| – Highly Confidential; For Discussion Purposes Only – Project Telluride Discussion Materials July 2024 |

| 1 – Highly Confidential; For Discussion Purposes Only – Executive Summary Luggage presented a framework for potentially effecting a transaction whereby Telluride would acquire Luggage, resulting in Telluride eliminating its dual-class share structure In assessing Luggage’s framework, one may consider a transaction through several lenses: – Premium: premium required to eliminate Telluride’s high-vote share class vs. precedent share reclassification situations (e.g., premium paid for Telluride’s Class B vs. Common shares and the aggregate $ premium paid as a percent of Telluride’s market cap) – Price: overall price paid for the acquired Telluride shares vs. the intrinsic value of Telluride shares – Other Financial Impacts: other qualitative and financial considerations (e.g., equity story complexity, accretion / dilution, pro forma leverage, etc.) With this background, today’s materials cover the following topics: – Luggage’s framework as it relates to a potential transaction – valuation considerations – Considerations for Telluride with respect to Luggage’s framework Should the Committee wish to move forward, the next step would be to align on a strawman for discussion in response to Luggage’s framework A B C |

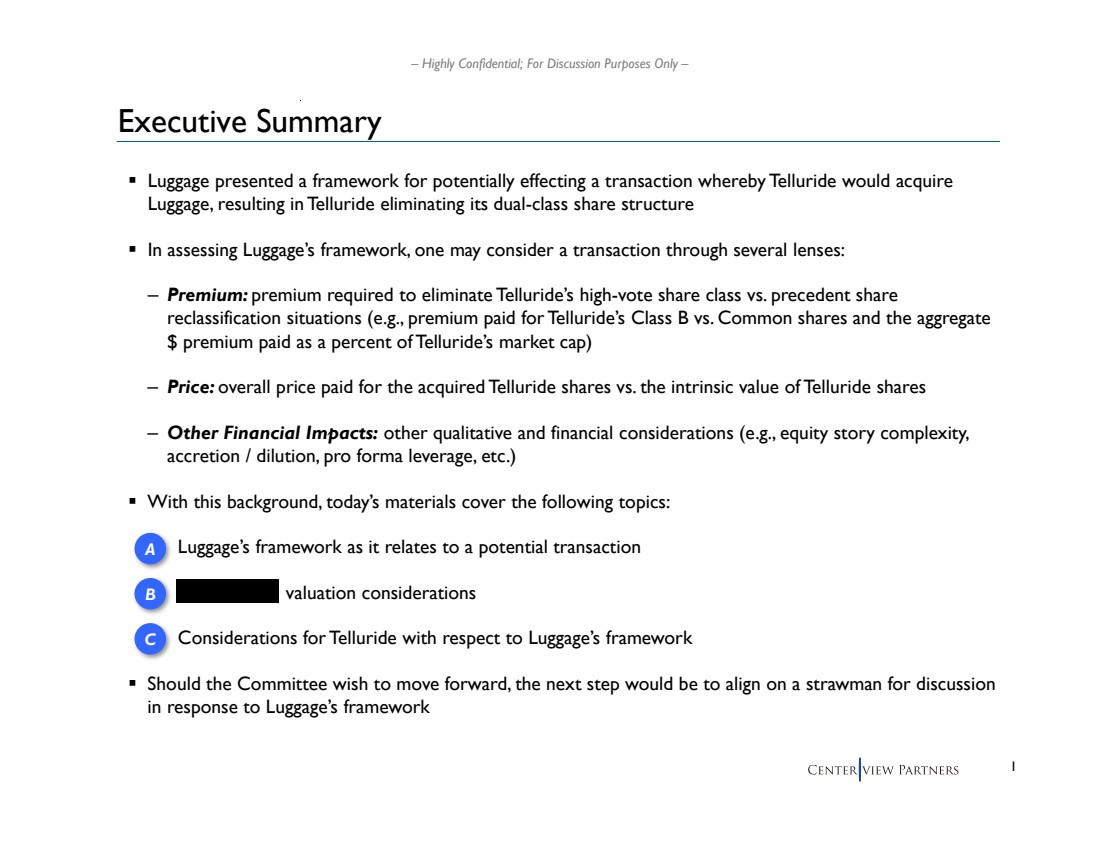

| 2 – Highly Confidential; For Discussion Purposes Only – Summary of Luggage Scenarios Source: Luggage materials, Company filings and FactSet. Note: Dollars in millions. Reflects par value of Series A Preferred of $270mm. (1) Reflects initial investment by Certares of $325mm, receipt of $281mm in cash and value of ~1.7mm Telluride shares at share price of $18.04 and value of Certares recovery. (2) Based on ~139mm of Telluride basic shares outstanding, per latest public filings. (3) Reflects sum of shares issued to Certares and ~1.7mm of existing Telluride shares owned by Certares divided by pro forma Telluride basic shares outstanding. Luggage Scenarios Commentary Assumes VPF settled with Telluride shares (~2.4mm), resulting in remaining share count of 26.8mm underlying Telluride shares Assumes Exchangeable Senior Debentures paid in cash at par Certares consideration in the form of cash / stock and contribution Reflects implied price paid for 26.8mm Telluride shares held by Luggage Implied premium based on total consideration relative to market transaction ($484mm) Assumes high-end of Luggage’s valuation and cash / stock consideration paid to Certares Retirement of Telluride Class B shares, collapsing dual class structure; net shares retired assumes 100% stock consideration to Luggage Common and Certares Tax Leakage: Excluded in Luggage scenarios Exchangeable Senior Debentures $330 $330 $330 $330 $330 Consideration to Luggage Common 25 25 25 25 25 Implied Value (Midpoint) 69 69 69 69 69 Cash / Stock Consideration to Certares 60 96 117 126 174 Implied Value of Total Consideration $484 $520 $541 $550 $598 Implied Telluride Share Price (Common + B's) $18.04 $19.39 $20.17 $20.50 $22.29 Aggregate Premium Paid $-- $36 $57 $66 $114 Implied Premium Paid for Class B vs. Common Stock --% 16% 25% 29% 49% Implied Premium Paid as % of Telluride Market Cap --% 1.3% 2.0% 2.3% 4.0% Certares Recovery ( at $96mm Value) $156 $192 $213 $222 $270 Implied Discount to Par (42%) (29%) (21%) (18%) --% Implied ROIC (1) 44% 55% 62% 64% 79% Net Shares Retired by Telluride 22.1 20.1 19.0 18.5 15.8 % of Telluride Shares Outstanding Issued to Certares (2) 2.4% 3.8% 4.7% 5.0% 6.9% Implied PF Certares Ownership (3) 4.3% 5.9% 6.8% 7.2% 9.2% B D E C A D E C Illustrative Summary of Scenarios as Presented by Luggage (July 18) F F B Implies transaction at market Implies Certares at par ($270mm) A A Luggage Framework |

