| – Highly Confidential; For Discussion Purposes Only – June 17, 2024 Project Telluride Discussion Materials |

| 1 – Highly Confidential; For Discussion Purposes Only – Executive Summary Since the earnings announcement on May 8th, Telluride shares have traded from ~$25.50 pre-earnings to ~$18.12 / share (29%) on updated guidance and news of no imminent acquisition of Telluride – Luggage Series A and Series B shares have traded from ~$1.52 to ~$0.53 / share (65%) and ~$6.53 to ~$5.25 / share (20%), respectively; total Luggage equity value decreased from $143mm to $64mm – However, Luggage’s Exchangeable Senior Debentures continue to trade around par On June 10, 2024, Telluride received an illustrative framework from Luggage outlining a potential scenario of a take private of Luggage by Telluride Luggage’s illustrative scenario includes an implied discount to par for the Certares Series A preferred; a key question remains under what terms Certares would be willing to transact – In prior communications, Certares did not reflect a willingness to accept a discount to par absent an asset swap that included and expressed limited appetite for receiving Telluride stock in excess of $50mm In assessing Luggage’s framework, key considerations include: – Does the proposal make financial sense for Telluride Shareholders? – What are potential motivations of the various Luggage stakeholders? – What are the potential impacts on Telluride shareholders in the event Luggage were to go bankrupt and/or restructure? – What are the financial levers that could allow for an improved proposal? Source: Company filings, Luggage materials and FactSet as of June 14, 2024. |

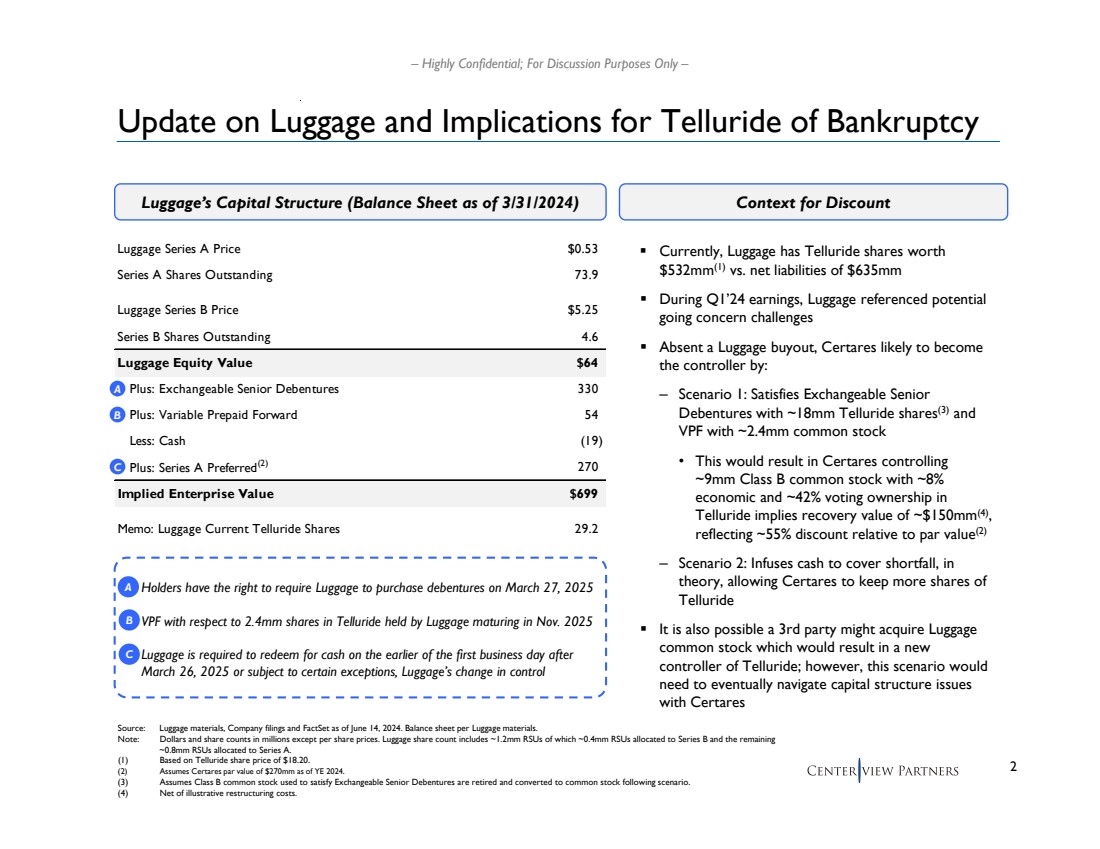

| 2 – Highly Confidential; For Discussion Purposes Only – Luggage Series A Price $0.53 Series A Shares Outstanding 73.9 Luggage Series B Price $5.25 Series B Shares Outstanding 4.6 Luggage Equity Value $64 Plus: Exchangeable Senior Debentures 330 Plus: Variable Prepaid Forward 54 Less: Cash (19) Plus: Series A Preferred(2) 270 Implied Enterprise Value $699 Memo: Luggage Current Telluride Shares 29.2 Update on Luggage and Implications for Telluride of Bankruptcy Source: Luggage materials, Company filings and FactSet as of June 14, 2024. Balance sheet per Luggage materials. Note: Dollars and share counts in millions except per share prices. Luggage share count includes ~1.2mm RSUs of which ~0.4mm RSUs allocated to Series B and the remaining ~0.8mm RSUs allocated to Series A. (1) Based on Telluride share price of $18.20. (2) Assumes Certares par value of $270mm as of YE 2024. (3) Assumes Class B common stock used to satisfy Exchangeable Senior Debentures are retired and converted to common stock following scenario. (4) Net of illustrative restructuring costs. Luggage’s Capital Structure (Balance Sheet as of 3/31/2024) Context for Discount B C A Holders have the right to require Luggage to purchase debentures on March 27, 2025 VPF with respect to 2.4mm shares in Telluride held by Luggage maturing in Nov. 2025 Luggage is required to redeem for cash on the earlier of the first business day after March 26, 2025 or subject to certain exceptions, Luggage’s change in control B C A Currently, Luggage has Telluride shares worth $532mm(1) vs. net liabilities of $635mm During Q1’24 earnings, Luggage referenced potential going concern challenges Absent a Luggage buyout, Certares likely to become the controller by: – Scenario 1: Satisfies Exchangeable Senior Debentures with ~18mm Telluride shares(3) and VPF with ~2.4mm common stock • This would result in Certares controlling ~9mm Class B common stock with ~8% economic and ~42% voting ownership in Telluride implies recovery value of ~$150mm(4), reflecting ~55% discount relative to par value(2) – Scenario 2: Infuses cash to cover shortfall, in theory, allowing Certares to keep more shares of Telluride It is also possible a 3rd party might acquire Luggage common stock which would result in a new controller of Telluride; however, this scenario would need to eventually navigate capital structure issues with Certares |

