| – Highly Confidential; For Discussion Purposes Only – Project Telluride Reference Analysis |

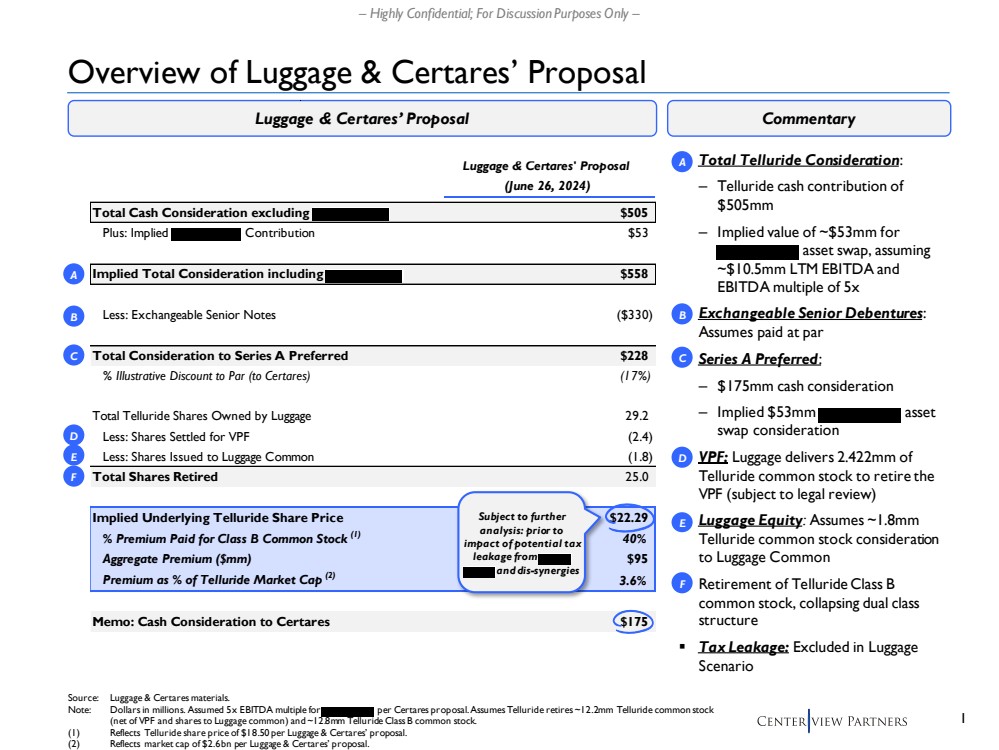

| 1 – Highly Confidential; For Discussion Purposes Only – Luggage & Certares' Proposal (June 26, 2024) Total Cash Consideration excluding $505 Plus: Implied Contribution $53 Implied Total Consideration including $558 Less: Exchangeable Senior Notes ($330) Total Consideration to Series A Preferred $228 % Illustrative Discount to Par (to Certares) (17%) Total Telluride Shares Owned by Luggage 29.2 Less: Shares Settled for VPF (2.4) Less: Shares Issued to Luggage Common (1.8) Total Shares Retired 25.0 Implied Underlying Telluride Share Price $22.29 % Premium Paid for Class B Common Stock (1) 40% Aggregate Premium ($mm) $95 Premium as % of Telluride Market Cap (2) 3.6% Memo: Cash Consideration to Certares $175 Overview of Luggage & Certares’ Proposal Luggage & Certares’ Proposal Commentary ▪ Total Telluride Consideration: – Telluride cash contribution of $505mm – Implied value of ~$53mm for asset swap, assuming ~$10.5mm LTM EBITDA and EBITDA multiple of 5x ▪ Exchangeable Senior Debentures: Assumes paid at par ▪ Series A Preferred: – $175mm cash consideration – Implied $53mm asset swap consideration ▪ VPF: Luggage delivers 2.422mm of Telluride common stock to retire the VPF (subject to legal review) ▪ Luggage Equity: Assumes ~1.8mm Telluride common stock consideration to Luggage Common ▪ Retirement of Telluride Class B common stock, collapsing dual class structure ▪ Tax Leakage: Excluded in Luggage Scenario D C A A Source: Luggage & Certares materials. Note: Dollars in millions. Assumed 5x EBITDA multiple for per Certares proposal. Assumes Telluride retires ~12.2mm Telluride common stock (net of VPF and shares to Luggage common) and ~12.8mm Telluride Class B common stock. (1) Reflects Telluride share price of $18.50 per Luggage & Certares’ proposal. (2) Reflects market cap of $2.6bn per Luggage & Certares’ proposal. B E F D C B E F Subject to further analysis: prior to impact of potential tax leakage from and dis-synergies |

