| December 18, 2024 Discussion Materials Project Telluride |

| 1 Disclaimer This presentation has been prepared by Centerview Partners LLC (“Centerview”) for use solely by the Special Committee of the Board of Directors of Telluride, Inc. (“Telluride”) in connection with Centerview advising the Special Committee in its evaluation of proposed strategic alternatives for Telluride and for no other purpose. The information contained herein is based upon information supplied by or on behalf of Telluride and publicly available information, and portions of the information contained herein may be based upon statements, estimates and forecasts provided by Telluride. Centerview has, with your consent, relied upon the accuracy and completeness of the foregoing information, and, at your direction, has not assumed any responsibility for any independent verification of such information or for any independent evaluation or appraisal of any of the assets or liabilities (contingent or otherwise) of Telluride or any other entity, or concerning the solvency or fair value of Telluride or any other entity. With respect to financial forecasts, Centerview has assumed that such forecasts have been reasonably prepared on bases reflecting the best currently available estimates and judgments of the management of Telluride as to the future financial performance of Telluride, and, at your direction, Centerview has relied upon such forecasts, as provided by Telluride’s management and approved for our use by the Special Committee of the Board of Directors of Telluride, with respect to Telluride. Centerview assumes no responsibilityfor and expresses no view as to such forecasts or the assumptions on which they are based. The information set forth herein is based upon financial, economic, monetary, currency, market and other conditions and circumstances as in effect on, and the information made available to us as of, the date hereof, unless indicated otherwise and Centerview assumes no obligation or responsibility to update or otherwise revise thesematerials. The financial analysis in this presentation is complex and is not necessarily susceptible to a partial analysis or summary description. In performing this financial analysis, Centerview has considered the results of its analysis as a whole and did not necessarily attribute aparticular weight to any particular portion of the analysis considered. Furthermore, selecting any portion of Centerview’s analysis, without considering the analysis as a whole, would create an incomplete view of the process underlying its financial analysis. Centerview may have deemed various assumptions more or less probable than other assumptions, so the reference ranges resulting from any particular portion of the analysis described above should not be taken to be Centerview’s view of the actual value of Telluride. These materials and the information contained herein are confidential, were not prepared with a view toward public disclosure, and may not be disclosed publicly or made available to third parties without the prior written consent of Centerview. These materials and any other advice, written or oral, rendered by Centerview are intended solely for the benefit and use of the Special Committee of the Board of Directors of Telluride (in its capacity as such) in its consideration of strategic alternatives, and are not for the benefit of, and do not convey any rights or remedies for any holder of securities of Telluride or any other person. Centerview will not be responsible for and has not provided any tax, accounting, actuarial, legal or other specialist advice. These materials are not intended to provide the sole basis for evaluating strategic alternatives, and this presentation does not represent a fairness opinion, recommendation, valuation or opinion of any kind, and is necessarily incomplete and should be viewed solely in conjunction with the oral presentation provided by Centerview. |

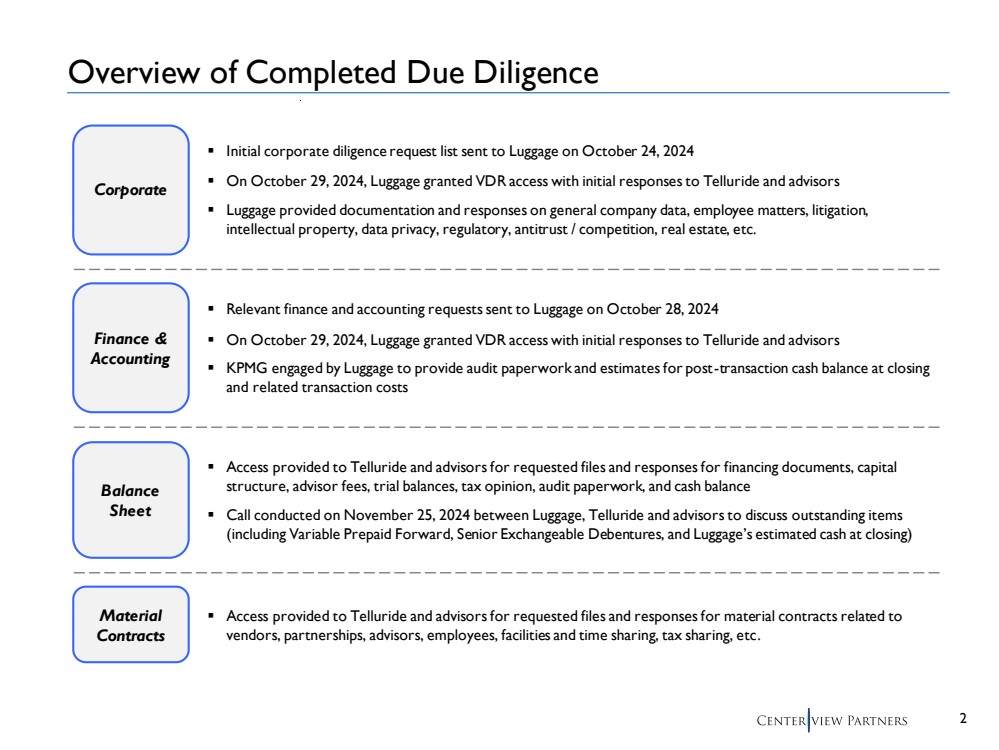

| 2 Overview of Completed Due Diligence Material Contracts ▪ Initial corporate diligence request list sent to Luggage on October 24, 2024 ▪ On October 29, 2024, Luggage granted VDR access with initial responses to Telluride and advisors ▪ Luggage provided documentation and responses on general company data, employee matters, litigation, intellectual property, data privacy, regulatory, antitrust / competition, real estate, etc. Corporate ▪ Access provided to Telluride and advisors for requested files and responses for financing documents, capital structure, advisor fees, trial balances, tax opinion, audit paperwork, and cash balance ▪ Call conducted on November 25, 2024 between Luggage, Telluride and advisors to discuss outstanding items (including Variable Prepaid Forward, Senior Exchangeable Debentures, and Luggage’s estimated cash at closing) Balance Sheet ▪ Relevant finance and accounting requests sent to Luggage on October 28, 2024 ▪ On October 29, 2024, Luggage granted VDR access with initial responses to Telluride and advisors ▪ KPMG engaged by Luggage to provide audit paperwork and estimates for post-transaction cash balance at closing and related transaction costs Finance & Accounting ▪ Access provided to Telluride and advisors for requested files and responses for material contracts related to vendors, partnerships, advisors, employees, facilities and time sharing, tax sharing, etc. |