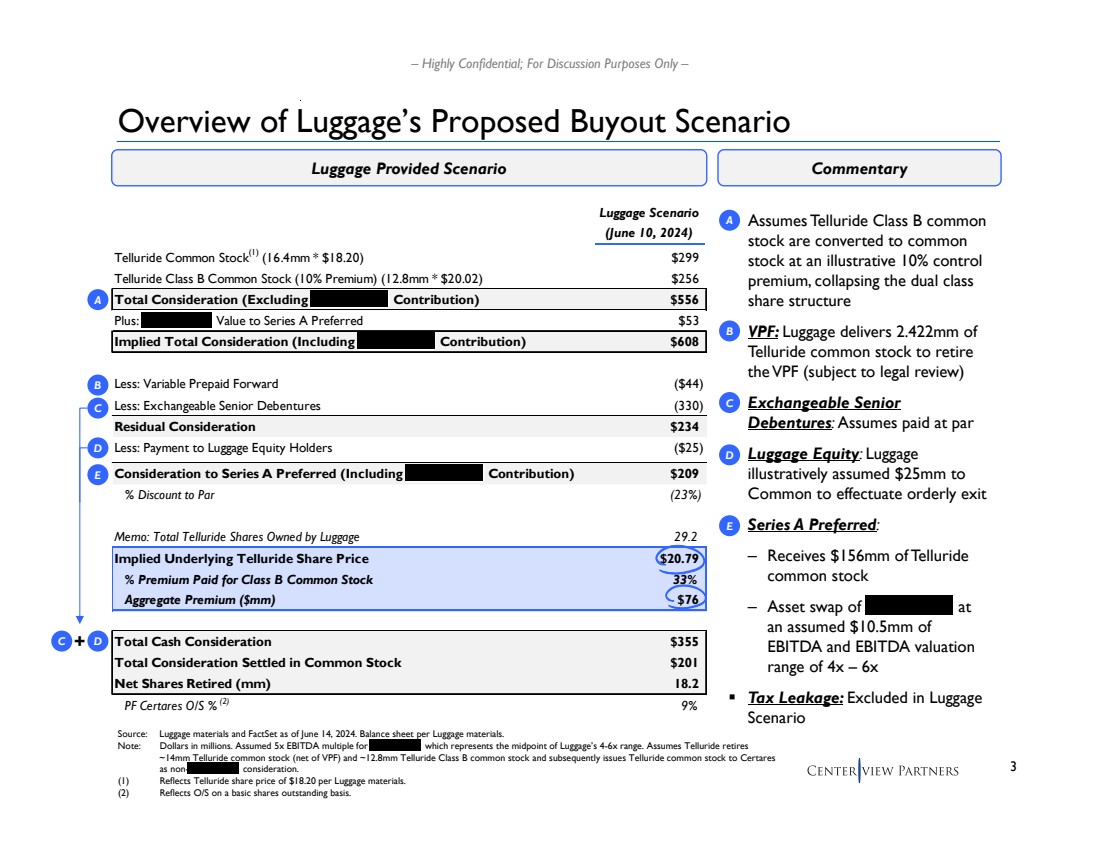

| 3 – Highly Confidential; For Discussion Purposes Only – Overview of Luggage’s Proposed Buyout Scenario Luggage Provided Scenario Commentary Assumes Telluride Class B common stock are converted to common stock at an illustrative 10% control premium, collapsing the dual class share structure VPF: Luggage delivers 2.422mm of Telluride common stock to retire the VPF (subject to legal review) Exchangeable Senior Debentures: Assumes paid at par Luggage Equity: Luggage illustratively assumed $25mm to Common to effectuate orderly exit Series A Preferred: – Receives $156mm of Telluride common stock – Asset swap of at an assumed $10.5mm of EBITDA and EBITDA valuation range of 4x – 6x Tax Leakage: Excluded in Luggage Scenario C D B A C D B A Source: Luggage materials and FactSet as of June 14, 2024. Balance sheet per Luggage materials. Note: Dollars in millions. Assumed 5x EBITDA multiple for which represents the midpoint of Luggage’s 4-6x range. Assumes Telluride retires ~14mm Telluride common stock (net of VPF) and ~12.8mm Telluride Class B common stock and subsequently issues Telluride common stock to Certares as non- consideration. (1) Reflects Telluride share price of $18.20 per Luggage materials. (2) Reflects O/S on a basic shares outstanding basis. Luggage Scenario (June 10, 2024) Telluride Common Stock(1) (16.4mm * $18.20) $299 Telluride Class B Common Stock (10% Premium) (12.8mm * $20.02) $256 Total Consideration (Excluding Contribution) $556 Plus: Value to Series A Preferred $53 Implied Total Consideration (Including Contribution) $608 Less: Variable Prepaid Forward ($44) Less: Exchangeable Senior Debentures (330) Residual Consideration $234 Less: Payment to Luggage Equity Holders ($25) Consideration to Series A Preferred (Including Contribution) $209 % Discount to Par (23%) Memo: Total Telluride Shares Owned by Luggage 29.2 Implied Underlying Telluride Share Price $20.79 % Premium Paid for Class B Common Stock 33% Aggregate Premium ($mm) $76 Total Cash Consideration $355 Total Consideration Settled in Common Stock $201 Net Shares Retired (mm) 18.2 PF Certares O/S % (2) 9% E E C + D |

| 4 – Highly Confidential; For Discussion Purposes Only – Financial Implications of Luggage Scenario to Telluride Source: Company filings and FactSet as of June 14, 2024. Telluride projections per Telluride management. Note: Dollars in millions except per share values. Assumes shares issued at current share price of $18.20 per Luggage materials. Assumes refinancing of $330mm exchangeable senior debentures into Telluride. Assumes transaction close of YE 2024. Transaction reflects ~$25mm of transaction fees and ~$7mm of taxes (21% tax rate) from sale of assuming $20mm tax basis per company estimate subject to review. Assumes interest rate of S+300 on new debt and ~5% interest on cash. Assumes excess free cash flow used to paydown new debt and no refinancing of 2025 senior notes per Status Quo case. 2026 figures assume 7% revenue growth and 5% thereafter with flat EBITDA margins (~39%). Assumes implied value of $53mm. Assumes VPF of $44mm and Luggage equity consideration of $25mm per Luggage scenario. Telluride Pro Forma P&L (Assumes $156mm of Non- Consideration (100% Stock)) Status Quo Pro Forma ∆ 2024 2025 2026 2027 2028 2024 2025 2026 2027 2028 2024 2025 2026 2027 2028 Revenue $1,868 $2,037 $2,230 $2,442 $2,677 $1,830 $1,995 $2,186 $2,396 $2,628 ($38) ($42) ($45) ($47) ($49) % Growth 4% 9% 10% 10% 10% 4% 9% 10% 10% 10% (16bps) 0bps +5bps +9bps +9bps EBITDA $345 $411 $491 $561 $644 $330 $395 $473 $543 $625 ($15) ($16) ($18) ($18) ($19) % Margin 18% 20% 22% 23% 24% 18% 20% 22% 23% 24% (45bps) (40bps) (35bps) (32bps) (29bps) Net Income $127 $170 $205 $246 $99 $149 $187 $228 ($28) ($22) ($18) ($17) % Margin 6% 8% 8% 9% 5% 7% 8% 9% (129bps) (84bps) (60bps) (49bps) Diluted Shares Outstanding 155 155 155 155 136 136 136 136 (18) (18) (18) (18) EPS $0.82 $1.10 $1.33 $1.59 $0.72 $1.09 $1.37 $1.67 (12%) (1%) +3% +5% Leverage Metrics Debt $902 $902 $902 $902 $902 $1,232 $985 $902 $902 $902 +$330 +$83 – – – Cash 899 1,032 1,280 1,605 1,979 842 700 843 1,150 1,507 (57) (332) (437) (455) (473) Net Debt $3 ($130) ($378) ($703) ($1,077) $390 $285 $59 ($248) ($605) +$387 +$415 +$437 +$455 +$473 Memo: Gross Leverage 2.6x 2.2x 1.8x 1.6x 1.4x 3.7x 2.5x 1.9x 1.7x 1.4x +1.1x +0.3x +0.1x +0.1x +0.0x Memo: Net Leverage 0.0x (0.3x) (0.8x) (1.3x) (1.7x) 1.2x 0.7x 0.1x (0.5x) (1.0x) +1.2x +1.0x +0.9x +0.8x +0.7x |

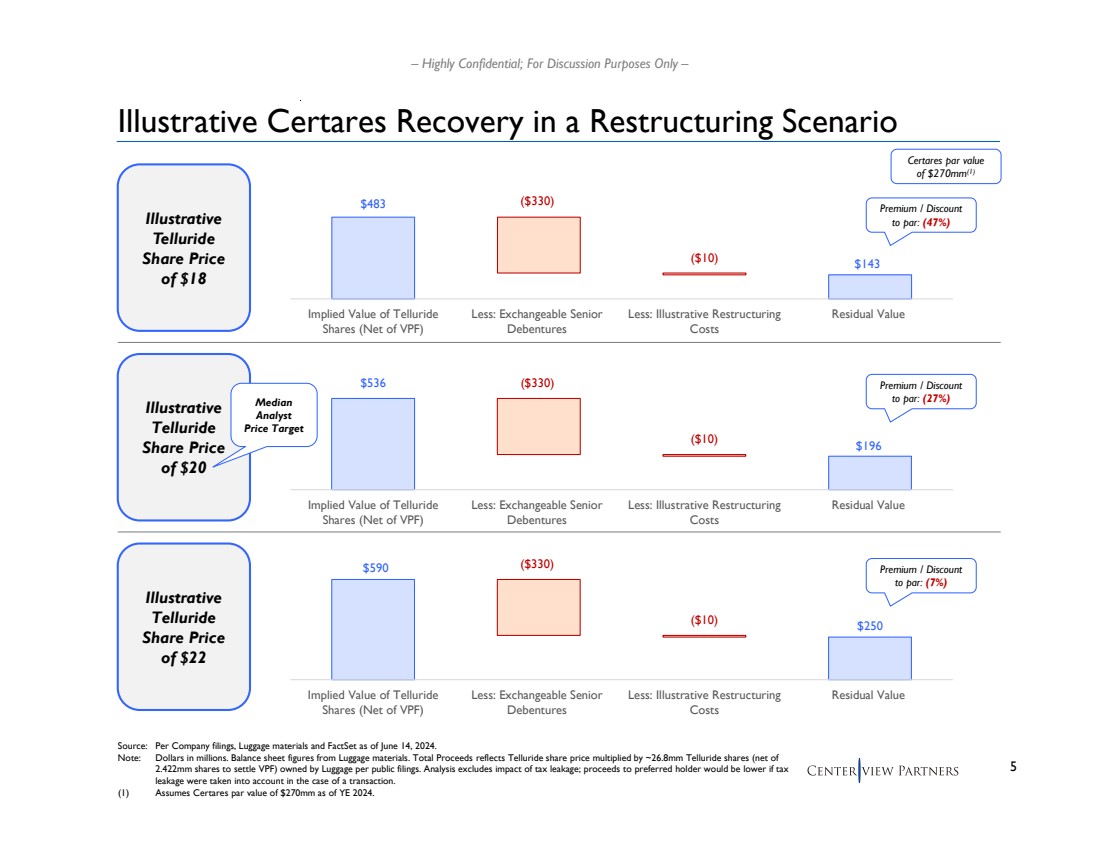

| 5 – Highly Confidential; For Discussion Purposes Only – Illustrative Certares Recovery in a Restructuring Scenario Illustrative Telluride Share Price of $18 Source: Per Company filings, Luggage materials and FactSet as of June 14, 2024. Note: Dollars in millions. Balance sheet figures from Luggage materials. Total Proceeds reflects Telluride share price multiplied by ~26.8mm Telluride shares (net of 2.422mm shares to settle VPF) owned by Luggage per public filings. Analysis excludes impact of tax leakage; proceeds to preferred holder would be lower if tax leakage were taken into account in the case of a transaction. (1) Assumes Certares par value of $270mm as of YE 2024. Illustrative Telluride Share Price of $20 Illustrative Telluride Share Price of $22 $483 $143 ($330) ($10) Implied Value of Telluride Shares (Net of VPF) Less: Exchangeable Senior Debentures Less: Illustrative Restructuring Costs Residual Value $536 $196 ($330) ($10) Implied Value of Telluride Shares (Net of VPF) Less: Exchangeable Senior Debentures Less: Illustrative Restructuring Costs Residual Value $590 $250 ($330) ($10) Implied Value of Telluride Shares (Net of VPF) Less: Exchangeable Senior Debentures Less: Illustrative Restructuring Costs Residual Value Premium / Discount to par: (47%) Premium / Discount to par: (27%) Premium / Discount to par: (7%) Certares par value of $270mm(1) Median Analyst Price Target |