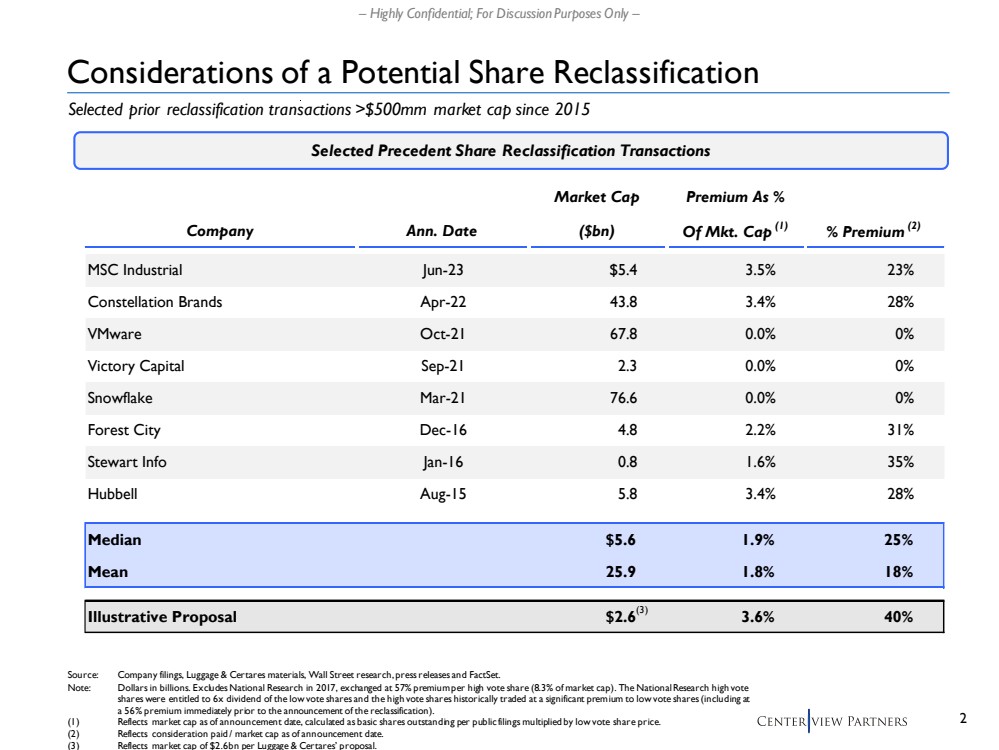

| 2 – Highly Confidential; For Discussion Purposes Only – Considerations of a Potential Share Reclassification Source: Company filings, Luggage & Certares materials, Wall Street research, press releases and FactSet. Note: Dollars in billions. Excludes National Research in 2017, exchanged at 57% premium per high vote share (8.3% of market cap). The National Research high vote shares were entitled to 6x dividend of the low vote shares and the high vote shares historically traded at a significant premium to low vote shares (including at a 56% premium immediately prior to the announcement of the reclassification). (1) Reflects market cap as of announcement date, calculated as basic shares outstanding per public filings multiplied by low vote share price. (2) Reflects consideration paid / market cap as of announcement date. (3) Reflects market cap of $2.6bn per Luggage & Certares’ proposal. Selected prior reclassification transactions >$500mm market cap since 2015 Selected Precedent Share Reclassification Transactions Market Cap Premium As % Company Ann. Date ($bn) Of Mkt. Cap (1) % Premium (2) MSC Industrial Jun-23 $5.4 3.5% 23% Constellation Brands Apr-22 43.8 3.4% 28% VMware Oct-21 67.8 0.0% 0% Victory Capital Sep-21 2.3 0.0% 0% Snowflake Mar-21 76.6 0.0% 0% Forest City Dec-16 4.8 2.2% 31% Stewart Info Jan-16 0.8 1.6% 35% Hubbell Aug-15 5.8 3.4% 28% Median $5.6 1.9% 25% Mean 25.9 1.8% 18% Illustrative Proposal $2.6 3.6% 40% (3) |