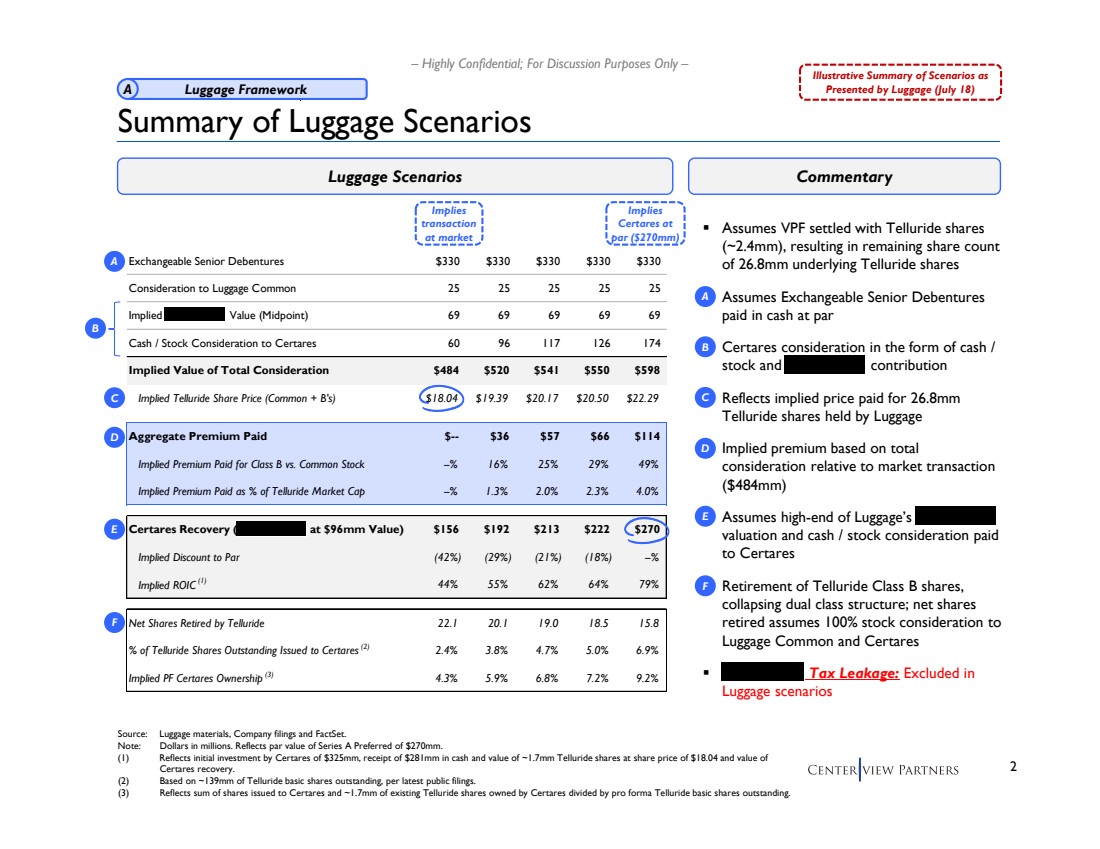

| 3 – Highly Confidential; For Discussion Purposes Only – Illustrative Luggage Value and Assumptions Assumptions Source: Figures per Luggage materials. projections per Telluride management. Note: Dollars in millions. (1) EBITDA not burdened for SBC. Low-end EBITDA assumes ~30% margin applied to CY’24E revenue of ~$36mm High-end EBITDA assumes CY’24E EBITDA of ~$13.5mm less revenue and shared services costs – Management EBITDA figure does not include corporate expenses including human resources, finance and accounting, legal, and licensing – Utilizing a headcount-based allocation to shared services results in additional cost of ~$700k As Illustrated in Luggage Scenarios Implied Value ($mm) Illustrative EBITDA Multiple 4.0x 6.0x 8.0x $10.5 $42 $64 $84 $11.3 $45 $69 $91 $12.0 $48 $72 $96 Implied EBITDA ($mm) CY'24E Revenue $36 Assumed EBITDA Margin (%) 30% EBITDA (Low-End) $10.5 CY'24E EBITDA $13.5 (Less): Telluride Revenue (0.8) (Less): Shared Services (0.7) EBITDA (High-End) $12.0 B A A B A B Assumed value for total consideration Assumed value for Certares recovery A Luggage Framework (1) Illustrative Summary of Scenarios as Presented by Luggage (July 18) |

