily incomplete and should be viewed solely in conjunction with the oral presentation provided by Centerview. |

| 2 – Highly Confidential; For Discussion Purposes Only – Situation Update ▪ The Special Committee and advisors have continued to evaluate potential strategic alternatives including: – The elimination of Telluride’s dual-class share structure through an acquisition of Luggage – Potential sale of Telluride to Grindelwald ▪ The transaction terms for a potential acquisition of Luggage have been agreed upon in principle: – Variable Prepaid Forward (“VPF”) to be settled by Luggage with Telluride Common shares prior to a transaction – Exchangeable Senior Debentures to be repaid by Telluride for ~$330mm in cash – Luggage Common Equity to receive $20mm of cash consideration – Value of consideration to Certares to flex depending on the Telluride reference share price Weil to provide update on state of play and transaction terms |

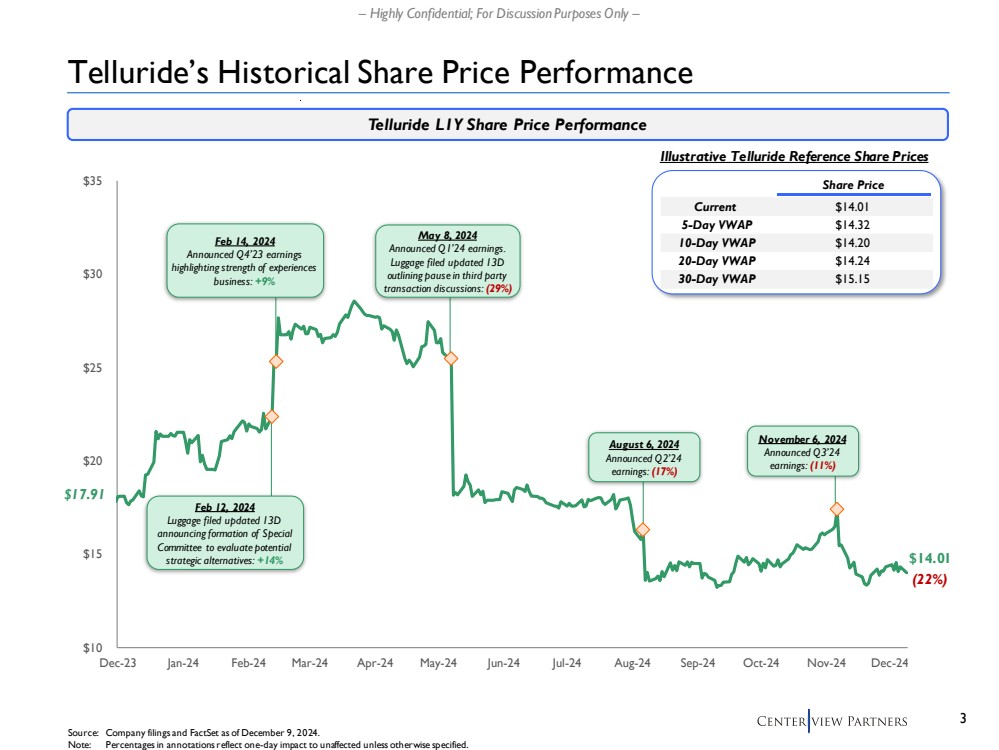

| 3 – Highly Confidential; For Discussion Purposes Only – Telluride’s Historical Share Price Performance Source: Company filings and FactSet as of December 9, 2024. Note: Percentages in annotations reflect one-day impact to unaffected unless otherwise specified. Telluride L1Y Share Price Performance (22%) $14.01 $17.91 Feb 12, 2024 Luggage filed updated 13D announcing formation of Special Committee to evaluate potential strategic alternatives: +14% Feb 14, 2024 Announced Q4’23 earnings highlighting strength of experiences business: +9% $10 $15 $20 $25 $30 $35 Dec-23 Jan-24 Feb-24 Mar-24 Apr-24 May-24 Jun-24 Jul-24 Aug-24 Sep-24 Oct-24 Nov-24 Dec-24 May 8, 2024 Announced Q1’24 earnings. Luggage filed updated 13D outlining pause in third party transaction discussions: (29%) August 6, 2024 Announced Q2’24 earnings: (17%) November 6, 2024 Announced Q3’24 earnings: (11%) Illustrative Telluride Reference Share Prices Share Price Current $14.01 5-Day VWAP $14.32 10-Day VWAP $14.20 20-Day VWAP $14.24 30-Day VWAP $15.15 |