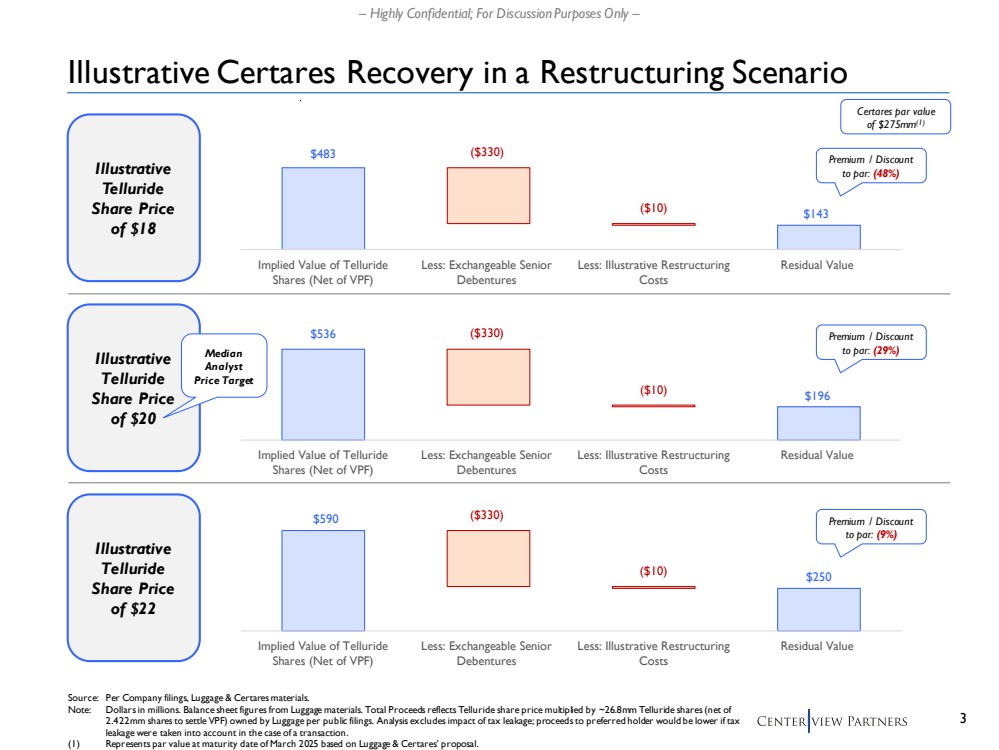

| 3 – Highly Confidential; For Discussion Purposes Only – Illustrative Certares Recovery in a Restructuring Scenario Illustrative Telluride Share Price of $18 Source: Per Company filings, Luggage & Certares materials. Note: Dollars in millions. Balance sheet figures from Luggage materials. Total Proceeds reflects Telluride share price multiplied by ~26.8mm Telluride shares (net of 2.422mm shares to settle VPF) owned by Luggage per public filings. Analysis excludes impact of tax leakage; proceeds to preferred holder would be lower if tax leakage were taken into account in the case of a transaction. (1) Represents par value at maturity date of March 2025 based on Luggage & Certares’ proposal. Illustrative Telluride Share Price of $20 Illustrative Telluride Share Price of $22 $483 $143 ($330) ($10) Implied Value of Telluride Shares (Net of VPF) Less: Exchangeable Senior Debentures Less: Illustrative Restructuring Costs Residual Value $536 $196 ($330) ($10) Implied Value of Telluride Shares (Net of VPF) Less: Exchangeable Senior Debentures Less: Illustrative Restructuring Costs Residual Value $590 $250 ($330) ($10) Implied Value of Telluride Shares (Net of VPF) Less: Exchangeable Senior Debentures Less: Illustrative Restructuring Costs Residual Value Premium / Discount to par: (48%) Premium / Discount to par: (29%) Premium / Discount to par: (9%) Certares par value of $275mm(1) Median Analyst Price Target |