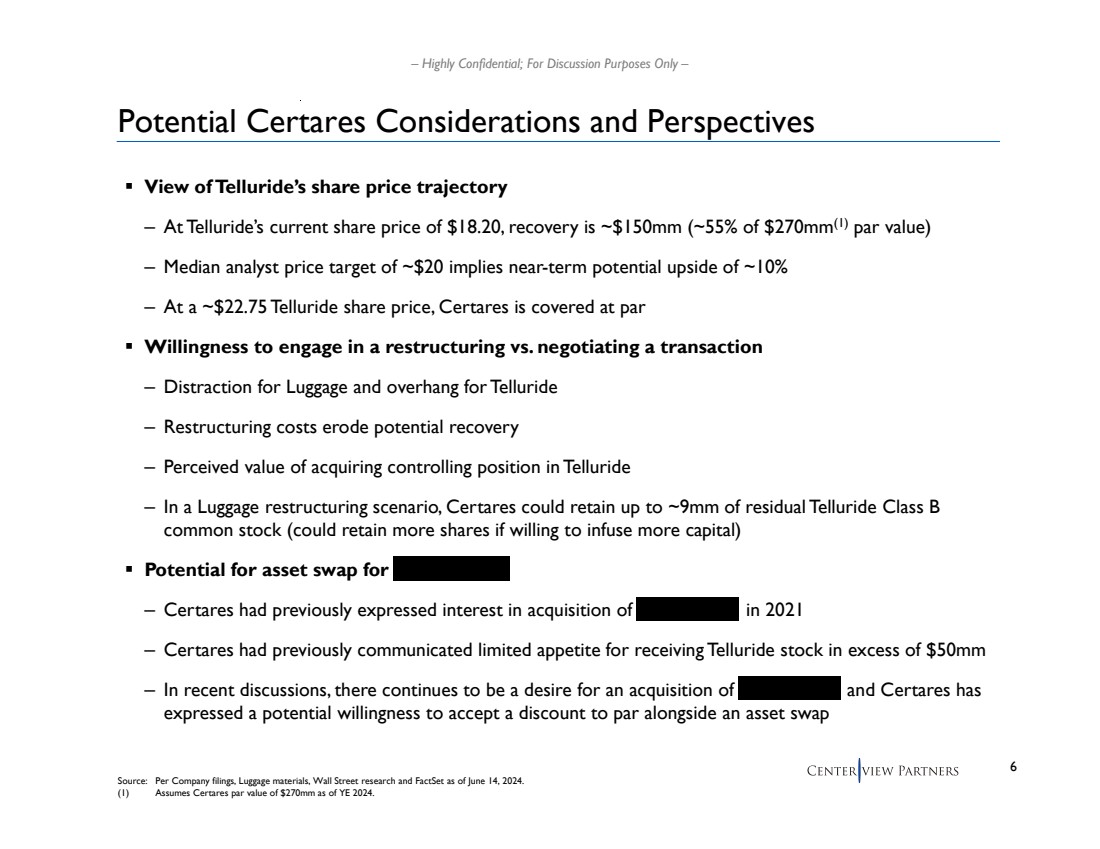

| 6 – Highly Confidential; For Discussion Purposes Only – Potential Certares Considerations and Perspectives Source: Per Company filings, Luggage materials, Wall Street research and FactSet as of June 14, 2024. (1) Assumes Certares par value of $270mm as of YE 2024. View of Telluride’s share price trajectory – At Telluride’s current share price of $18.20, recovery is ~$150mm (~55% of $270mm(1) par value) – Median analyst price target of ~$20 implies near-term potential upside of ~10% – At a ~$22.75 Telluride share price, Certares is covered at par Willingness to engage in a restructuring vs. negotiating a transaction – Distraction for Luggage and overhang for Telluride – Restructuring costs erode potential recovery – Perceived value of acquiring controlling position in Telluride – In a Luggage restructuring scenario, Certares could retain up to ~9mm of residual Telluride Class B common stock (could retain more shares if willing to infuse more capital) Potential for asset swap for – Certares had previously expressed interest in acquisition of in 2021 – Certares had previously communicated limited appetite for receiving Telluride stock in excess of $50mm – In recent discussions, there continues to be a desire for an acquisition of and Certares has expressed a potential willingness to accept a discount to par alongside an asset swap |

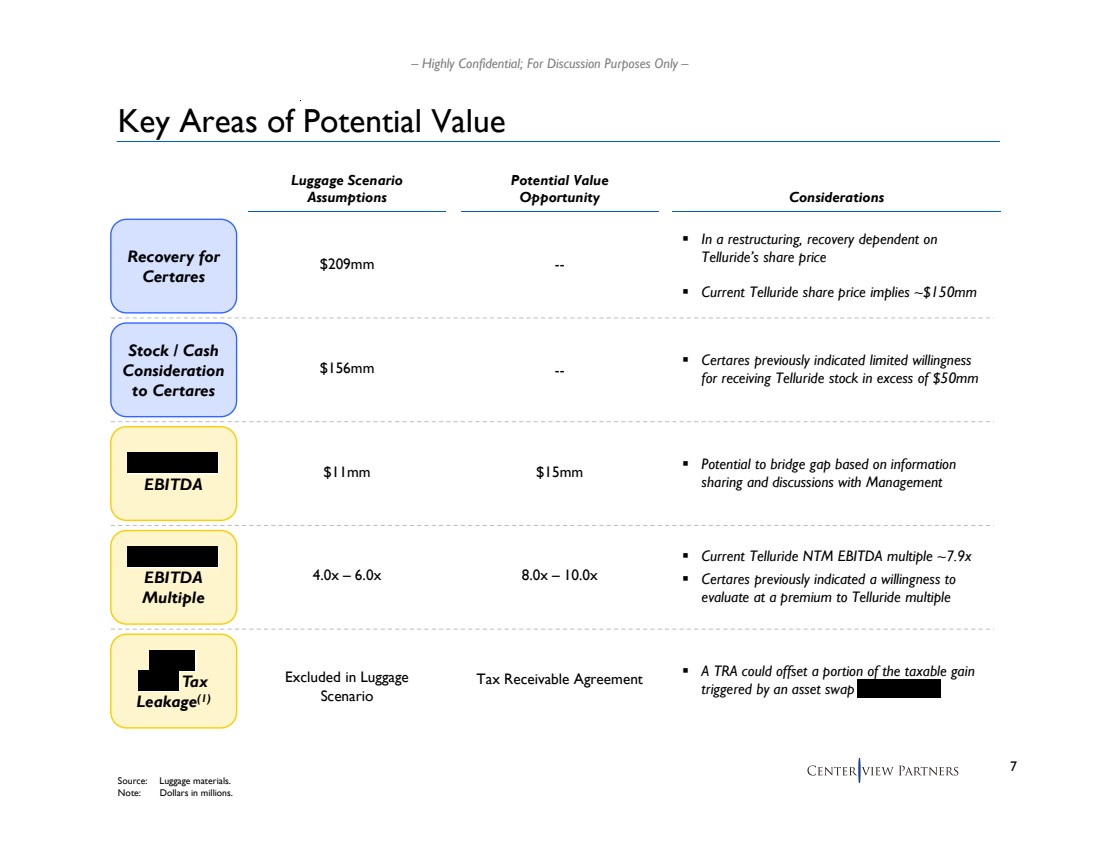

| 7 – Highly Confidential; For Discussion Purposes Only – Key Areas of Potential Value Source: Luggage materials. Note: Dollars in millions. Luggage Scenario Assumptions Potential Value Opportunity Considerations EBITDA EBITDA Multiple Recovery for Certares Tax Leakage(1) Stock / Cash Consideration to Certares $11mm 4.0x – 6.0x $209mm Excluded in Luggage Scenario $156mm $15mm 8.0x – 10.0x -- Tax Receivable Agreement In a restructuring, recovery dependent on Telluride’s share price Current Telluride share price implies ~$150mm Potential to bridge gap based on information sharing and discussions with Management Current Telluride NTM EBITDA multiple ~7.9x Certares previously indicated a willingness to evaluate at a premium to Telluride multiple A TRA could offset a portion of the taxable gain triggered by an asset swap Certares previously indicated limited willingness for receiving Telluride stock in excess of $50mm -- |