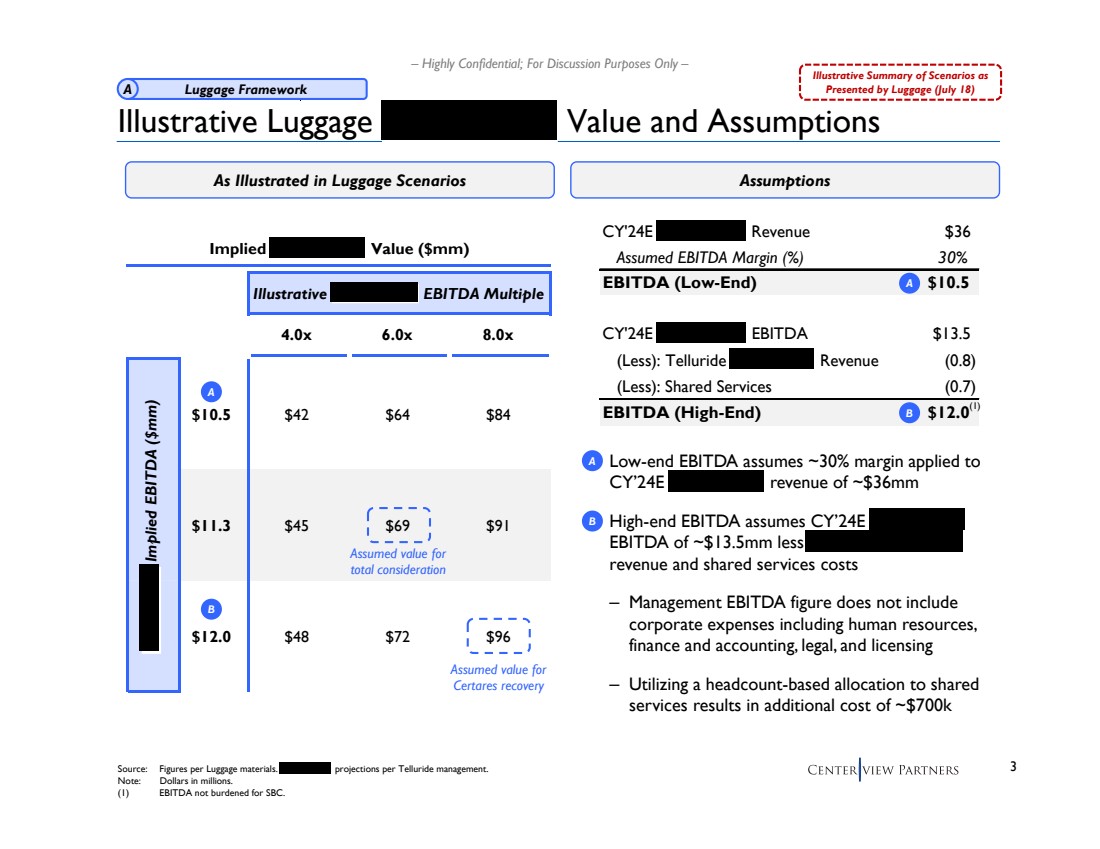

| 4 – Highly Confidential; For Discussion Purposes Only – Discounted Cash Flow Analysis Source: projections per Telluride Management. Note: Dollars in millions. (1) EBITDA is burdened by stock-based compensation, shared services expenses and revenue. Enterprise Value ($mm) Discount Terminal NTM EBITDA Multiple Rate 6.0x 7.0x 8.0x 19.50% $62 $67 $72 20.25% $60 $65 $70 21.00% $59 $63 $68 Fiscal Year Ending December 31, Terminal 2024E 2025E 2026E 2027E 2028E 2029E Year Revenue $36 $38 $40 $42 $43 $44 $44 % Growth 6% 6% 5% 4% 4% 3% Burdened EBITDA $10 $11 $12 $12 $13 $13 $13 % Margin 28% 30% 30% 30% 30% 30% 30% (-) D&A ($1) ($1) ($1) ($1) ($1) ($1) ($1) Burdened EBIT $10 $11 $11 $12 $12 $12 $12 % Margin 26% 28% 28% 28% 28% 28% 28% (-) Taxes ($2) ($2) ($2) ($2) ($3) ($3) ($3) Tax Rate % 21% 21% 21% 21% 21% 21% 21% NOPAT $8 $8 $9 $9 $10 $10 $10 (+) D&A 1111111 (-) ∆ in NWC -- -- -- -- -- -- -- (-) CapEx (1) (1) (1) (1) (1) (1) (1) Unlevered Free Cash Flow $8 $8 $9 $9 $10 $10 $10 % Margin 21% 22% 22% 22% 22% 22% 22% B Valuation Considerations (1) |

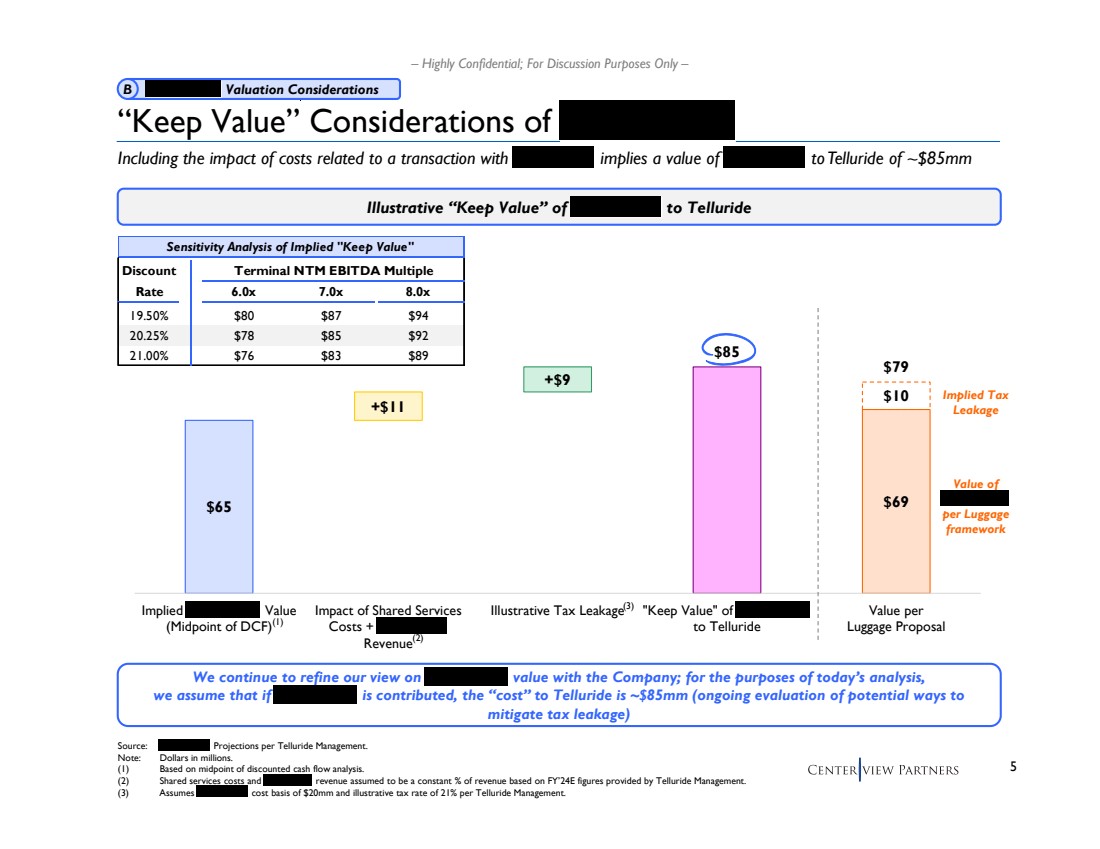

| 5 – Highly Confidential; For Discussion Purposes Only – “Keep Value” Considerations of Source: Projections per Telluride Management. Note: Dollars in millions. (1) Based on midpoint of discounted cash flow analysis. (2) Shared services costs and revenue assumed to be a constant % of revenue based on FY’24E figures provided by Telluride Management. (3) Assumes cost basis of $20mm and illustrative tax rate of 21% per Telluride Management. Including the impact of costs related to a transaction with implies a value of to Telluride of ~$85mm $65 $69 +$11 +$9 $10 $85 $79 Implied Value (Midpoint of DCF) Impact of Shared Services Costs + Revenue Illustrative Tax Leakage "Keep Value" of to Telluride Value per Luggage Proposal (1) (3) (2) Illustrative “Keep Value” of to Telluride We continue to refine our view on value with the Company; for the purposes of today’s analysis, we assume that if is contributed, the “cost” to Telluride is ~$85mm (ongoing evaluation of potential ways to mitigate tax leakage) Sensitivity Analysis of Implied "Keep Value" Discount Terminal NTM EBITDA Multiple Rate 6.0x 7.0x 8.0x 19.50% $80 $87 $94 20.25% $78 $85 $92 21.00% $76 $83 $89 Value of per Luggage framework Implied Tax Leakage B Valuation Considerations |