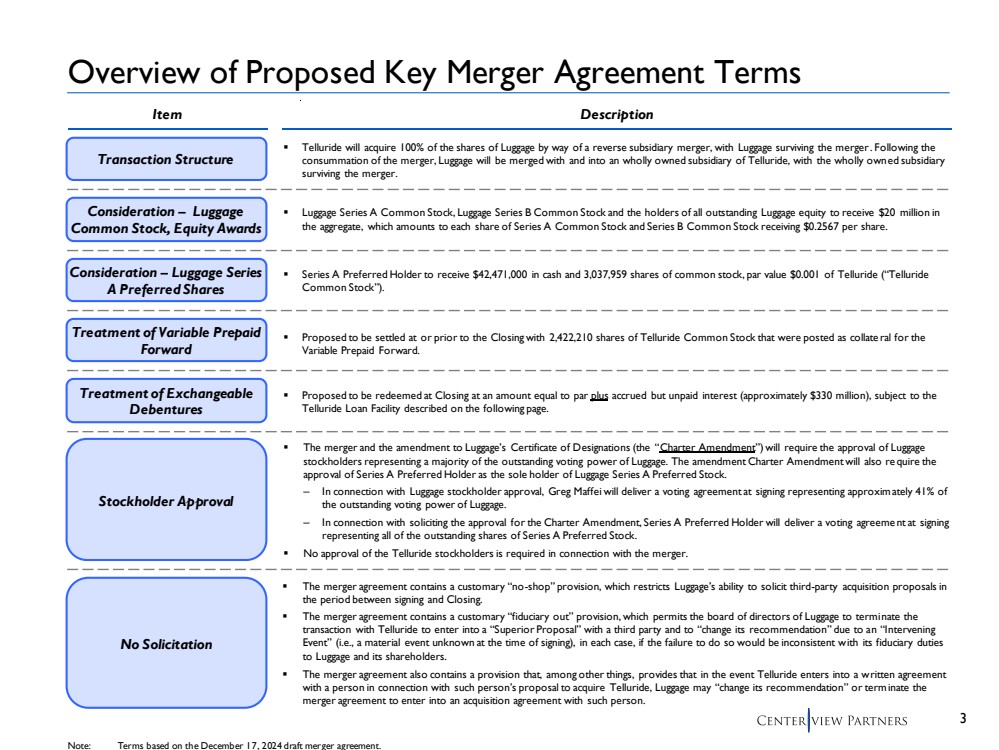

| 3 Overview of Proposed Key Merger Agreement Terms ▪ Telluride will acquire 100% of the shares of Luggage by way of a reverse subsidiary merger, with Luggage surviving the merger. Following the consummation of the merger, Luggage will be merged with and into an wholly owned subsidiary of Telluride, with the wholly owned subsidiary surviving the merger. Transaction Structure Consideration – Luggage Common Stock, Equity Awards ▪ Luggage Series A Common Stock, Luggage Series B Common Stock and the holders of all outstanding Luggage equity to receive $20 million in the aggregate, which amounts to each share of Series A Common Stock and Series B Common Stock receiving $0.2567 per share. Consideration – Luggage Series A Preferred Shares ▪ Series A Preferred Holder to receive $42,471,000 in cash and 3,037,959 shares of common stock, par value $0.001 of Telluride (“Telluride Common Stock”). Treatment of Variable Prepaid Forward ▪ Proposed to be settled at or prior to the Closing with 2,422,210 shares of Telluride Common Stock that were posted as collate ral for the Variable Prepaid Forward. Treatment of Exchangeable Debentures ▪ Proposed to be redeemed at Closing at an amount equal to par plus accrued but unpaid interest (approximately $330 million), subject to the Telluride Loan Facility described on the following page. Stockholder Approval ▪ The merger and the amendment to Luggage’s Certificate of Designations (the “Charter Amendment”) will require the approval of Luggage stockholders representing a majority of the outstanding voting power of Luggage. The amendment Charter Amendment will also re quire the approval of Series A Preferred Holder as the sole holder of Luggage Series A Preferred Stock. – In connection with Luggage stockholder approval, Greg Maffei will deliver a voting agreement at signing representing approximately 41% of the outstanding voting power of Luggage. – In connection with soliciting the approval for the Charter Amendment, Series A Preferred Holder will deliver a voting agreeme nt at signing representing all of the outstanding shares of Series A Preferred Stock. ▪ No approval of the Telluride stockholders is required in connection with the merger. Item Description No Solicitation ▪ The merger agreement contains a customary “no-shop” provision, which restricts Luggage’s ability to solicit third-party acquisition proposals in the period between signing and Closing. ▪ The merger agreement contains a customary “fiduciary out” provision, which permits the board of directors of Luggage to terminate the transaction with Telluride to enter into a “Superior Proposal” with a third party and to “change its recommendation” due to an “Intervening Event” (i.e., a material event unknown at the time of signing), in each case, if the failure to do so would be inconsistent with its fiduciary duties to Luggage and its shareholders. ▪ The merger agreement also contains a provision that, among other things, provides that in the event Telluride enters into a written agreement with a person in connection with such person’s proposal to acquire Telluride, Luggage may “change its recommendation” or terminate the merger agreement to enter into an acquisition agreement with such person. Note: Terms based on the December 17, 2024 draft merger agreement. |