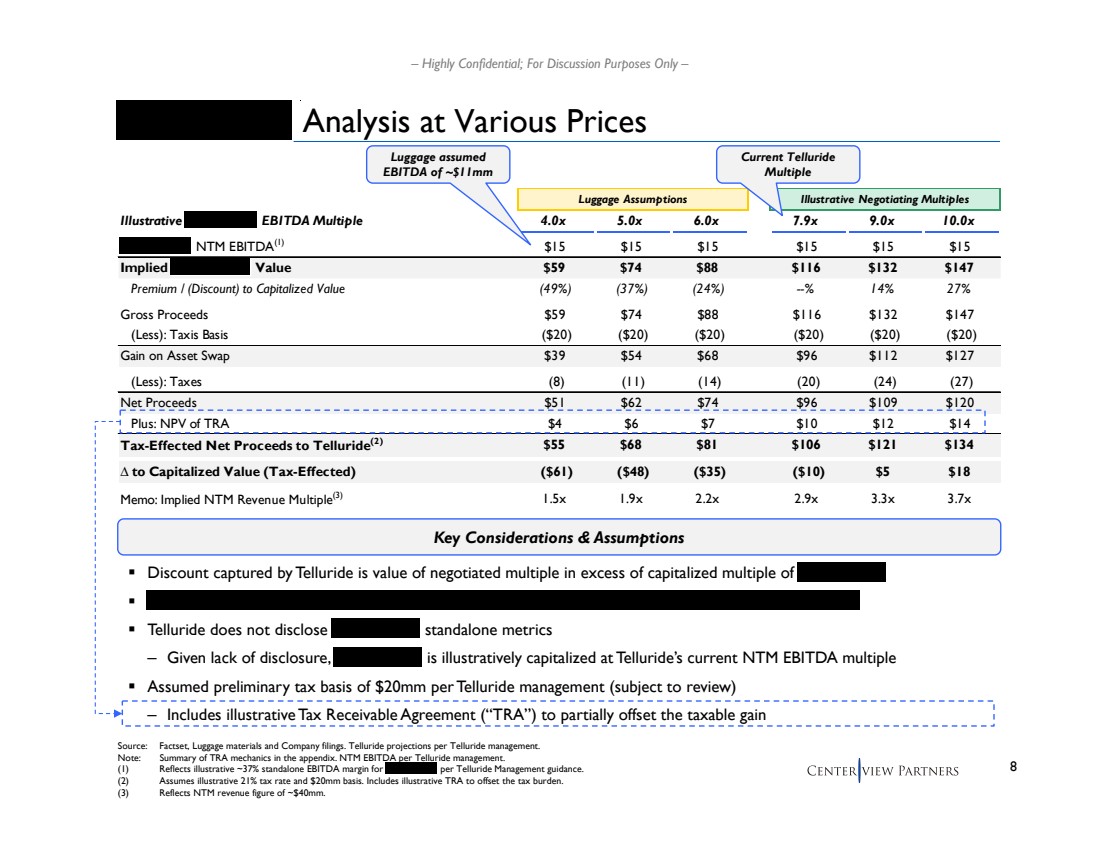

| 8 – Highly Confidential; For Discussion Purposes Only – Luggage Assumptions Illustrative Negotiating Multiples Illustrative EBITDA Multiple 4.0x 5.0x 6.0x 7.9x 9.0x 10.0x NTM EBITDA(1) $15 $15 $15 $15 $15 $15 Implied Value $59 $74 $88 $116 $132 $147 Premium / (Discount) to Capitalized Value (49%) (37%) (24%) --% 14% 27% Gross Proceeds $59 $74 $88 $116 $132 $147 (Less): Taxis Basis ($20) ($20) ($20) ($20) ($20) ($20) Gain on Asset Swap $39 $54 $68 $96 $112 $127 (Less): Taxes (8) (11) (14) (20) (24) (27) Net Proceeds $51 $62 $74 $96 $109 $120 Plus: NPV of TRA $4 $6 $7 $10 $12 $14 Tax-Effected Net Proceeds to Telluride(2) $55 $68 $81 $106 $121 $134 ∆ to Capitalized Value (Tax-Effected) ($61) ($48) ($35) ($10) $5 $18 Memo: Implied NTM Revenue Multiple(3) 1.5x 1.9x 2.2x 2.9x 3.3x 3.7x Analysis at Various Prices Key Considerations & Assumptions Source: Factset, Luggage materials and Company filings. Telluride projections per Telluride management. Note: Summary of TRA mechanics in the appendix. NTM EBITDA per Telluride management. (1) Reflects illustrative ~37% standalone EBITDA margin for per Telluride Management guidance. (2) Assumes illustrative 21% tax rate and $20mm basis. Includes illustrative TRA to offset the tax burden. (3) Reflects NTM revenue figure of ~$40mm. Current Telluride Multiple Discount captured by Telluride is value of negotiated multiple in excess of capitalized multiple of Telluride does not disclose standalone metrics – Given lack of disclosure, is illustratively capitalized at Telluride’s current NTM EBITDA multiple Assumed preliminary tax basis of $20mm per Telluride management (subject to review) – Includes illustrative Tax Receivable Agreement (“TRA”) to partially offset the taxable gain Luggage assumed EBITDA of ~$11mm |

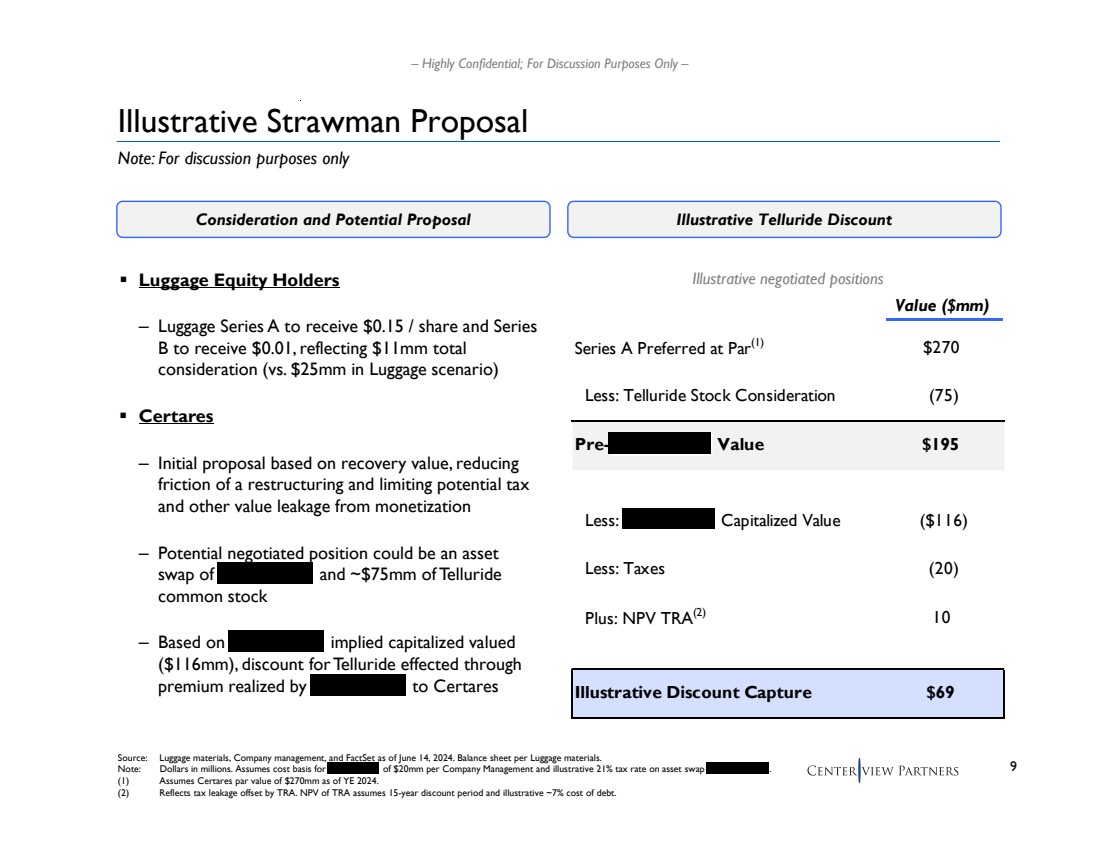

| 9 – Highly Confidential; For Discussion Purposes Only – Value ($mm) Series A Preferred at Par(1) $270 Less: Telluride Stock Consideration (75) Pre- Value $195 Less: Capitalized Value ($116) Less: Taxes (20) Plus: NPV TRA(2) 10 Illustrative Discount Capture $69 Illustrative Strawman Proposal Luggage Equity Holders – Luggage Series A to receive $0.15 / share and Series B to receive $0.01, reflecting $11mm total consideration (vs. $25mm in Luggage scenario) Certares – Initial proposal based on recovery value, reducing friction of a restructuring and limiting potential tax and other value leakage from monetization – Potential negotiated position could be an asset swap of and ~$75mm of Telluride common stock – Based on implied capitalized valued ($116mm), discount for Telluride effected through premium realized by to Certares Illustrative negotiated positions Note: For discussion purposes only Source: Luggage materials, Company management, and FactSet as of June 14, 2024. Balance sheet per Luggage materials. Note: Dollars in millions. Assumes cost basis for of $20mm per Company Management and illustrative 21% tax rate on asset swap . (1) Assumes Certares par value of $270mm as of YE 2024. (2) Reflects tax leakage offset by TRA. NPV of TRA assumes 15-year discount period and illustrative ~7% cost of debt. Consideration and Potential Proposal Illustrative Telluride Discount |