| 6 – Highly Confidential; For Discussion Purposes Only – Selected Share Reclassification Precedents Source: Company filings, Luggage & Certares materials, Wall Street research, press releases and FactSet. Note: Dollars in billions. Excludes National Research in 2017, exchanged at 57% premium per high vote share (8.3% of market cap). The National Research high vote shares were entitled to 6x dividend of the low vote shares and the high vote shares historically traded at a significant premium to low vote shares (including at a 56% premium immediately prior to the announcement of the reclassification). (1) Reflects market cap as of announcement date, calculated as basic shares outstanding per public filings multiplied by low vote share price. (2) Reflects consideration paid / market cap as of announcement date. Selected prior reclassification transactions >$500mm market cap since 2015 Selected Precedent Share Reclassification Transactions Market Cap Premium As % Company Ann. Date ($bn) (1) Of Mkt. Cap (2) % Premium MSC Industrial Jun-23 $5.4 3.5% 23% Constellation Brands Apr-22 43.8 3.4% 28% VMware Oct-21 67.8 0.0% 0% Victory Capital Sep-21 2.3 0.0% 0% Snowflake Mar-21 76.6 0.0% 0% Forest City Dec-16 4.8 2.2% 31% Stewart Info Jan-16 0.8 1.6% 35% Hubbell Aug-15 5.8 3.4% 28% Median $5.6 1.9% 25% Mean 25.9 1.8% 18% C Considerations for Telluride |