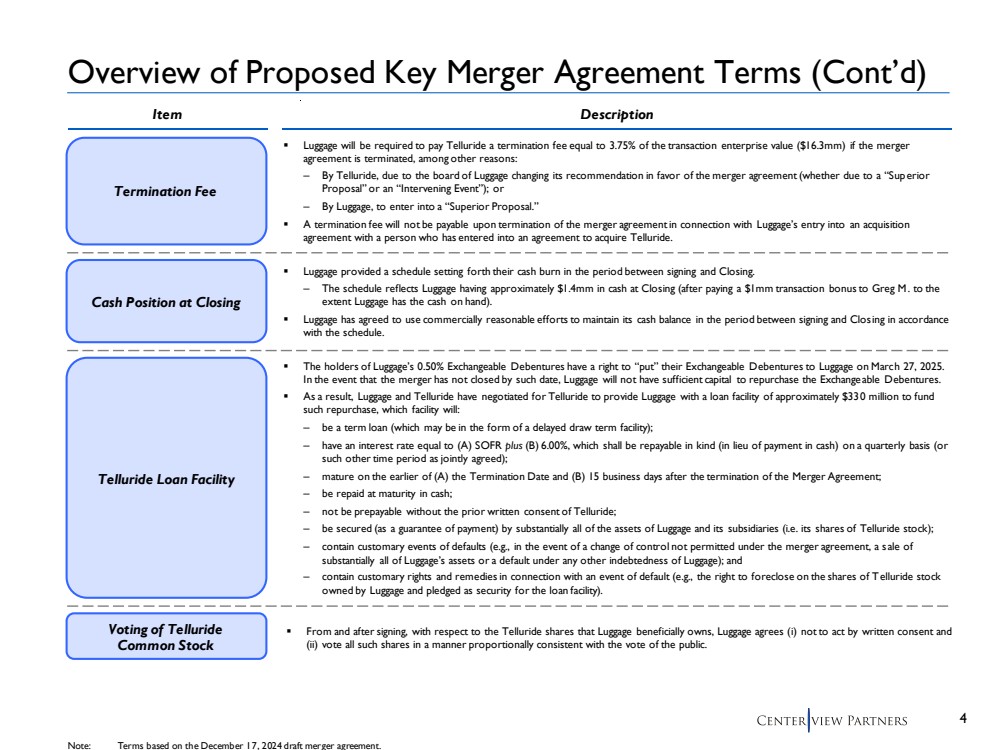

| 4 Overview of Proposed Key Merger Agreement Terms (Cont’d) Item Description ▪ Luggage will be required to pay Telluride a termination fee equal to 3.75% of the transaction enterprise value ($16.3mm) if the merger agreement is terminated, among other reasons: – By Telluride, due to the board of Luggage changing its recommendation in favor of the merger agreement (whether due to a “Superior Proposal” or an “Intervening Event”); or – By Luggage, to enter into a “Superior Proposal.” ▪ A termination fee will not be payable upon termination of the merger agreement in connection with Luggage’s entry into an acquisition agreement with a person who has entered into an agreement to acquire Telluride. Termination Fee Cash Position at Closing ▪ Luggage provided a schedule setting forth their cash burn in the period between signing and Closing. – The schedule reflects Luggage having approximately $1.4mm in cash at Closing (after paying a $1mm transaction bonus to Greg M. to the extent Luggage has the cash on hand). ▪ Luggage has agreed to use commercially reasonable efforts to maintain its cash balance in the period between signing and Closing in accordance with the schedule. Telluride Loan Facility ▪ The holders of Luggage’s 0.50% Exchangeable Debentures have a right to “put” their Exchangeable Debentures to Luggage on March 27, 2025. In the event that the merger has not closed by such date, Luggage will not have sufficient capital to repurchase the Exchange able Debentures. ▪ As a result, Luggage and Telluride have negotiated for Telluride to provide Luggage with a loan facility of approximately $330 million to fund such repurchase, which facility will: – be a term loan (which may be in the form of a delayed draw term facility); – have an interest rate equal to (A) SOFR plus (B) 6.00%, which shall be repayable in kind (in lieu of payment in cash) on a quarterly basis (or such other time period as jointly agreed); – mature on the earlier of (A) the Termination Date and (B) 15 business days after the termination of the Merger Agreement; – be repaid at maturity in cash; – not be prepayable without the prior written consent of Telluride; – be secured (as a guarantee of payment) by substantially all of the assets of Luggage and its subsidiaries (i.e. its shares of Telluride stock); – contain customary events of defaults (e.g., in the event of a change of control not permitted under the merger agreement, a s ale of substantially all of Luggage’s assets or a default under any other indebtedness of Luggage); and – contain customary rights and remedies in connection with an event of default (e.g., the right to foreclose on the shares of Telluride stock owned by Luggage and pledged as security for the loan facility). Voting of Telluride Common Stock ▪ From and after signing, with respect to the Telluride shares that Luggage beneficially owns, Luggage agrees (i) not to act by written consent and (ii) vote all such shares in a manner proportionally consistent with the vote of the public. Note: Terms based on the December 17, 2024 draft merger agreement. |