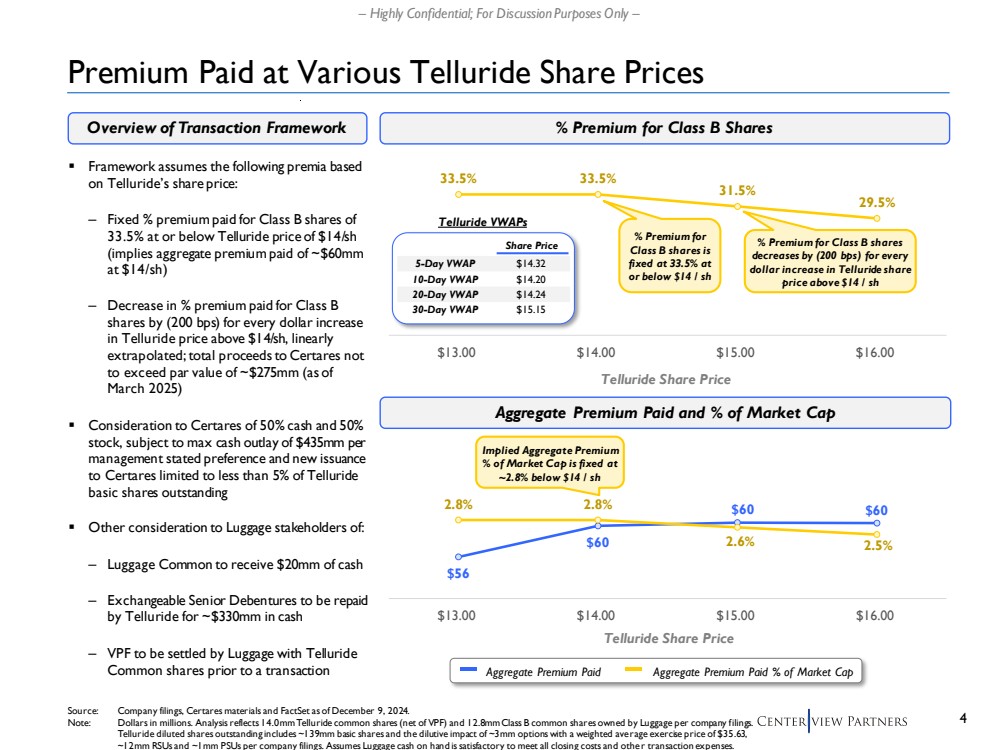

| 4 – Highly Confidential; For Discussion Purposes Only – $56 $60 $60 $60 2.8% 2.8% 2.6% 2.5% $13.00 $14.00 $15.00 $16.00 33.5% 33.5% 31.5% 29.5% $13.00 $14.00 $15.00 $16.00 Premium Paid at Various Telluride Share Prices ▪ Framework assumes the following premia based on Telluride’s share price: – Fixed % premium paid for Class B shares of 33.5% at or below Telluride price of $14/sh (implies aggregate premium paid of ~$60mm at $14/sh) – Decrease in % premium paid for Class B shares by (200 bps) for every dollar increase in Telluride price above $14/sh, linearly extrapolated; total proceeds to Certares not to exceed par value of ~$275mm (as of March 2025) ▪ Consideration to Certares of 50% cash and 50% stock, subject to max cash outlay of $435mm per management stated preference and new issuance to Certares limited to less than 5% of Telluride basic shares outstanding ▪ Other consideration to Luggage stakeholders of: – Luggage Common to receive $20mm of cash – Exchangeable Senior Debentures to be repaid by Telluride for ~$330mm in cash – VPF to be settled by Luggage with Telluride Common shares prior to a transaction Overview of Transaction Framework % Premium for Class B Shares Telluride Share Price % Premium for Class B shares is fixed at 33.5% at or below $14 / sh % Premium for Class B shares decreases by (200 bps) for every dollar increase in Telluride share price above $14 / sh Aggregate Premium Paid and % of Market Cap Telluride Share Price Aggregate Premium Paid Aggregate Premium Paid % of Market Cap Implied Aggregate Premium % of Market Cap is fixed at ~2.8% below $14 / sh Source: Company filings, Certares materials and FactSet as of December 9, 2024. Note: Dollars in millions. Analysis reflects 14.0mm Telluride common shares (net of VPF) and 12.8mm Class B common shares owned by Luggage per company filings. Telluride diluted shares outstanding includes ~139mm basic shares and the dilutive impact of ~3mm options with a weighted average exercise price of $35.63, ~12mm RSUs and ~1mm PSUs per company filings. Assumes Luggage cash on hand is satisfactory to meet all closing costs and other transaction expenses. Telluride VWAPs Share Price 5-Day VWAP $14.32 10-Day VWAP $14.20 20-Day VWAP $14.24 30-Day VWAP $15.15 |