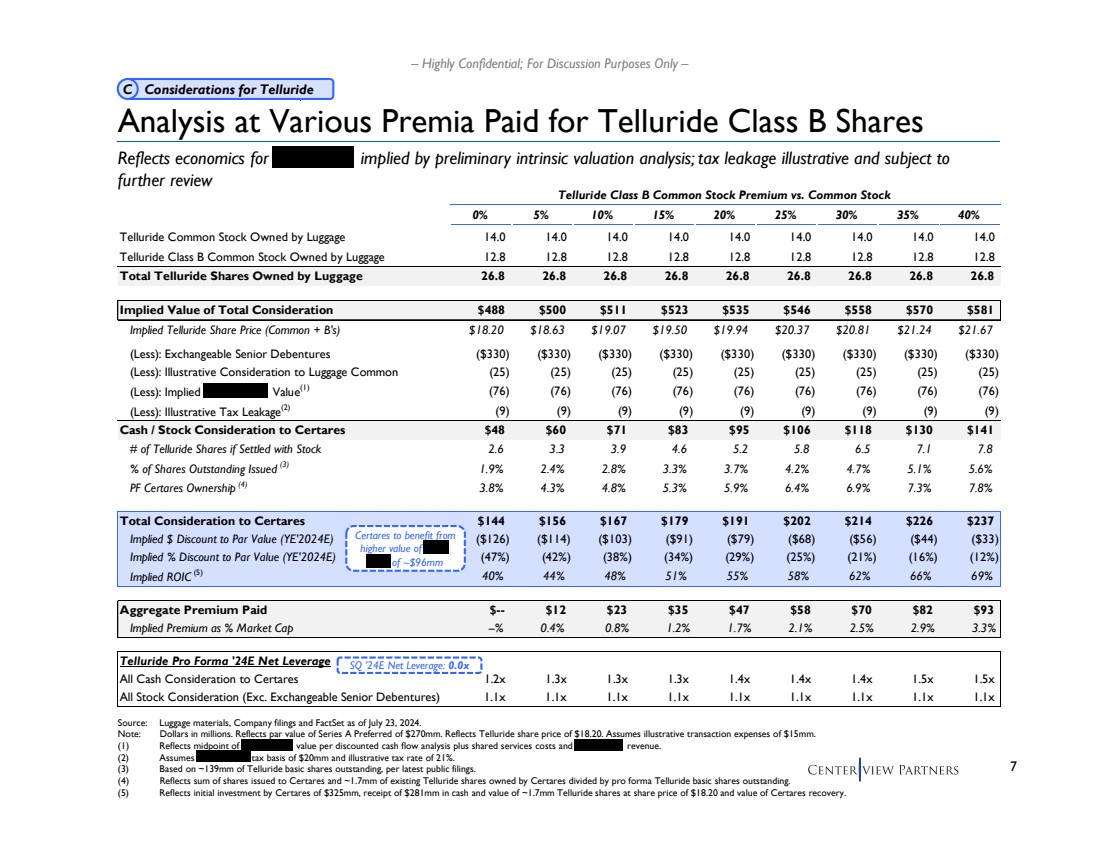

| 7 – Highly Confidential; For Discussion Purposes Only – Telluride Class B Common Stock Premium vs. Common Stock 0% 5% 10% 15% 20% 25% 30% 35% 40% Telluride Common Stock Owned by Luggage 14.0 14.0 14.0 14.0 14.0 14.0 14.0 14.0 14.0 Telluride Class B Common Stock Owned by Luggage 12.8 12.8 12.8 12.8 12.8 12.8 12.8 12.8 12.8 Total Telluride Shares Owned by Luggage 26.8 26.8 26.8 26.8 26.8 26.8 26.8 26.8 26.8 Implied Value of Total Consideration $488 $500 $511 $523 $535 $546 $558 $570 $581 Implied Telluride Share Price (Common + B's) $18.20 $18.63 $19.07 $19.50 $19.94 $20.37 $20.81 $21.24 $21.67 (Less): Exchangeable Senior Debentures ($330) ($330) ($330) ($330) ($330) ($330) ($330) ($330) ($330) (Less): Illustrative Consideration to Luggage Common (25) (25) (25) (25) (25) (25) (25) (25) (25) (Less): Implied Value(1) (76) (76) (76) (76) (76) (76) (76) (76) (76) (Less): Illustrative Tax Leakage(2) (9) (9) (9) (9) (9) (9) (9) (9) (9) Cash / Stock Consideration to Certares $48 $60 $71 $83 $95 $106 $118 $130 $141 # of Telluride Shares if Settled with Stock 2.6 3.3 3.9 4.6 5.2 5.8 6.5 7.1 7.8 % of Shares Outstanding Issued (3) 1.9% 2.4% 2.8% 3.3% 3.7% 4.2% 4.7% 5.1% 5.6% PF Certares Ownership (4) 3.8% 4.3% 4.8% 5.3% 5.9% 6.4% 6.9% 7.3% 7.8% Total Consideration to Certares $144 $156 $167 $179 $191 $202 $214 $226 $237 Implied $ Discount to Par Value (YE'2024E) ($126) ($114) ($103) ($91) ($79) ($68) ($56) ($44) ($33) Implied % Discount to Par Value (YE'2024E) (47%) (42%) (38%) (34%) (29%) (25%) (21%) (16%) (12%) Implied ROIC (5) 40% 44% 48% 51% 55% 58% 62% 66% 69% Aggregate Premium Paid $-- $12 $23 $35 $47 $58 $70 $82 $93 Implied Premium as % Market Cap --% 0.4% 0.8% 1.2% 1.7% 2.1% 2.5% 2.9% 3.3% Telluride Pro Forma '24E Net Leverage All Cash Consideration to Certares 1.2x 1.3x 1.3x 1.3x 1.4x 1.4x 1.4x 1.5x 1.5x All Stock Consideration (Exc. Exchangeable Senior Debentures) 1.1x 1.1x 1.1x 1.1x 1.1x 1.1x 1.1x 1.1x 1.1x Analysis at Various Premia Paid for Telluride Class B Shares Source: Luggage materials, Company filings and FactSet as of July 23, 2024. Note: Dollars in millions. Reflects par value of Series A Preferred of $270mm. Reflects Telluride share price of $18.20. Assumes illustrative transaction expenses of $15mm. (1) Reflects midpoint of value per discounted cash flow analysis plus shared services costs and revenue. (2) Assumes tax basis of $20mm and illustrative tax rate of 21%. (3) Based on ~139mm of Telluride basic shares outstanding, per latest public filings. (4) Reflects sum of shares issued to Certares and ~1.7mm of existing Telluride shares owned by Certares divided by pro forma Telluride basic shares outstanding. (5) Reflects initial investment by Certares of $325mm, receipt of $281mm in cash and value of ~1.7mm Telluride shares at share price of $18.20 and value of Certares recovery. SQ ’24E Net Leverage: 0.0x Reflects economics for implied by preliminary intrinsic valuation analysis; tax leakage illustrative and subject to further review Certares to benefit from higher value of of ~$96mm C Considerations for Telluride |