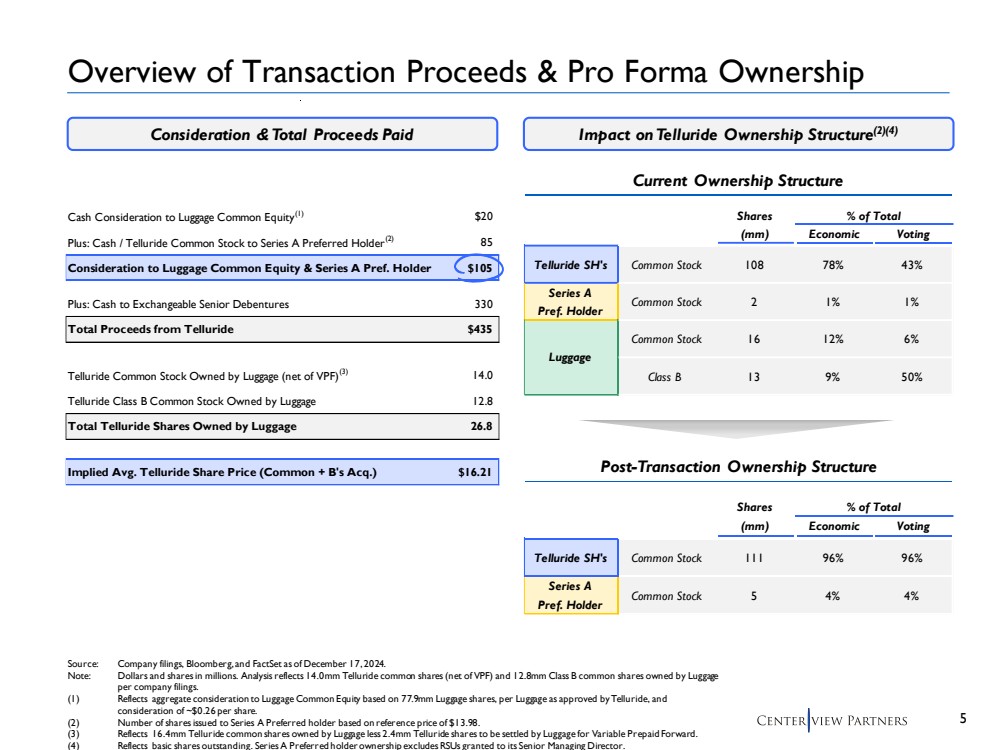

| 5 Cash Consideration to Luggage Common Equity(1) $20 Plus: Cash / Telluride Common Stock to Series A Preferred Holder(2) 8 5 Consideration to Luggage Common Equity & Series A Pref. Holder $105 Plus: Cash to Exchangeable Senior Debentures 330 Total Proceeds from Telluride $435 Telluride Common Stock Owned by Luggage (net of VPF)(3) 14.0 Telluride Class B Common Stock Owned by Luggage 12.8 Total Telluride Shares Owned by Luggage 26.8 Implied Avg. Telluride Share Price (Common + B's Acq.) $16.21 Overview of Transaction Proceeds & Pro Forma Ownership Shares % of Total (mm) Economic Voting Telluride SH's Common Stock 108 78% 43% Series A Pref. Holder Common Stock 2 1 % 1 % Common Stock 1 6 12% 6 % Class B 1 3 9 % 50% Luggage Shares % of Total (mm) Economic Voting Telluride SH's Common Stock 111 96% 96% Series A Pref. Holder Common Stock 5 4 % 4 % Source: Company filings, Bloomberg, and FactSet as of December 17, 2024. Note: Dollars and shares in millions. Analysis reflects 14.0mm Telluride common shares (net of VPF) and 12.8mm Class B common shares owned by Luggage per company filings. (1) Reflects aggregate consideration to Luggage Common Equity based on 77.9mm Luggage shares, per Luggage as approved by Telluride, and consideration of ~$0.26 per share. (2) Number of shares issued to Series A Preferred holder based on reference price of $13.98. (3) Reflects 16.4mm Telluride common shares owned by Luggage less 2.4mm Telluride shares to be settled by Luggage for Variable Prepaid Forward. (4) Reflects basic shares outstanding. Series A Preferred holder ownership excludes RSUs granted to its Senior Managing Director. Impact on Telluride Ownership Structure(2)(4) Current Ownership Structure Post-Transaction Ownership Structure Consideration & Total Proceeds Paid |

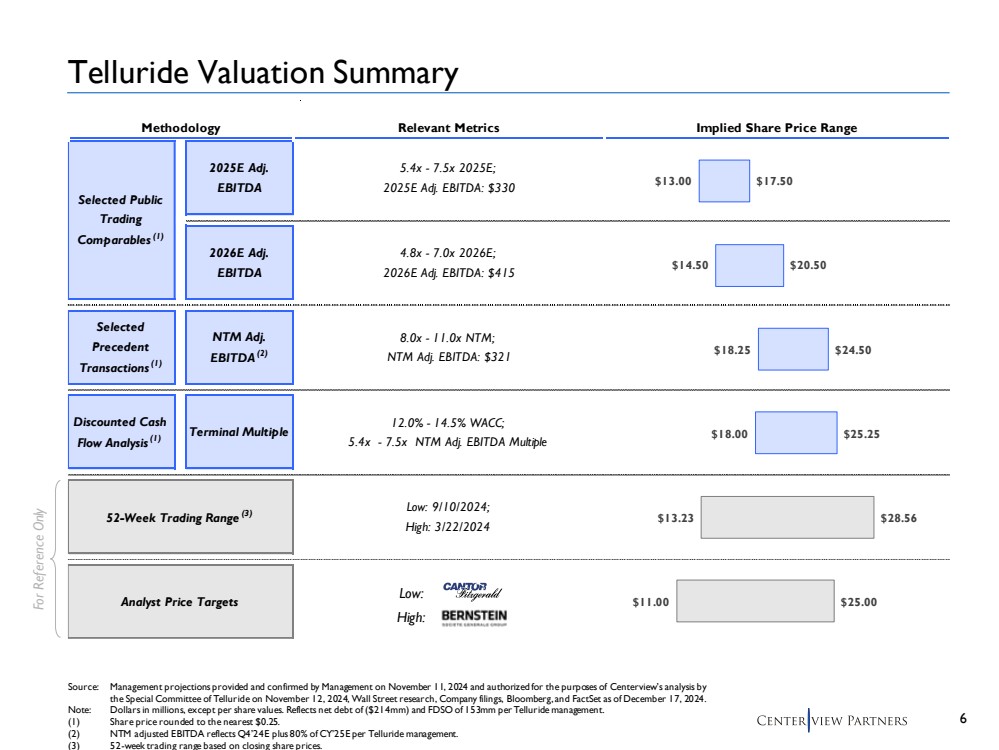

| 6 Methodology Relevant Metrics Implied Share Price Range 12.0% - 14.5% WACC; 5.4x - 7.5x NTM Adj. EBITDA Multiple 5.4x - 7.5x 2025E; 2025E Adj. EBITDA: $330 8.0x - 11.0x NTM; NTM Adj. EBITDA: $321 Low: 9/10/2024; High: 3/22/2024 4.8x - 7.0x 2026E; 2026E Adj. EBITDA: $415 52-Week Trading Range (3) Analyst Price Targets Discounted Cash Flow Analysis(1) Terminal Multiple 2025E Adj. EBITDA Selected Precedent Transactions(1) NTM Adj. EBITDA(2) 2026E Adj. EBITDA Selected Public Trading Comparables(1) $13.00 $14.50 $18.25 $18.00 $13.23 $11.00 $17.50 $20.50 $24.50 $25.25 $28.56 $25.00 Telluride Valuation Summary Source: Management projections provided and confirmed by Management on November 11, 2024 and authorized for the purposes of Centerview’s analysis by the Special Committee of Telluride on November 12, 2024, Wall Street research, Company filings, Bloomberg, and FactSet as of December 17, 2024. Note: Dollars in millions, except per share values. Reflects net debt of ($214mm) and FDSO of 153mm per Telluride management. (1) Share price rounded to the nearest $0.25. (2) NTM adjusted EBITDA reflects Q4’24E plus 80% of CY’25E per Telluride management. (3) 52-week trading range based on closing share prices. For Reference Only Low: High: |