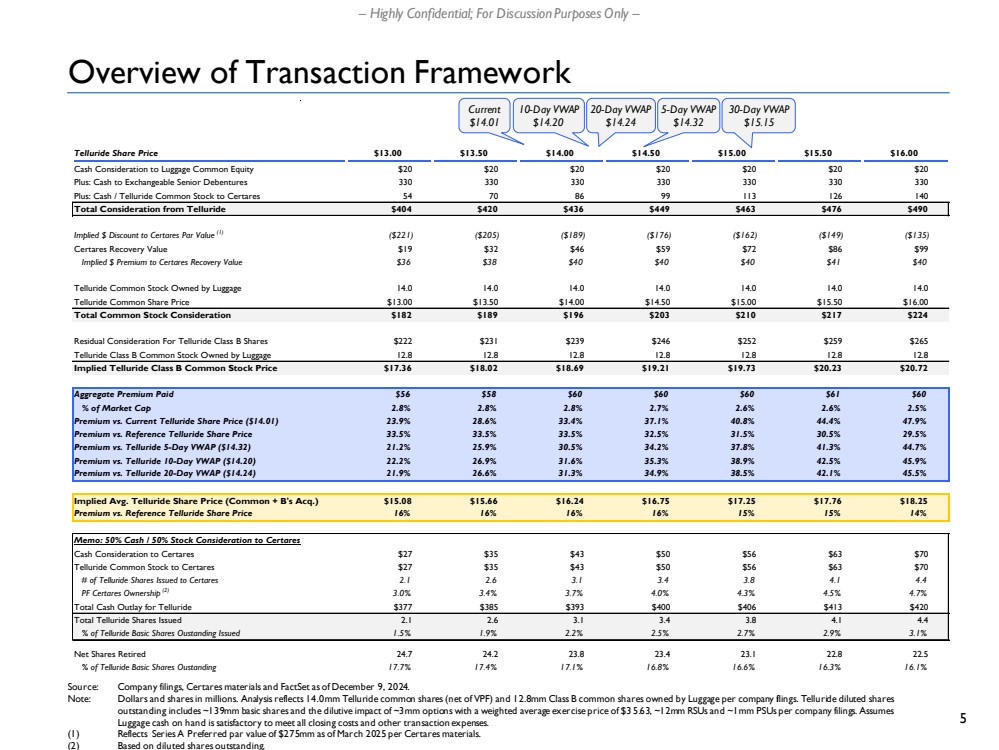

| 5 – Highly Confidential; For Discussion Purposes Only – Overview of Transaction Framework Source: Company filings, Certares materials and FactSet as of December 9, 2024. Note: Dollars and shares in millions. Analysis reflects 14.0mm Telluride common shares (net of VPF) and 12.8mm Class B common shares owned by Luggage per company filings. Telluride diluted shares outstanding includes ~139mm basic shares and the dilutive impact of ~3mm options with a weighted average exercise price of $3 5.63, ~12mm RSUs and ~1mm PSUs per company filings. Assumes Luggage cash on hand is satisfactory to meet all closing costs and other transaction expenses. (1) Reflects Series A Preferred par value of $275mm as of March 2025 per Certares materials. (2) Based on diluted shares outstanding. Current $14.01 5-Day VWAP $14.32 10-Day VWAP $14.20 20-Day VWAP $14.24 30-Day VWAP $15.15 Telluride Share Price $13.00 $13.50 $14.00 $14.50 $15.00 $15.50 $16.00 Cash Consideration to Luggage Common Equity $20 $20 $20 $20 $20 $20 $20 Plus: Cash to Exchangeable Senior Debentures 330 330 330 330 330 330 330 Plus: Cash / Telluride Common Stock to Certares 54 70 86 99 113 126 140 Total Consideration from Telluride $404 $420 $436 $449 $463 $476 $490 Implied $ Discount to Certares Par Value (1) ($221) ($205) ($189) ($176) ($162) ($149) ($135) Certares Recovery Value $19 $32 $46 $59 $72 $86 $99 Implied $ Premium to Certares Recovery Value $36 $38 $40 $40 $40 $41 $40 Telluride Common Stock Owned by Luggage 14.0 14.0 14.0 14.0 14.0 14.0 14.0 Telluride Common Share Price $13.00 $13.50 $14.00 $14.50 $15.00 $15.50 $16.00 Total Common Stock