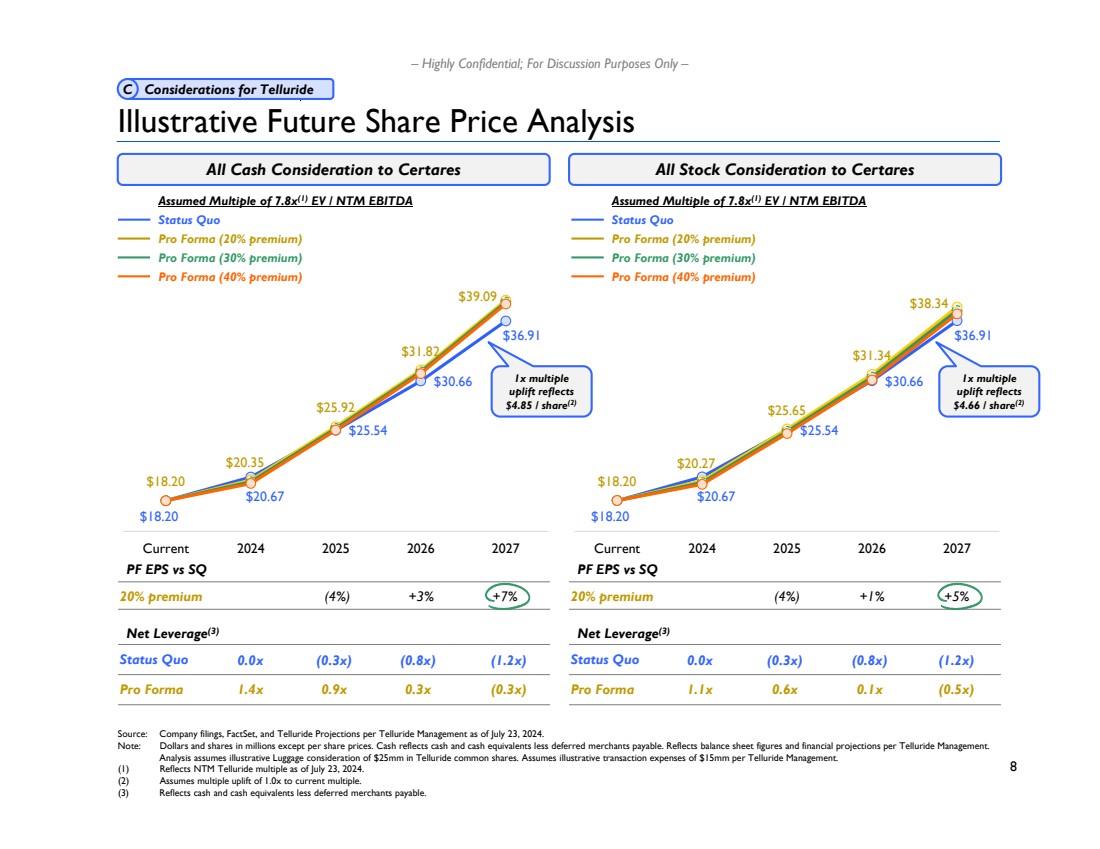

| 8 – Highly Confidential; For Discussion Purposes Only – $18.20 $20.67 $25.54 $30.66 $36.91 $18.20 $20.35 $25.92 $31.82 $39.09 Current 2024 2025 2026 2027 Assumed Multiple of 7.8x(1) EV / NTM EBITDA Status Quo Pro Forma (20% premium) Pro Forma (30% premium) Pro Forma (40% premium) Illustrative Future Share Price Analysis Source: Company filings, FactSet, and Telluride Projections per Telluride Management as of July 23, 2024. Note: Dollars and shares in millions except per share prices. Cash reflects cash and cash equivalents less deferred merchants payable. Reflects balance sheet figures and financial projections per Telluride Management. Analysis assumes illustrative Luggage consideration of $25mm in Telluride common shares. Assumes illustrative transaction expenses of $15mm per Telluride Management. (1) Reflects NTM Telluride multiple as of July 23, 2024. (2) Assumes multiple uplift of 1.0x to current multiple. (3) Reflects cash and cash equivalents less deferred merchants payable. PF EPS vs SQ (4%) +3% +7% Net Leverage(3) Status Quo Pro Forma 0.0x (0.3x) (0.8x) 1.4x 0.9x 0.3x Assumed Multiple of 7.8x(1) EV / NTM EBITDA Status Quo Pro Forma (20% premium) Pro Forma (30% premium) Pro Forma (40% premium) 20% premium All Cash Consideration to Certares All Stock Consideration to Certares PF EPS vs SQ (4%) +1% +5% Net Leverage(3) Status Quo Pro Forma 0.0x (0.3x) (0.8x) 1.1x 0.6x 0.1x 20% premium $18.20 $20.67 $25.54 $30.66 $36.91 $18.20 $20.27 $25.65 $31.34 $38.34 Current 2024 2025 2026 2027 (1.2x) (0.3x) (1.2x) (0.5x) 1x multiple uplift reflects $4.85 / share(2) 1x multiple uplift reflects $4.66 / share(2) C Considerations for Telluride |

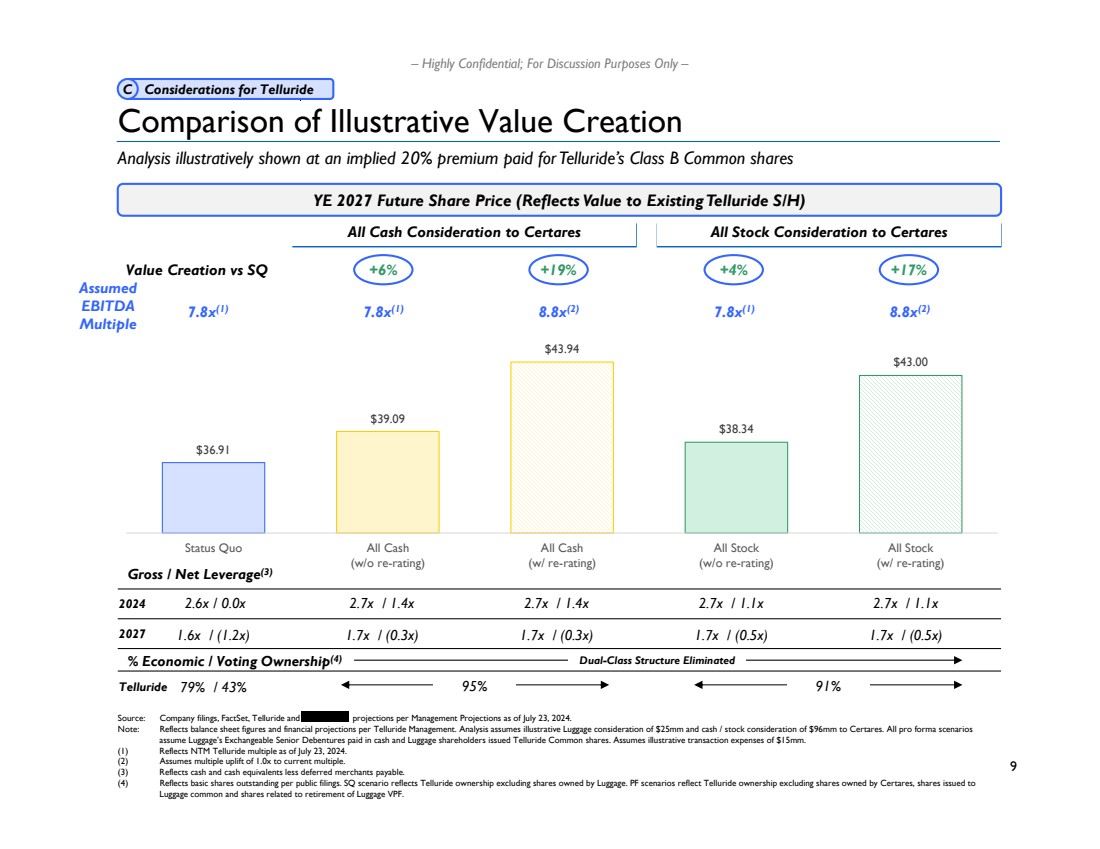

| 9 – Highly Confidential; For Discussion Purposes Only – Value Creation vs SQ +19% Assumed EBITDA Multiple 7.8x(1) 8.8x(2) +6% 7.8x(1) All Cash Consideration to Certares All Stock Consideration to Certares +4% +17% 8.8x(2) 7.8x(1) $36.91 $39.09 $43.94 $38.34 $43.00 Status Quo All Cash (w/o re-rating) All Cash (w/ re-rating) All Stock (w/o re-rating) All Stock (w/ re-rating) Comparison of Illustrative Value Creation YE 2027 Future Share Price (Reflects Value to Existing Telluride S/H) Source: Company filings, FactSet, Telluride and projections per Management Projections as of July 23, 2024. Note: Reflects balance sheet figures and financial projections per Telluride Management. Analysis assumes illustrative Luggage consideration of $25mm and cash / stock consideration of $96mm to Certares. All pro forma scenarios assume Luggage’s Exchangeable Senior Debentures paid in cash and Luggage shareholders issued Telluride Common shares. Assumes illustrative transaction expenses of $15mm. (1) Reflects NTM Telluride multiple as of July 23, 2024. (2) Assumes multiple uplift of 1.0x to current multiple. (3) Reflects cash and cash equivalents less deferred merchants payable. (4) Reflects basic shares outstanding per public filings. SQ scenario reflects Telluride ownership excluding shares owned by Luggage. PF scenarios reflect Telluride ownership excluding shares owned by Certares, shares issued to Luggage common and shares related to retirement of Luggage VPF. % Economic / Voting Ownership(4) Telluride 79% / 43% 95% Dual-Class Structure Eliminated 91% Gross / Net Leverage(3) 2024 2.6x / 0.0x 2027 1.6x / (1.2x) 2.7x / 1.4x 1.7x / (0.3x) 2.7x / 1.4x 1.7x / (0.3x) 2.7x / 1.1x 2.7x / 1.1x 1.7x / (0.5x) 1.7x / (0.5x) Analysis illustratively shown at an implied 20% premium paid for Telluride’s Class B Common shares C Considerations for Telluride |