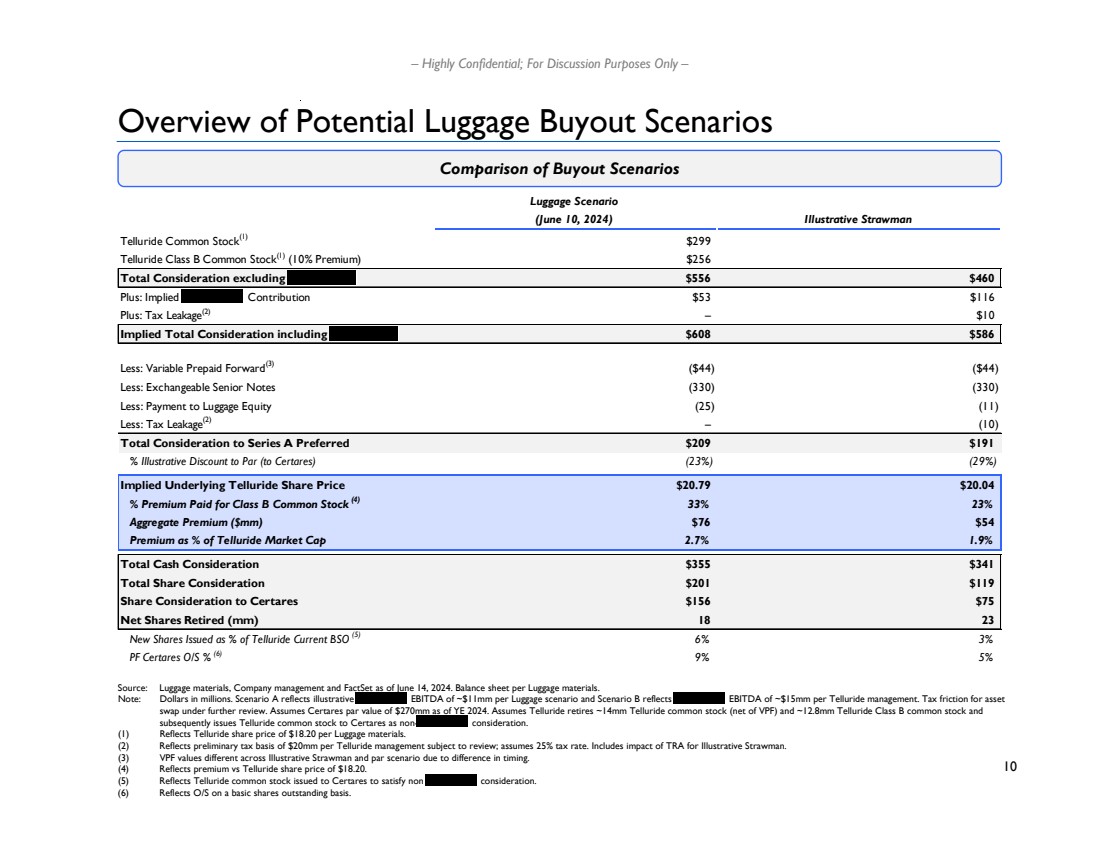

| 10 – Highly Confidential; For Discussion Purposes Only – Overview of Potential Luggage Buyout Scenarios Comparison of Buyout Scenarios Source: Luggage materials, Company management and FactSet as of June 14, 2024. Balance sheet per Luggage materials. Note: Dollars in millions. Scenario A reflects illustrative EBITDA of ~$11mm per Luggage scenario and Scenario B reflects EBITDA of ~$15mm per Telluride management. Tax friction for asset swap under further review. Assumes Certares par value of $270mm as of YE 2024. Assumes Telluride retires ~14mm Telluride common stock (net of VPF) and ~12.8mm Telluride Class B common stock and subsequently issues Telluride common stock to Certares as non- consideration. (1) Reflects Telluride share price of $18.20 per Luggage materials. (2) Reflects preliminary tax basis of $20mm per Telluride management subject to review; assumes 25% tax rate. Includes impact of TRA for Illustrative Strawman. (3) VPF values different across Illustrative Strawman and par scenario due to difference in timing. (4) Reflects premium vs Telluride share price of $18.20. (5) Reflects Telluride common stock issued to Certares to satisfy non consideration. (6) Reflects O/S on a basic shares outstanding basis. Luggage Scenario (June 10, 2024) Illustrative Strawman Telluride Common Stock(1) $299 Telluride Class B Common Stock(1) (10% Premium) $256 Total Consideration excluding $556 $460 Plus: Implied Contribution $53 $116 Plus: Tax Leakage(2) – $10 Implied Total Consideration including $608 $586 Less: Variable Prepaid Forward(3) ($44) ($44) Less: Exchangeable Senior Notes (330) (330) Less: Payment to Luggage Equity (25) (11) Less: Tax Leakage(2) – (10) Total Consideration to Series A Preferred $209 $191 % Illustrative Discount to Par (to Certares) (23%) (29%) Implied Underlying Telluride Share Price $20.79 $20.04 % Premium Paid for Class B Common Stock (4) 33% 23% Aggregate Premium ($mm) $76 $54 Premium as % of Telluride Market Cap 2.7% 1.9% Total Cash Consideration $355 $341 Total Share Consideration $201 $119 Share Consideration to Certares $156 $75 Net Shares Retired (mm) 18 23 New Shares Issued as % of Telluride Current BSO (5) 6% 3% PF Certares O/S % (6) 9% 5% |

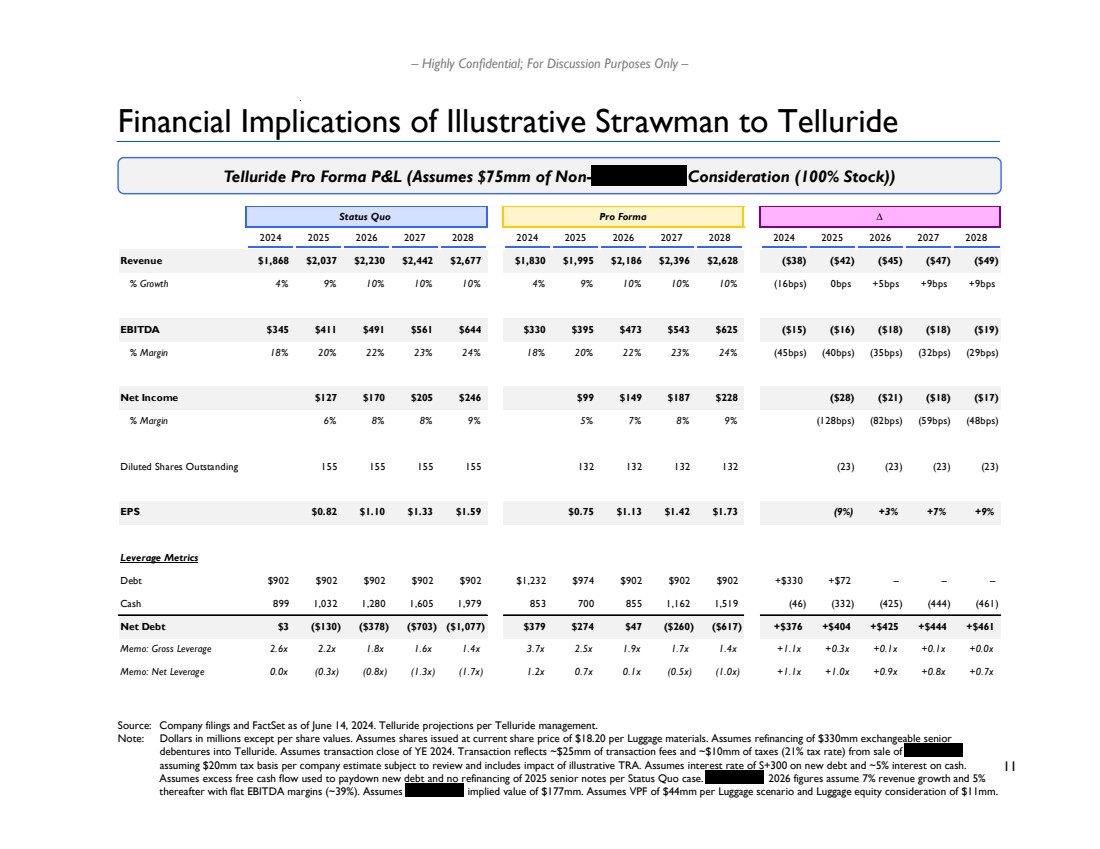

| 11 – Highly Confidential; For Discussion Purposes Only – Financial Implications of Illustrative Strawman to Telluride Source: Company filings and FactSet as of June 14, 2024. Telluride projections per Telluride management. Note: Dollars in millions except per share values. Assumes shares issued at current share price of $18.20 per Luggage materials. Assumes refinancing of $330mm exchangeable senior debentures into Telluride. Assumes transaction close of YE 2024. Transaction reflects ~$25mm of transaction fees and ~$10mm of taxes (21% tax rate) from sale of assuming $20mm tax basis per company estimate subject to review and includes impact of illustrative TRA. Assumes interest rate of S+300 on new debt and ~5% interest on cash. Assumes excess free cash flow used to paydown new debt and no refinancing of 2025 senior notes per Status Quo case. 2026 figures assume 7% revenue growth and 5% thereafter with flat EBITDA margins (~39%). Assumes implied value of $177mm. Assumes VPF of $44mm per Luggage scenario and Luggage equity consideration of $11mm. Telluride Pro Forma P&L (Assumes $75mm of Non- Consideration (100% Stock)) Status Quo Pro Forma ∆ 2024 2025 2026 2027 2028 2024 2025 2026 2027 2028 2024 2025 2026 2027 2028 Revenue $1,868 $2,037 $2,230 $2,442 $2,677 $1,830 $1,995 $2,186 $2,396 $2,628 ($38) ($42) ($45) ($47) ($49) % Growth 4% 9% 10% 10% 10% 4% 9% 10% 10% 10% (16bps) 0bps +5bps +9bps +9bps EBITDA $345 $411 $491 $561 $644 $330 $395 $473 $543 $625 ($15) ($16) ($18) ($18) ($19) % Margin 18% 20% 22% 23% 24% 18% 20% 22% 23% 24% (45bps) (40bps) (35bps) (32bps) (29bps) Net Income $127 $170 $205 $246 $99 $149 $187 $228 ($28) ($21) ($18) ($17) % Margin 6% 8% 8% 9% 5% 7% 8% 9% (128bps) (82bps) (59bps) (48bps) Diluted Shares Outstanding 155 155 155 155 132 132 132 132 (23) (23) (23) (23) EPS $0.82 $1.10 $1.33 $1.59 $0.75 $1.13 $1.42 $1.73 (9%) +3% +7% +9% Leverage Metrics Debt $902 $902 $902 $902 $902 $1,232 $974 $902 $902 $902 +$330 +$72 – – – Cash 899 1,032 1,280 1,605 1,979 853 700 855 1,162 1,519 (46) (332) (425) (444) (461) Net Debt $3 ($130) ($378) ($703) ($1,077) $379 $274 $47 ($260) ($617) +$376 +$404 +$425 +$444 +$461 Memo: Gross Leverage 2.6x 2.2x 1.8x 1.6x 1.4x 3.7x 2.5x 1.9x 1.7x 1.4x +1.1x +0.3x +0.1x +0.1x +0.0x Memo: Net Leverage 0.0x (0.3x) (0.8x) (1.3x) (1.7x) 1.2x 0.7x 0.1x (0.5x) (1.0x) +1.1x +1.0x +0.9x +0.8x +0.7x |