Consideration $182 $189 $196 $203 $210 $217 $224 Residual Consideration For Telluride Class B Shares $222 $231 $239 $246 $252 $259 $265 Telluride Class B Common Stock Owned by Luggage 12.8 12.8 12.8 12.8 12.8 12.8 12.8 Implied Telluride Class B Common Stock Price $17.36 $18.02 $18.69 $19.21 $19.73 $20.23 $20.72 Aggregate Premium Paid $56 $58 $60 $60 $60 $61 $60 % of Market Cap 2.8% 2.8% 2.8% 2.7% 2.6% 2.6% 2.5% Premium vs. Current Telluride Share Price ($14.01) 23.9% 28.6% 33.4% 37.1% 40.8% 44.4% 47.9% Premium vs. Reference Telluride Share Price 33.5% 33.5% 33.5% 32.5% 31.5% 30.5% 29.5% Premium vs. Telluride 5-Day VWAP ($14.32) 21.2% 25.9% 30.5% 34.2% 37.8% 41.3% 44.7% Premium vs. Telluride 10-Day VWAP ($14.20) 22.2% 26.9% 31.6% 35.3% 38.9% 42.5% 45.9% Premium vs. Telluride 20-Day VWAP ($14.24) 21.9% 26.6% 31.3% 34.9% 38.5% 42.1% 45.5% Implied Avg. Telluride Share Price (Common + B's Acq.) $15.08 $15.66 $16.24 $16.75 $17.25 $17.76 $18.25 Premium vs. Reference Telluride Share Price 16% 16% 16% 16% 15% 15% 14% Memo: 50% Cash / 50% Stock Consideration to Certares Cash Consideration to Certares $27 $35 $43 $50 $56 $63 $70 Telluride Common Stock to Certares $27 $35 $43 $50 $56 $63 $70 # of Telluride Shares Issued to Certares 2.1 2.6 3.1 3.4 3.8 4.1 4.4 PF Certares Ownership (2) 3.0% 3.4% 3.7% 4.0% 4.3% 4.5% 4.7% Total Cash Outlay for Telluride $377 $385 $393 $400 $406 $413 $420 Total Telluride Shares Issued 2.1 2.6 3.1 3.4 3.8 4.1 4.4 % of Telluride Basic Shares Oustanding Issued 1.5% 1.9% 2.2% 2.5% 2.7% 2.9% 3.1% Net Shares Retired 24.7 24.2 23.8 23.4 23.1 22.8 22.5 % of Telluride Basic Shares Oustanding 17.7% 17.4% 17.1% 16.8% 16.6% 16.3% 16.1% |