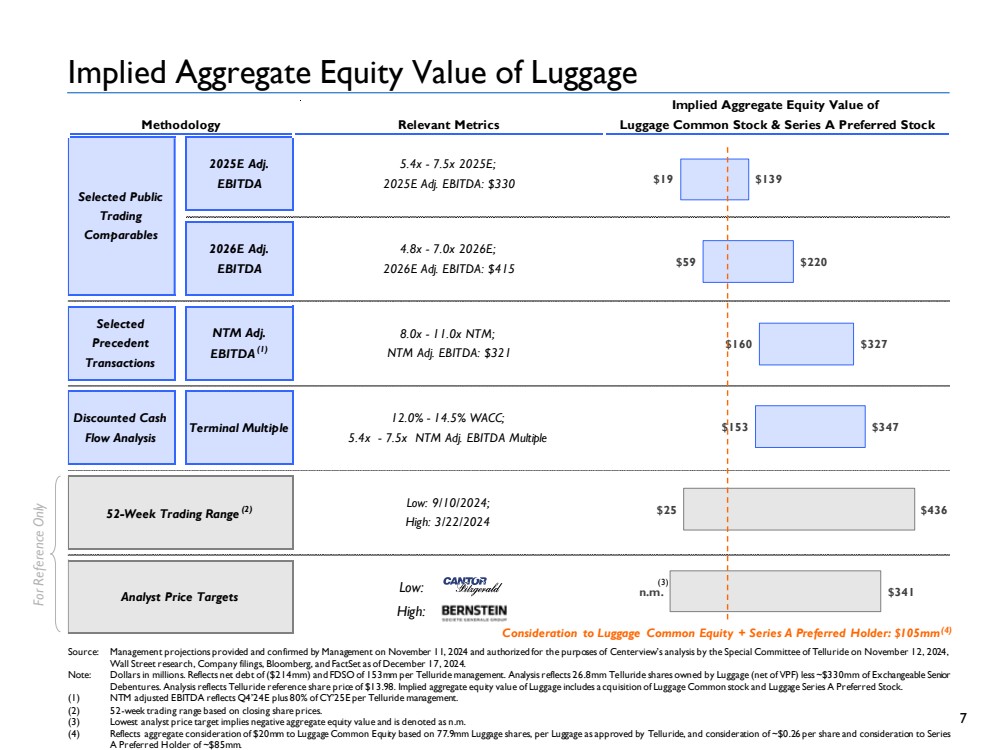

| 7 Implied Aggregate Equity Value of Methodology Relevant Metrics Luggage Common Stock & Series A Preferred Stock Analyst Price Targets Selected Public Trading Comparables 2025E Adj. EBITDA 5.4x - 7.5x 2025E; 2025E Adj. EBITDA: $330 2026E Adj. EBITDA 4.8x - 7.0x 2026E; 2026E Adj. EBITDA: $415 Selected Precedent Transactions NTM Adj. EBITDA(1) 8.0x - 11.0x NTM; NTM Adj. EBITDA: $321 Discounted Cash Flow Analysis Terminal Multiple 12.0% - 14.5% WACC; 5.4x - 7.5x NTM Adj. EBITDA Multiple 52-Week Trading Range (2) Low: 9/10/2024; High: 3/22/2024 $19 $59 $160 $153 $25 n.m. $139 $220 $327 $347 $436 $341 Implied Aggregate Equity Value of Luggage Source: Management projections provided and confirmed by Management on November 11, 2024 and authorized for the purposes of Centerview’s analysis by the Special Committee of Telluride on November 12, 2024, Wall Street research, Company filings, Bloomberg, and FactSet as of December 17, 2024. Note: Dollars in millions. Reflects net debt of ($214mm) and FDSO of 153mm per Telluride management. Analysis reflects 26.8mm Telluride shares owned by Luggage (net of VPF) less ~$330mm of Exchangeable Senior Debentures. Analysis reflects Telluride reference share price of $13.98. Implied aggregate equity value of Luggage includes a cquisition of Luggage Common stock and Luggage Series A Preferred Stock. (1) NTM adjusted EBITDA reflects Q4’24E plus 80% of CY’25E per Telluride management. (2) 52-week trading range based on closing share prices. (3) Lowest analyst price target implies negative aggregate equity value and is denoted as n.m. (4) Reflects aggregate consideration of $20mm to Luggage Common Equity based on 77.9mm Luggage shares, per Luggage as approved by Telluride, and consideration of ~$0.26 per share and consideration to Series A Preferred Holder of ~$85mm. For Reference Only Low: High: Consideration to Luggage Common Equity + Series A Preferred Holder: $105mm(4) (3) |

| 8 Selected Public Trading Comparables Source: Management projections provided and confirmed by Management on November 11, 2024 and authorized for the purposes of Centerview’s analysis by the Special Committee of Telluride on November 12, 2024, Company filings and FactSet as of December 17, 2024. Note: Dollars in billions. (1) NTM LRP figures reflect Q4’24E plus 80% of CY’25E per Telluride management. Equity Enterprise Rev Growth (%) EBITDA Margin (%) EV / EBITDA Company Value Value NTM CY'25 CY'26 NTM CY'25 CY'26 NTM CY'25 CY'26 Expedia $24.8 $25.9 8 % 8 % 7 % 22% 22% 22% 8.2x 8.2x 7.4x CarGurus 4.1 3.8 9 % 9 % 10% 29% 29% 28% 13.7x 13.6x 12.6x Yelp 2.9 2.5 5 % 5 % 5 % 25% 25% 25% 6.9x 6.9x 6.5x Sabre Corporation 1.6 6.2 5 % 5 % 4 % 21% 22% 22% 9.1x 9.0x 8.6x Nerdwallet 1.1 1.0 12% 12% 12% 18% 18% 17% 7.4x 7.4x 6.6x Angi 0.9 1.0 (8%) (8%) 4 % 13% 13% 14% 7.1x 7.1x 6.4x Average 5% 5% 7% 21% 21% 21% 8.7x 8.7x 8.0x Median 7% 7% 6% 22% 22% 22% 7.8x 7.8x 7.0x Telluride (Consensus) $2.1 $1.8 6% 7% 8% 18% 18% 18% 5.4x 5.4x 4.8x Telluride (LRP)(1) $2.1 $1.8 7% 6% 10% 17% 17% 19% 5.7x 5.6x 4.5x |