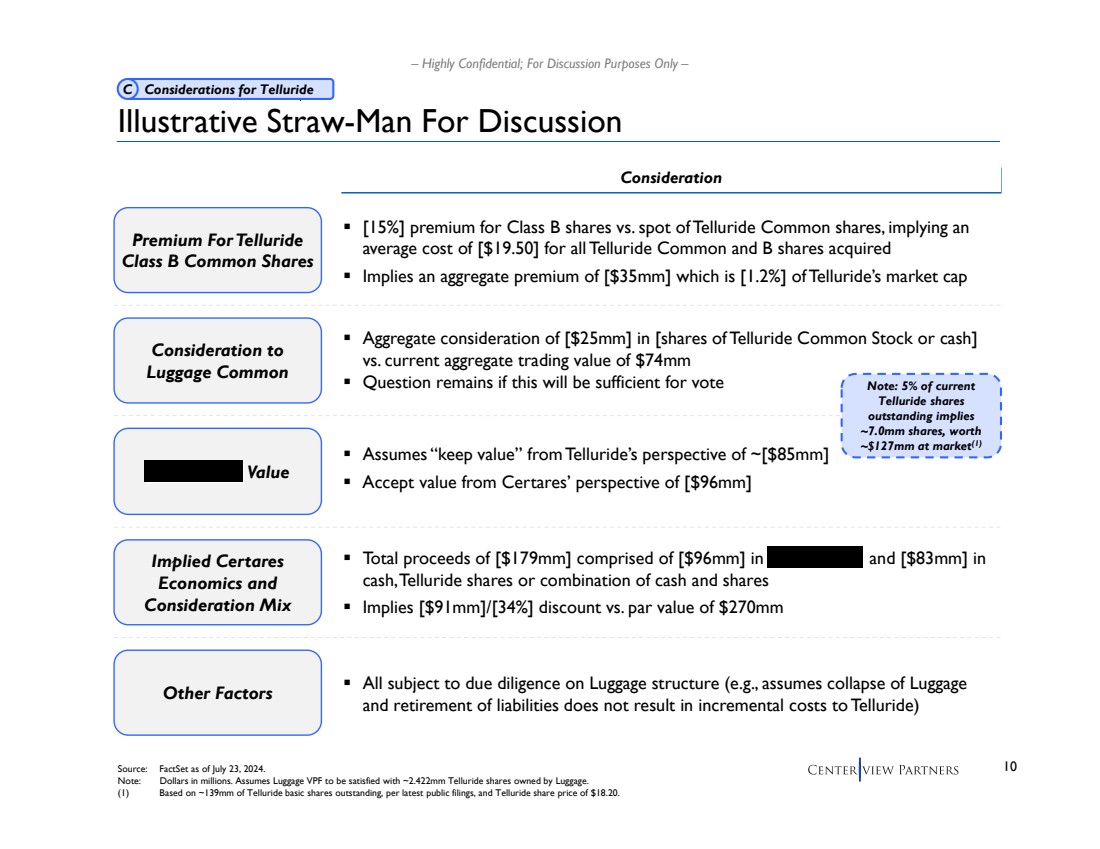

| 10 – Highly Confidential; For Discussion Purposes Only – Illustrative Straw-Man For Discussion Consideration to Luggage Common Premium For Telluride Class B Common Shares Other Factors All subject to due diligence on Luggage structure (e.g., assumes collapse of Luggage and retirement of liabilities does not result in incremental costs to Telluride) [15%] premium for Class B shares vs. spot of Telluride Common shares, implying an average cost of [$19.50] for all Telluride Common and B shares acquired Implies an aggregate premium of [$35mm] which is [1.2%] of Telluride’s market cap Aggregate consideration of [$25mm] in [shares of Telluride Common Stock or cash] vs. current aggregate trading value of $74mm Question remains if this will be sufficient for vote Value Assumes “keep value” from Telluride’s perspective of ~[$85mm] Accept value from Certares’ perspective of [$96mm] Implied Certares Economics and Consideration Mix Total proceeds of [$179mm] comprised of [$96mm] in and [$83mm] in cash, Telluride shares or combination of cash and shares Implies [$91mm]/[34%] discount vs. par value of $270mm Consideration Source: FactSet as of July 23, 2024. Note: Dollars in millions. Assumes Luggage VPF to be satisfied with ~2.422mm Telluride shares owned by Luggage. (1) Based on ~139mm of Telluride basic shares outstanding, per latest public filings, and Telluride share price of $18.20. C Considerations for Telluride Note: 5% of current Telluride shares outstanding implies ~7.0mm shares, worth ~$127mm at market(1) |