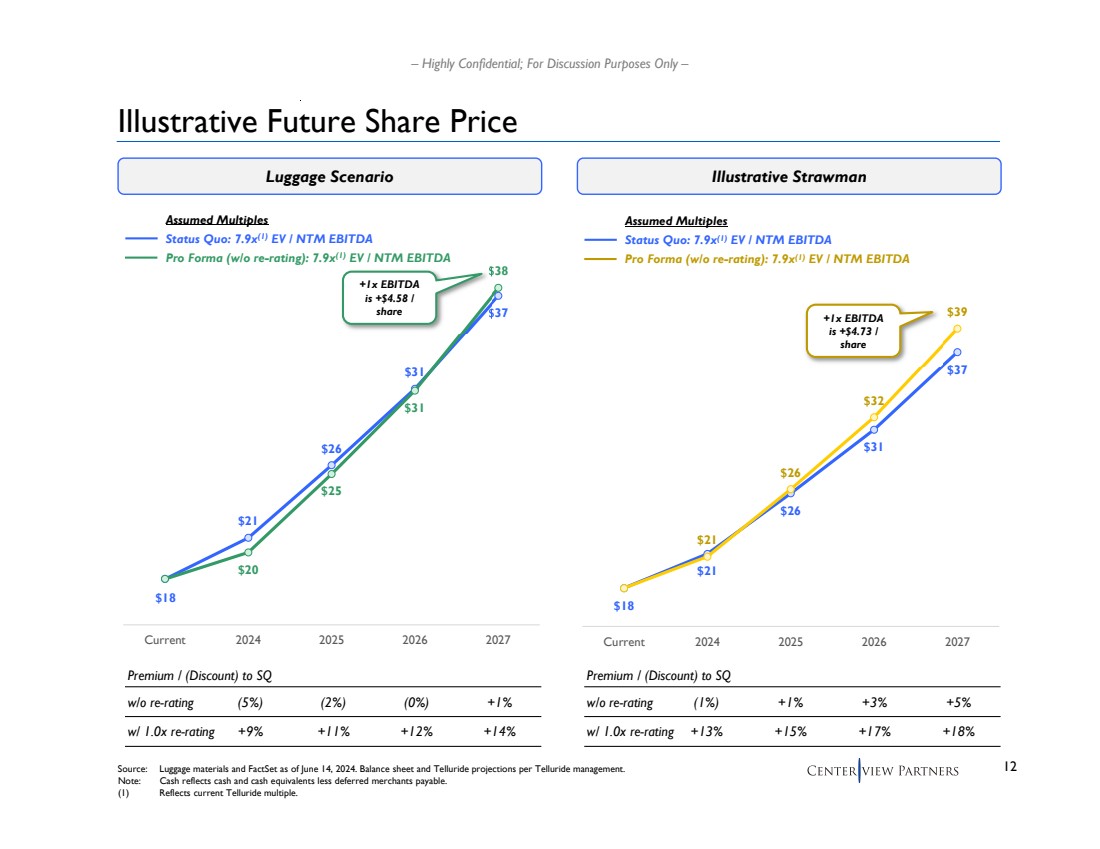

| 12 – Highly Confidential; For Discussion Purposes Only – Illustrative Future Share Price Luggage Scenario Illustrative Strawman $18 $21 $26 $31 $37 $20 $25 $31 $38 Current 2024 2025 2026 2027 Assumed Multiples Status Quo: 7.9x(1) EV / NTM EBITDA Pro Forma (w/o re-rating): 7.9x(1) EV / NTM EBITDA +1x EBITDA is +$4.58 / share Premium / (Discount) to SQ w/o re-rating (5%) (2%) (0%) Source: Luggage materials and FactSet as of June 14, 2024. Balance sheet and Telluride projections per Telluride management. Note: Cash reflects cash and cash equivalents less deferred merchants payable. (1) Reflects current Telluride multiple. w/ 1.0x re-rating +9% +11% +12% $18 $21 $26 $31 $37 $21 $26 $32 $39 Current 2024 2025 2026 2027 Assumed Multiples Status Quo: 7.9x(1) EV / NTM EBITDA Pro Forma (w/o re-rating): 7.9x(1) EV / NTM EBITDA +1x EBITDA is +$4.73 / share Premium / (Discount) to SQ w/o re-rating (1%) +1% +3% w/ 1.0x re-rating +13% +15% +17% +1% +14% +5% +18% |

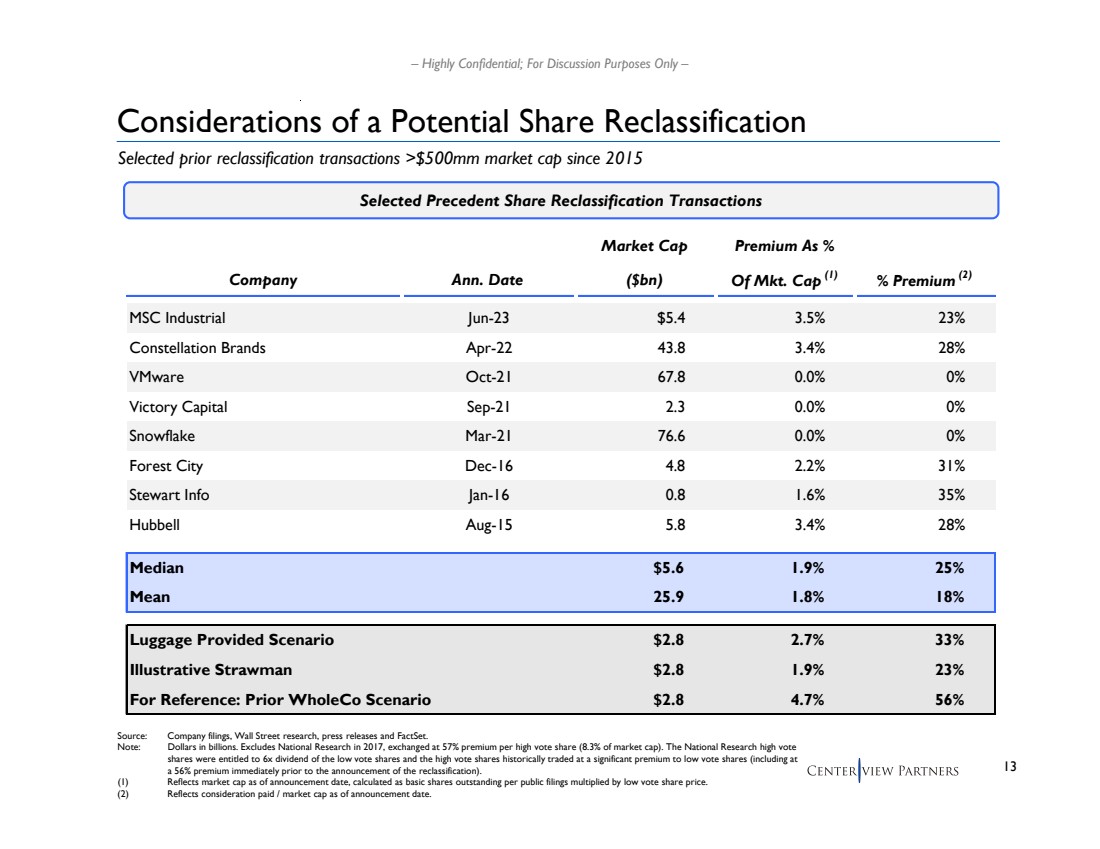

| 13 – Highly Confidential; For Discussion Purposes Only – Considerations of a Potential Share Reclassification Source: Company filings, Wall Street research, press releases and FactSet. Note: Dollars in billions. Excludes National Research in 2017, exchanged at 57% premium per high vote share (8.3% of market cap). The National Research high vote shares were entitled to 6x dividend of the low vote shares and the high vote shares historically traded at a significant premium to low vote shares (including at a 56% premium immediately prior to the announcement of the reclassification). (1) Reflects market cap as of announcement date, calculated as basic shares outstanding per public filings multiplied by low vote share price. (2) Reflects consideration paid / market cap as of announcement date. Selected prior reclassification transactions >$500mm market cap since 2015 Selected Precedent Share Reclassification Transactions Market Cap Premium As % Company Ann. Date ($bn) Of Mkt. Cap (1) % Premium (2) MSC Industrial Jun-23 $5.4 3.5% 23% Constellation Brands Apr-22 43.8 3.4% 28% VMware Oct-21 67.8 0.0% 0% Victory Capital Sep-21 2.3 0.0% 0% Snowflake Mar-21 76.6 0.0% 0% Forest City Dec-16 4.8 2.2% 31% Stewart Info Jan-16 0.8 1.6% 35% Hubbell Aug-15 5.8 3.4% 28% Median $5.6 1.9% 25% Mean 25.9 1.8% 18% Luggage Provided Scenario $2.8 2.7% 33% Illustrative Strawman $2.8 1.9% 23% For Reference: Prior WholeCo Scenario $2.8 4.7% 56% |

| 14 – Highly Confidential; For Discussion Purposes Only – Potential Path Forward To the extent that the Special Committee is interested in further exploring a potential buyout of Luggage, key next steps include: – Performing further due diligence around the optimal transaction structure and sources of funding – Understanding the transactions parameters that are actionable for Certares, including what discount and form of consideration are acceptable (relative to prior stated positions) – Refining view on potential value of a asset swap to Telluride and understanding of tax consequences of a potential transaction – Developing of an engagement strategy and proposal to Luggage |