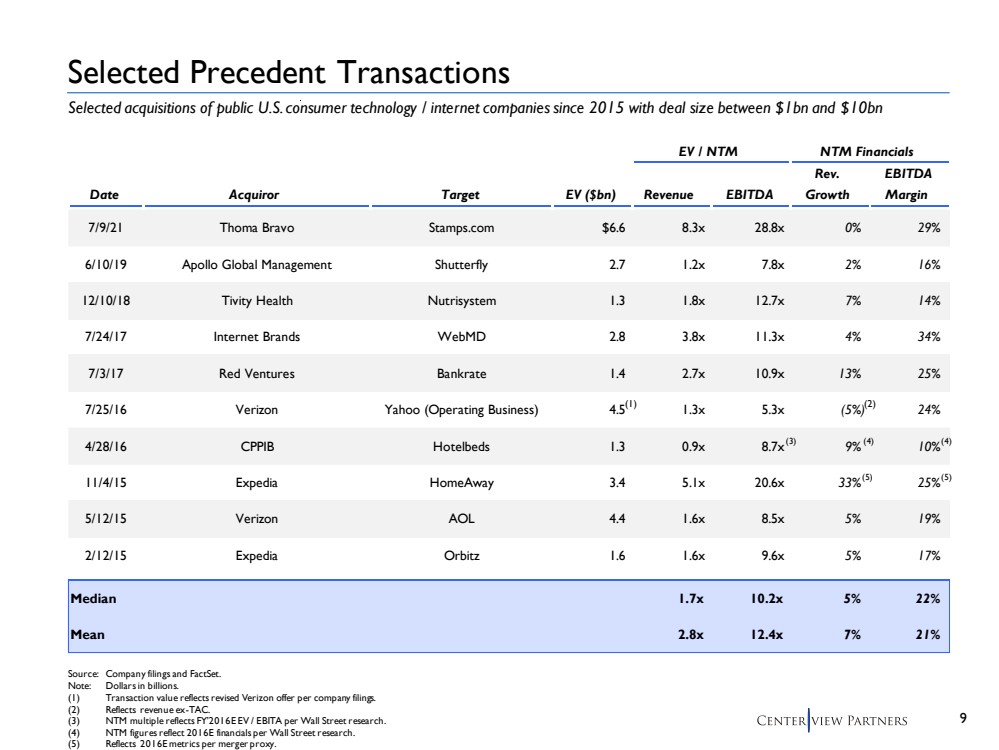

| 9 EV / NTM NTM Financials Rev. EBITDA Date Acquiror Target EV ($bn) Revenue EBITDA Growth Margin 7/9/21 Thoma Bravo Stamps.com $6.6 8.3x 28.8x 0% 29% 6/10/19 Apollo Global Management Shutterfly 2.7 1.2x 7.8x 2% 16% 12/10/18 Tivity Health Nutrisystem 1.3 1.8x 12.7x 7% 14% 7/24/17 Internet Brands WebMD 2.8 3.8x 11.3x 4% 34% 7/3/17 Red Ventures Bankrate 1.4 2.7x 10.9x 13% 25% 7/25/16 Verizon Yahoo (Operating Business) 4.5 1.3x 5.3x (5%) 24% 4/28/16 CPPIB Hotelbeds 1.3 0.9x 8.7x 9% 10% 11/4/15 Expedia HomeAway 3.4 5.1x 20.6x 33% 25% 5/12/15 Verizon AOL 4.4 1.6x 8.5x 5% 19% 2/12/15 Expedia Orbitz 1.6 1.6x 9.6x 5% 17% Median 1.7x 10.2x 5 % 22% Mean 2.8x 12.4x 7 % 21% Selected Precedent Transactions Source: Company filings and FactSet. Note: Dollars in billions. (1) Transaction value reflects revised Verizon offer per company filings. (2) Reflects revenue ex-TAC. (3) NTM multiple reflects FY’2016E EV / EBITA per Wall Street research. (4) NTM figures reflect 2016E financials per Wall Street research. (5) Reflects 2016E metrics per merger proxy. Selected acquisitions of public U.S. consumer technology / internet companies since 2015 with deal size between $1bn and $10bn (3) (1) (2) (4) (4) (5) (5) |

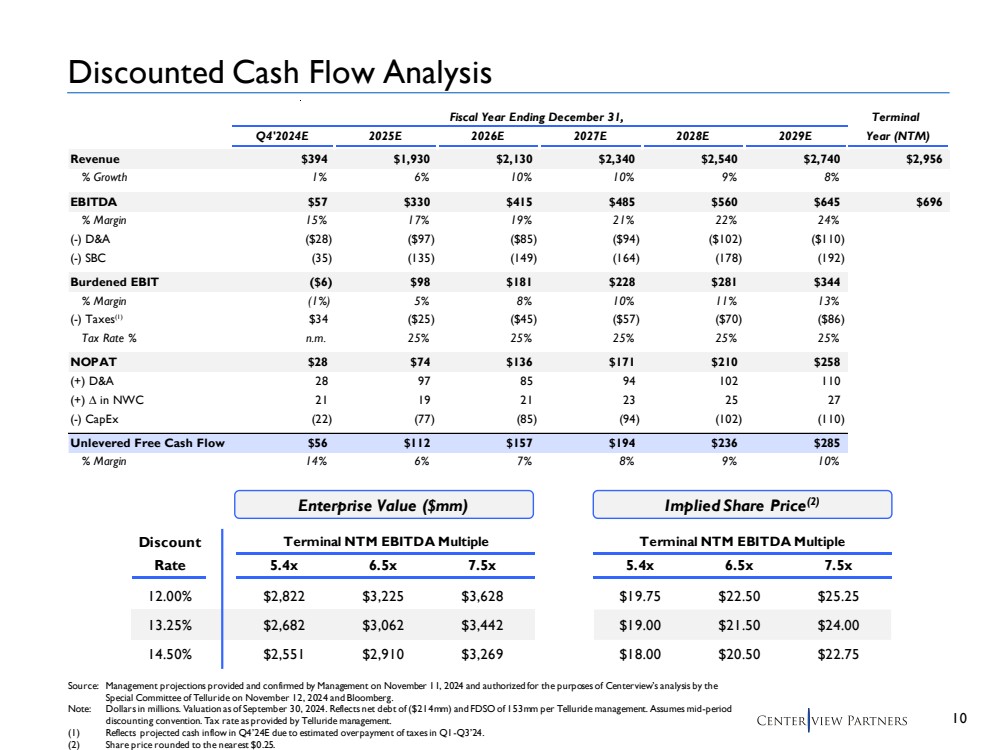

| 10 Fiscal Year Ending December 31, Terminal Q4'2024E 2025E 2026E 2027E 2028E 2029E Year (NTM) Revenue $394 $1,930 $2,130 $2,340 $2,540 $2,740 $2,956 % Growth 1 % 6 % 10% 10% 9 % 8 % EBITDA $57 $330 $415 $485 $560 $645 $696 % Margin 15% 17% 19% 21% 22% 24% (-) D&A ($28) ($97) ($85) ($94) ($102) ($110) (-) SBC (35) (135) (149) (164) (178) (192) Burdened EBIT ($6) $98 $181 $228 $281 $344 % Margin (1%) 5 % 8 % 10% 11% 13% (-) Taxes(1) $34 ($25) ($45) ($57) ($70) ($86) Tax Rate % n.m. 25% 25% 25% 25% 25% NOPAT $28 $74 $136 $171 $210 $258 (+) D&A 2 8 9 7 8 5 9 4 102 110 (+) ∆ in NWC 2 1 1 9 2 1 2 3 2 5 2 7 (-) CapEx (22) (77) (85) (94) (102) (110) Unlevered Free Cash Flow $56 $112 $157 $194 $236 $285 % Margin 14% 6 % 7 % 8 % 9 % 10% Source: Management projections provided and confirmed by Management on November 11, 2024 and authorized for the purposes of Centerview’s analysis by the Special Committee of Telluride on November 12, 2024 and Bloomberg. Note: Dollars in millions. Valuation as of September 30, 2024. Reflects net debt of ($214mm) and FDSO of 153mm per Telluride management. Assumes mid-period discounting convention. Tax rate as provided by Telluride management. (1) Reflects projected cash inflow in Q4’24E due to estimated overpayment of taxes in Q1-Q3’24. (2) Share price rounded to the nearest $0.25. Discounted Cash Flow Analysis Enterprise Value ($mm) Implied Share Price(2) Discount Terminal NTM EBITDA Multiple Terminal NTM EBITDA Multiple Rate 5.4x 6.5x 7.5x 12.00% $2,822 $3,225 $3,628 13.25% $2,682 $3,062 $3,442 14.50% $2,551 $2,910 $3,269 Terminal NTM EBITDA Multiple Terminal NTM EBITDA Multiple 5.4x 6.5x 7.5x $19.75 $22.50 $25.25 $19.00 $21.50 $24.00 $18.00 $20.50 $22.75 |