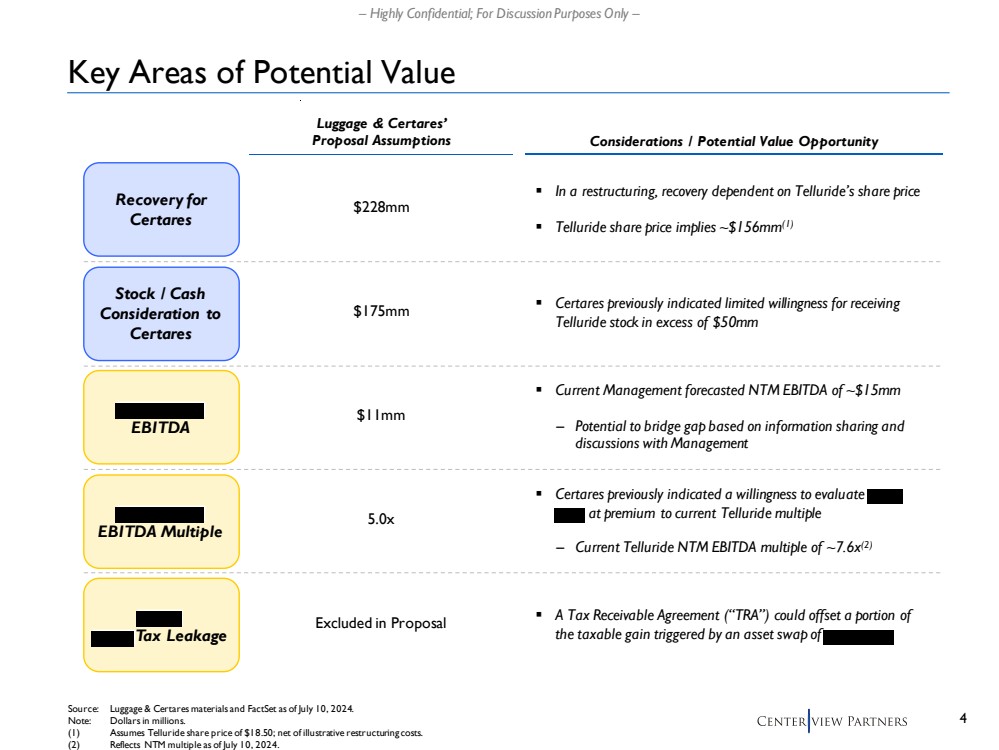

| 4 – Highly Confidential; For Discussion Purposes Only – Key Areas of Potential Value Source: Luggage & Certares materials and FactSet as of July 10, 2024. Note: Dollars in millions. (1) Assumes Telluride share price of $18.50; net of illustrative restructuring costs. (2) Reflects NTM multiple as of July 10, 2024. EBITDA EBITDA Multiple Recovery for Certares Tax Leakage Stock / Cash Consideration to Certares Luggage & Certares’ Proposal Assumptions Considerations / Potential Value Opportunity $11mm 5.0x $228mm Excluded in Proposal $175mm ▪ In a restructuring, recovery dependent on Telluride’s share price ▪ Telluride share price implies ~$156mm(1) ▪ Current Management forecasted NTM EBITDA of ~$15mm – Potential to bridge gap based on information sharing and discussions with Management ▪ Certares previously indicated a willingness to evaluate at premium to current Telluride multiple – Current Telluride NTM EBITDA multiple of ~7.6x(2) ▪ A Tax Receivable Agreement (“TRA”) could offset a portion of the taxable gain triggered by an asset swap of ▪ Certares previously indicated limited willingness for receiving Telluride stock in excess of $50mm |