| Appendix |

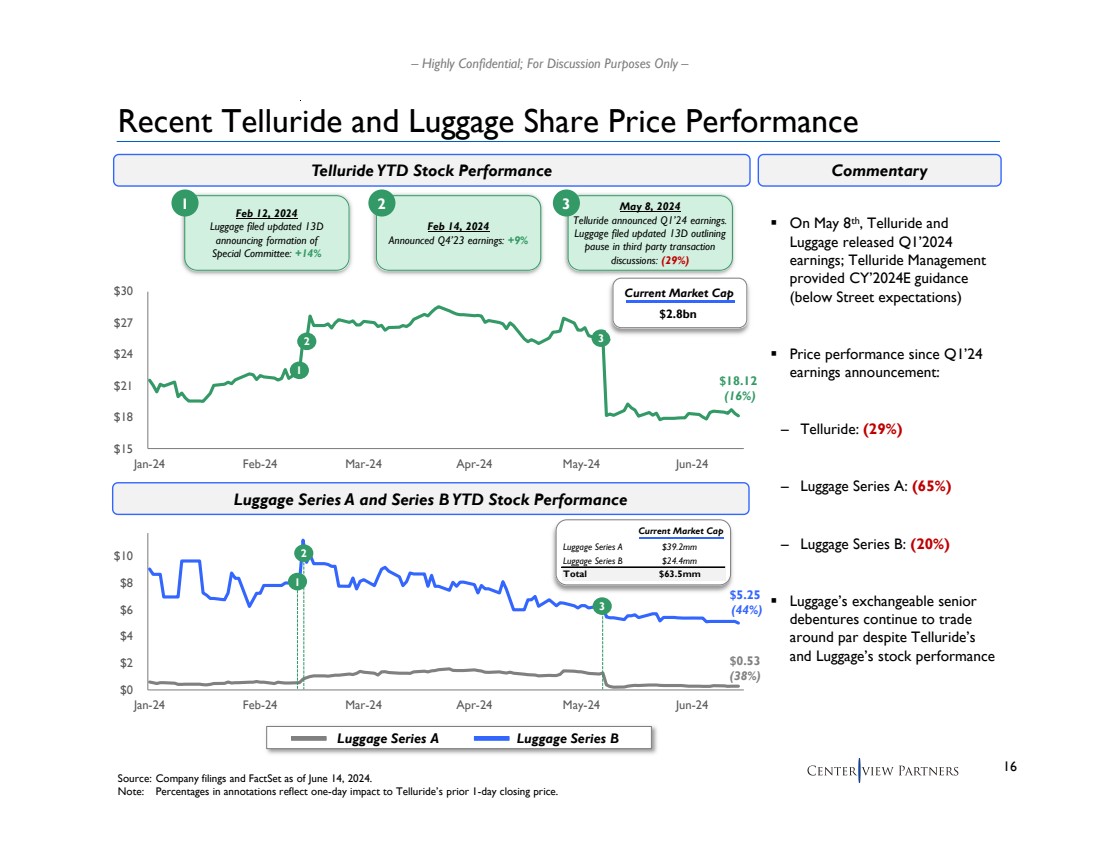

| 16 – Highly Confidential; For Discussion Purposes Only – $0 $2 $4 $6 $8 $10 Jan-24 Feb-24 Mar-24 Apr-24 May-24 Jun-24 $15 $18 $21 $24 $27 $30 Jan-24 Feb-24 Mar-24 Apr-24 May-24 Jun-24 Recent Telluride and Luggage Share Price Performance Telluride YTD Stock Performance Source: Company filings and FactSet as of June 14, 2024. Note: Percentages in annotations reflect one-day impact to Telluride’s prior 1-day closing price. On May 8th, Telluride and Luggage released Q1’2024 earnings; Telluride Management provided CY’2024E guidance (below Street expectations) Price performance since Q1’24 earnings announcement: – Telluride: (29%) – Luggage Series A: (65%) – Luggage Series B: (20%) Luggage’s exchangeable senior debentures continue to trade around par despite Telluride’s and Luggage’s stock performance Commentary Luggage Series A and Series B YTD Stock Performance Luggage Series A Luggage Series B Feb 12, 2024 Luggage filed updated 13D announcing formation of Special Committee: +14% Feb 14, 2024 Announced Q4’23 earnings: +9% May 8, 2024 Telluride announced Q1’24 earnings. Luggage filed updated 13D outlining pause in third party transaction discussions: (29%) 1 2 3 1 2 3 1 2 3 $18.12 (16%) $5.25 (44%) $0.53 (38%) Current Market Cap Luggage Series A $39.2mm Luggage Series B $24.4mm Total $63.5mm Current Market Cap $2.8bn |

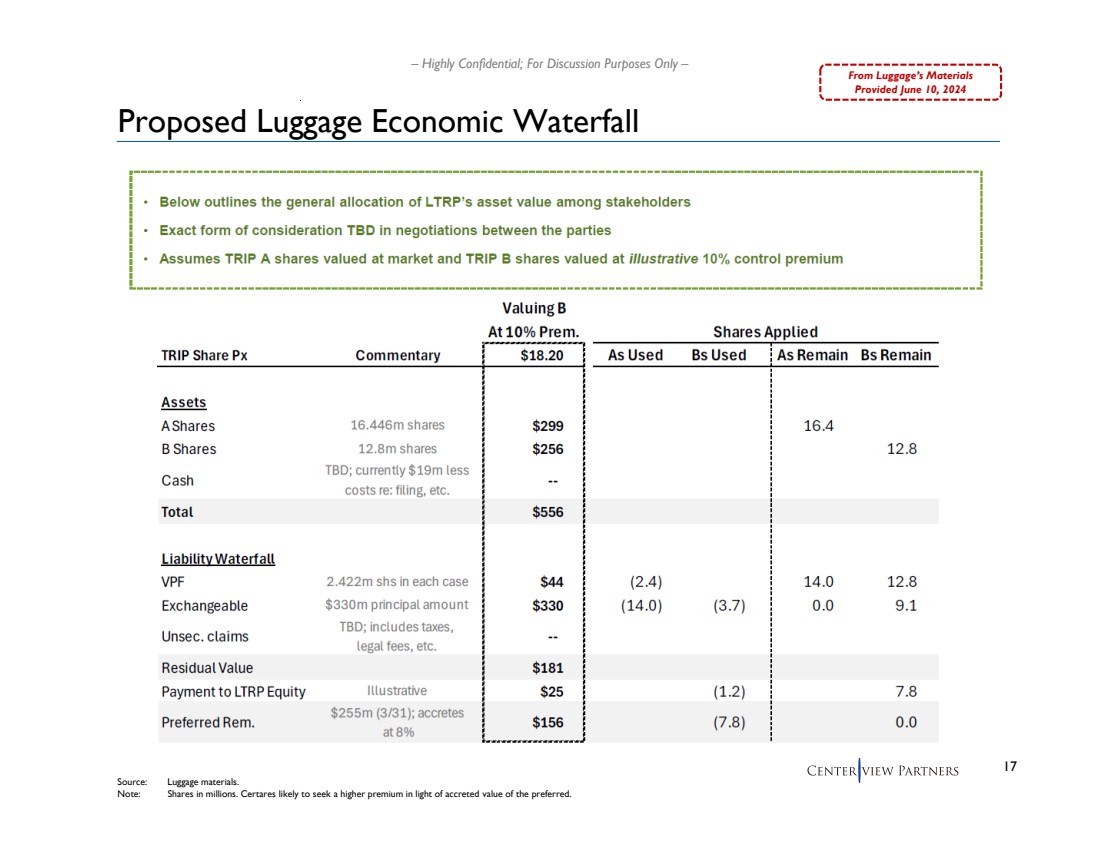

| 17 – Highly Confidential; For Discussion Purposes Only – Proposed Luggage Economic Waterfall Source: Luggage materials. Note: Shares in millions. Certares likely to seek a higher premium in light of accreted value of the preferred. From Luggage’s Materials Provided June 10, 2024 |

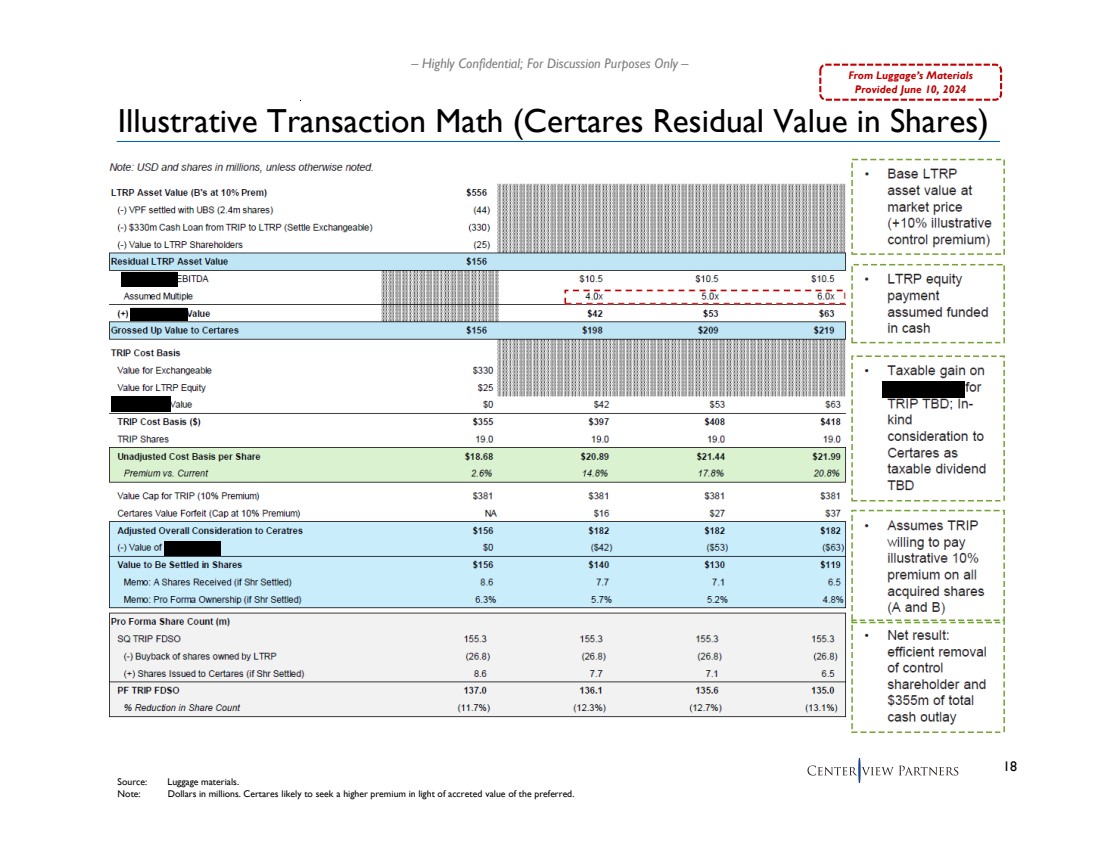

| 18 – Highly Confidential; For Discussion Purposes Only – Illustrative Transaction Math (Certares Residual Value in Shares) Source: Luggage materials. Note: Dollars in millions. Certares likely to seek a higher premium in light of accreted value of the preferred. From Luggage’s Materials Provided June 10, 2024 |