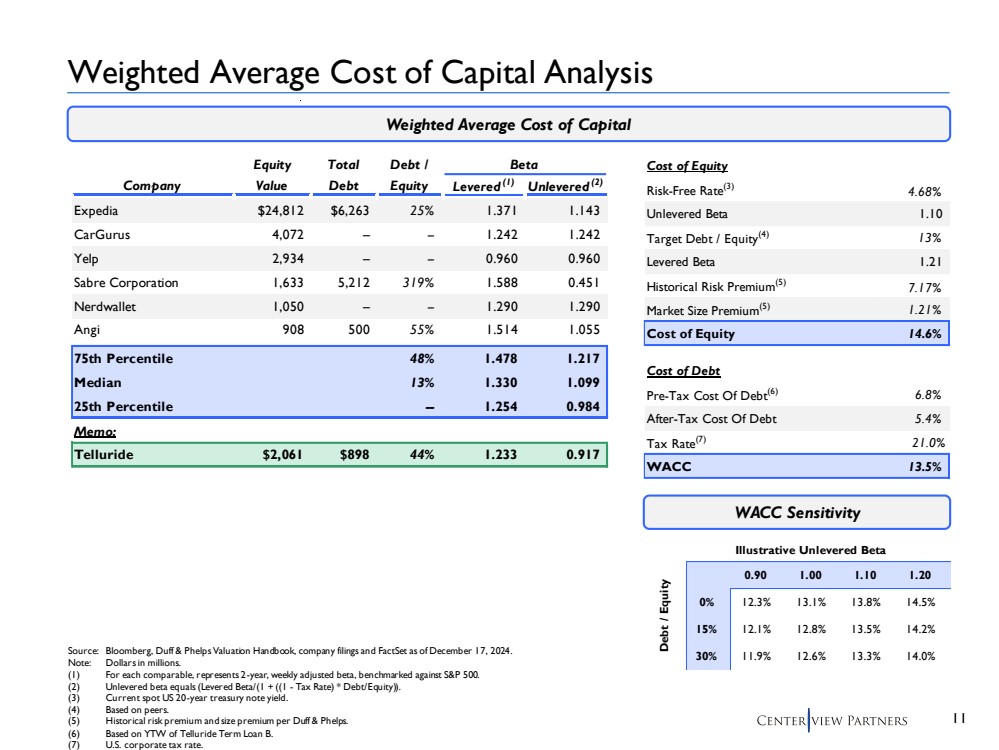

| 11 Cost of Equity Risk-Free Rate(3) 4.68% Unlevered Beta 1.10 Target Debt / Equity(4) 13% Levered Beta 1.21 Historical Risk Premium(5) 7.17% Market Size Premium(5) 1.21% Cost of Equity 14.6% Cost of Debt Pre-Tax Cost Of Debt(6) 6.8% After-Tax Cost Of Debt 5.4% Tax Rate(7) 21.0% WACC 13.5% Weighted Average Cost of Capital Analysis Source: Bloomberg, Duff & Phelps Valuation Handbook, company filings and FactSet as of December 17, 2024. Note: Dollars in millions. (1) For each comparable, represents 2-year, weekly adjusted beta, benchmarked against S&P 500. (2) Unlevered beta equals (Levered Beta/(1 + ((1 - Tax Rate) * Debt/Equity)). (3) Current spot US 20-year treasury note yield. (4) Based on peers. (5) Historical risk premium and size premium per Duff & Phelps. (6) Based on YTW of Telluride Term Loan B. (7) U.S. corporate tax rate. Weighted Average Cost of Capital WACC Sensitivity Illustrative Unlevered Beta 14% 0.90 1.00 1.10 1.20 0% 12.3% 13.1% 13.8% 14.5% 15% 12.1% 12.8% 13.5% 14.2% 30% 11.9% 12.6% 13.3% 14.0% Debt / Equity Equity Total Debt / Beta Company Value Debt Equity Levered (1) Unlevered (2) Expedia $24,812 $6,263 25% 1.371 1.143 CarGurus 4,072 – -- 1.242 1.242 Yelp 2,934 – -- 0.960 0.960 Sabre Corporation 1,633 5,212 319% 1.588 0.451 Nerdwallet 1,050 – -- 1.290 1.290 Angi 908 500 55% 1.514 1.055 75th Percentile 48% 1.478 1.217 Median 13% 1.330 1.099 25th Percentile -- 1.254 0.984 Memo: Telluride $2,061 $898 44% 1.233 0.917 |

| Appendix Supplementary Materials |

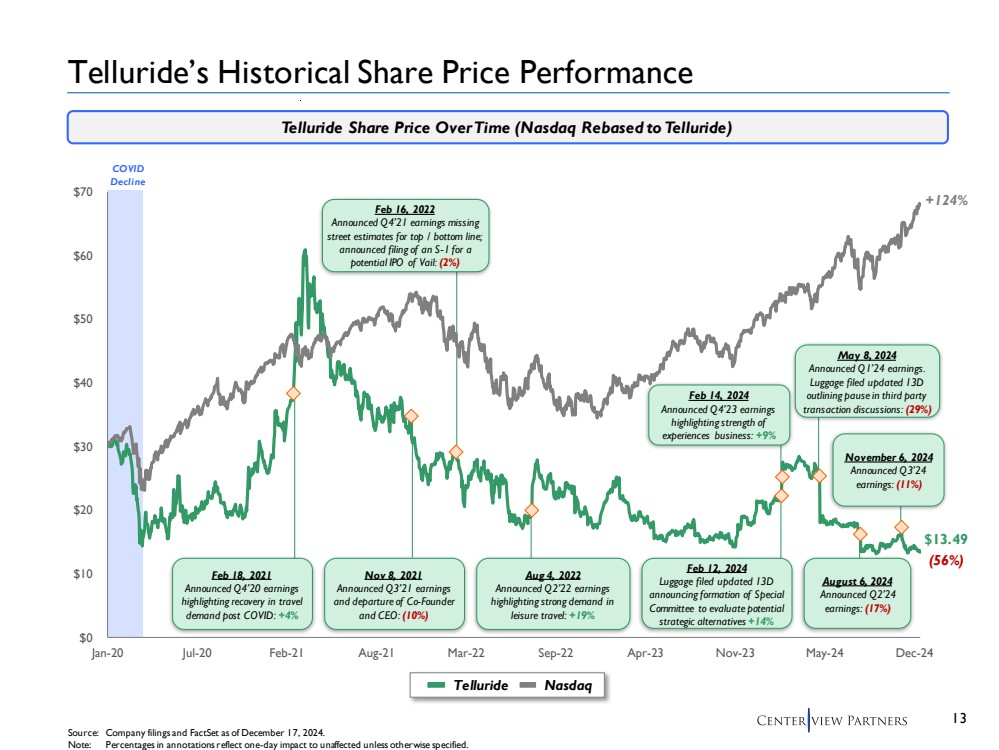

| 13 COVID Decline Telluride’s Historical Share Price Performance Source: Company filings and FactSet as of December 17, 2024. Note: Percentages in annotations reflect one-day impact to unaffected unless otherwise specified. Telluride Share Price Over Time (Nasdaq Rebased to Telluride) Telluride Nasdaq Feb 18, 2021 Announced Q4’20 earnings highlighting recovery in travel demand post COVID: +4% Nov 8, 2021 Announced Q3’21 earnings and departure of Co-Founder and CEO: (10%) Feb 16, 2022 Announced Q4’21 earnings missing street estimates for top / bottom line; announced filing of an S-1 for a potential IPO of Vail: (2%) Aug 4, 2022 Announced Q2’22 earnings highlighting strong demand in leisure travel: +19% Feb 12, 2024 Luggage filed updated 13D announcing formation of Special Committee to evaluate potential strategic alternatives +14% Feb 14, 2024 Announced Q4’23 earnings highlighting strength of experiences business: +9% May 8, 2024 Announced Q1’24 earnings. Luggage filed updated 13D outlining pause in third party transaction discussions: (29%) August 6, 2024 Announced Q2’24 earnings: (17%) (56%) +124% $13.49 November 6, 2024 Announced Q3’24 earnings: (11%) $0 $10 $20 $30 $40 $50 $60 $70 Jan-20 Jul-20 Feb-21 Aug-21 Mar-22 Sep-22 Apr-23 Nov-23 May-24 Dec-24 |

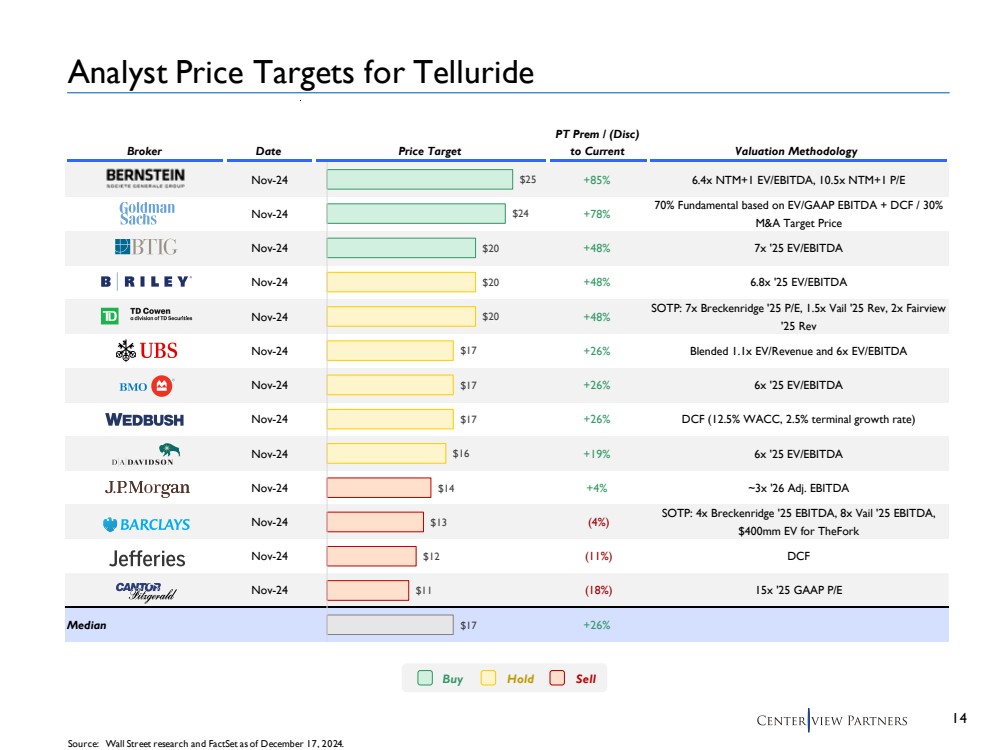

| 14 PT Prem / (Disc) Broker Date Price Target to Current Valuation Methodology Nov-24 +85% 6.4x NTM+1 EV/EBITDA, 10.5x NTM+1 P/E Nov-24 +78% 70% Fundamental based on EV/GAAP EBITDA + DCF / 30% M&A Target Price Nov-24 +48% 7x '25 EV/EBITDA Nov-24 +48% 6.8x '25 EV/EBITDA Nov-24 +48% SOTP: 7x Breckenridge '25 P/E, 1.5x Vail '25 Rev, 2x Fairview '25 Rev Nov-24 +26% Blended 1.1x EV/Revenue and 6x EV/EBITDA Nov-24 +26% 6x '25 EV/EBITDA Nov-24 +26% DCF (12.5% WACC, 2.5% terminal growth rate) Nov-24 +19% 6x '25 EV/EBITDA Nov-24 +4% ~3x '26 Adj. EBITDA Nov-24 (4%) SOTP: 4x Breckenridge '25 EBITDA, 8x Vail '25 EBITDA, $400mm EV for TheFork Nov-24 (11%) DCF Nov-24 (18%) 15x '25 GAAP P/E Median +26% $25 $24 $20 $20 $20 $17 $17 $17 $16 $14 $13 $12 $11 $17 Analyst Price Targets for Telluride Source: Wall Street research and FactSet as of December 17, 2024. Buy Hold Sell |