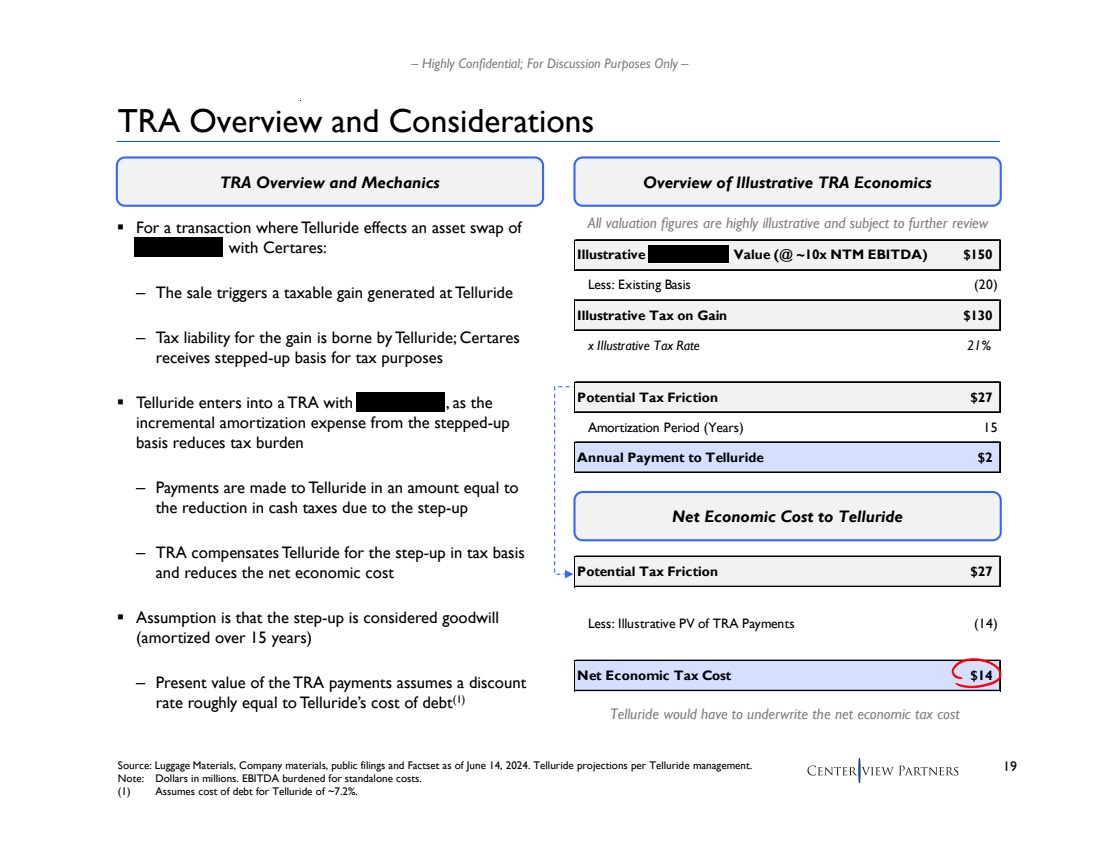

| 19 – Highly Confidential; For Discussion Purposes Only – TRA Overview and Considerations Source: Luggage Materials, Company materials, public filings and Factset as of June 14, 2024. Telluride projections per Telluride management. Note: Dollars in millions. EBITDA burdened for standalone costs. (1) Assumes cost of debt for Telluride of ~7.2%. For a transaction where Telluride effects an asset swap of with Certares: – The sale triggers a taxable gain generated at Telluride – Tax liability for the gain is borne by Telluride; Certares receives stepped-up basis for tax purposes Telluride enters into a TRA with , as the incremental amortization expense from the stepped-up basis reduces tax burden – Payments are made to Telluride in an amount equal to the reduction in cash taxes due to the step-up – TRA compensates Telluride for the step-up in tax basis and reduces the net economic cost Assumption is that the step-up is considered goodwill (amortized over 15 years) – Present value of the TRA payments assumes a discount rate roughly equal to Telluride’s cost of debt(1) TRA Overview and Mechanics Illustrative Value (@ ~10x NTM EBITDA) $150 Less: Existing Basis (20) Illustrative Tax on Gain $130 x Illustrative Tax Rate 21% Potential Tax Friction $27 Amortization Period (Years) 15 Annual Payment to Telluride $2 Potential Tax Friction $27 Less: Illustrative PV of TRA Payments (14) Net Economic Tax Cost $14 Net Economic Cost to Telluride Overview of Illustrative TRA Economics All valuation figures are highly illustrative and subject to further review Telluride would have to underwrite the net economic tax cost |

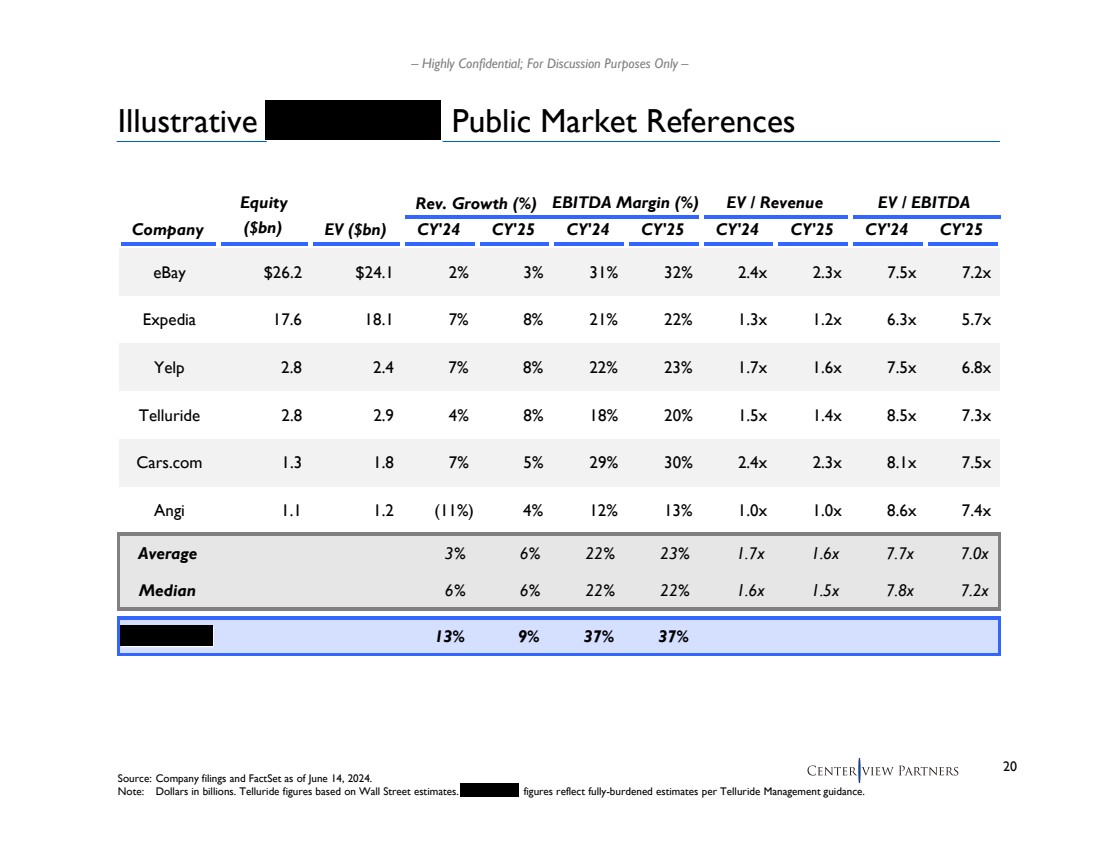

| 20 – Highly Confidential; For Discussion Purposes Only – Illustrative Public Market References Source: Company filings and FactSet as of June 14, 2024. Note: Dollars in billions. Telluride figures based on Wall Street estimates. figures reflect fully-burdened estimates per Telluride Management guidance. Equity Rev. Growth (%) EBITDA Margin (%) EV / Revenue EV / EBITDA Company ($bn) EV ($bn) CY'24 CY'25 CY'24 CY'25 CY'24 CY'25 CY'24 CY'25 eBay $26.2 $24.1 2% 3% 31% 32% 2.4x 2.3x 7.5x 7.2x Expedia 17.6 18.1 7% 8% 21% 22% 1.3x 1.2x 6.3x 5.7x Yelp 2.8 2.4 7% 8% 22% 23% 1.7x 1.6x 7.5x 6.8x Telluride 2.8 2.9 4% 8% 18% 20% 1.5x 1.4x 8.5x 7.3x Cars.com 1.3 1.8 7% 5% 29% 30% 2.4x 2.3x 8.1x 7.5x Angi 1.1 1.2 (11%) 4% 12% 13% 1.0x 1.0x 8.6x 7.4x Average 3% 6% 22% 23% 1.7x 1.6x 7.7x 7.0x Median 6% 6% 22% 22% 1.6x 1.5x 7.8x 7.2x 13% 9% 37% 37% |