| Supplementary Materials Appendix |

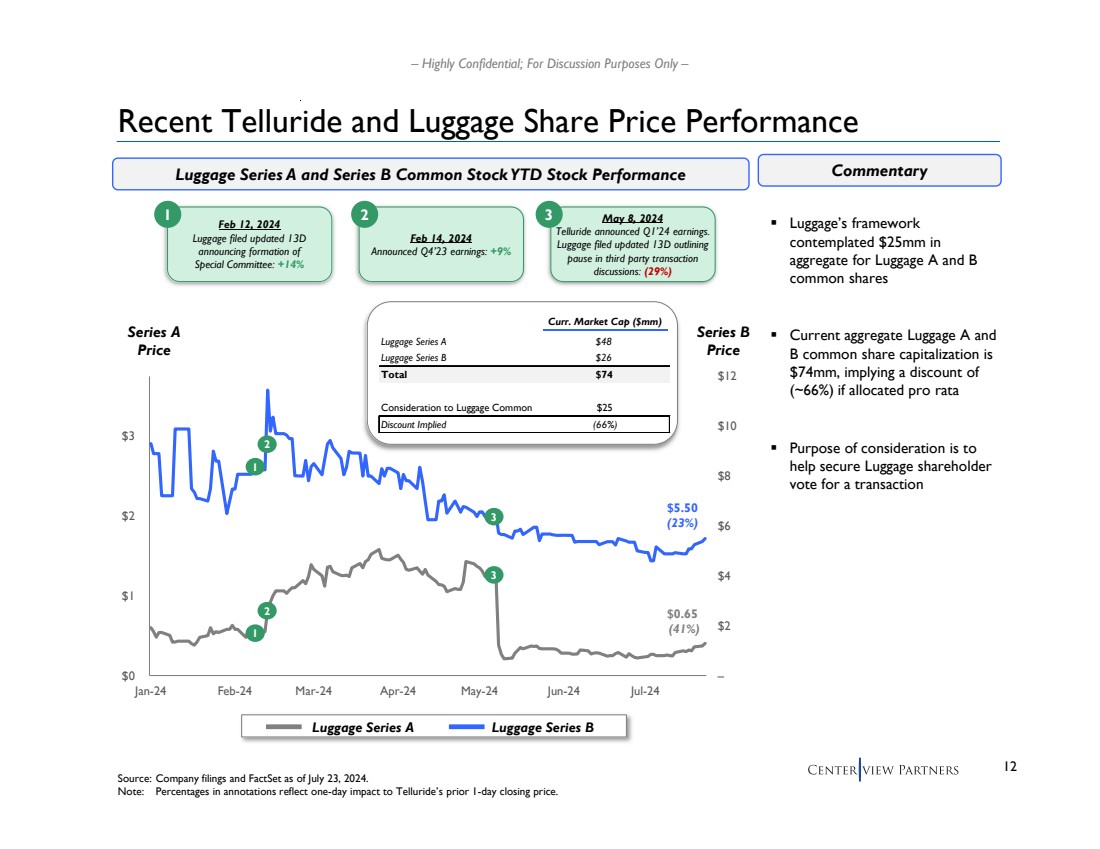

| 12 – Highly Confidential; For Discussion Purposes Only – Curr. Market Cap ($mm) Luggage Series A $48 Luggage Series B $26 Total $74 Consideration to Luggage Common $25 Discount Implied (66%) Recent Telluride and Luggage Share Price Performance Source: Company filings and FactSet as of July 23, 2024. Note: Percentages in annotations reflect one-day impact to Telluride’s prior 1-day closing price. Luggage’s framework contemplated $25mm in aggregate for Luggage A and B common shares Current aggregate Luggage A and B common share capitalization is $74mm, implying a discount of (~66%) if allocated pro rata Purpose of consideration is to help secure Luggage shareholder vote for a transaction Luggage Series A and Series B Common Stock YTD Stock Performance Commentary Luggage Series A Luggage Series B Feb 12, 2024 Luggage filed updated 13D announcing formation of Special Committee: +14% Feb 14, 2024 Announced Q4’23 earnings: +9% May 8, 2024 Telluride announced Q1’24 earnings. Luggage filed updated 13D outlining pause in third party transaction discussions: (29%) 1 2 3 – $2 $4 $6 $8 $10 $12 $0 $1 $2 $3 Jan-24 Feb-24 Mar-24 Apr-24 May-24 Jun-24 Jul-24 Series A Price Series B Price $5.50 (23%) $0.65 (41%) 1 2 3 1 2 3 |

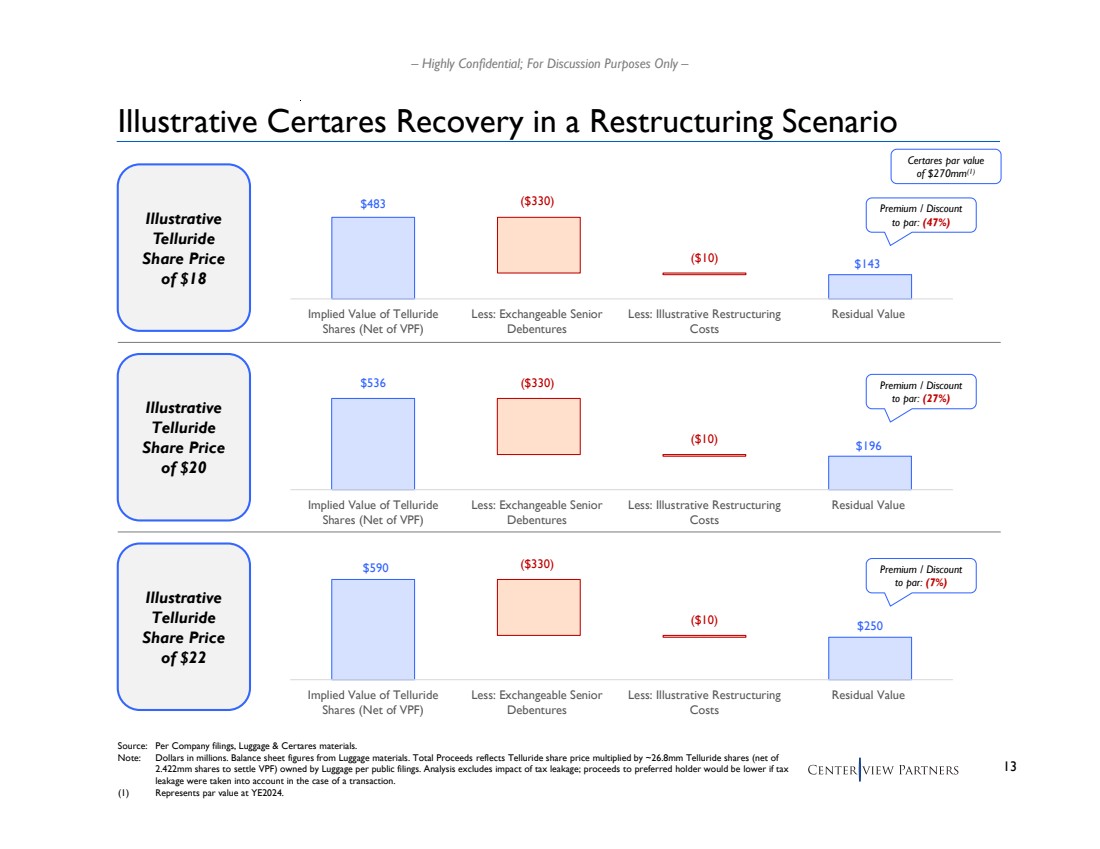

| 13 – Highly Confidential; For Discussion Purposes Only – Illustrative Certares Recovery in a Restructuring Scenario Illustrative Telluride Share Price of $18 Source: Per Company filings, Luggage & Certares materials. Note: Dollars in millions. Balance sheet figures from Luggage materials. Total Proceeds reflects Telluride share price multiplied by ~26.8mm Telluride shares (net of 2.422mm shares to settle VPF) owned by Luggage per public filings. Analysis excludes impact of tax leakage; proceeds to preferred holder would be lower if tax leakage were taken into account in the case of a transaction. (1) Represents par value at YE2024. Illustrative Telluride Share Price of $20 Illustrative Telluride Share Price of $22 $483 $143 ($330) ($10) Implied Value of Telluride Shares (Net of VPF) Less: Exchangeable Senior Debentures Less: Illustrative Restructuring Costs Residual Value $536 $196 ($330) ($10) Implied Value of Telluride Shares (Net of VPF) Less: Exchangeable Senior Debentures Less: Illustrative Restructuring Costs Residual Value $590 $250 ($330) ($10) Implied Value of Telluride Shares (Net of VPF) Less: Exchangeable Senior Debentures Less: Illustrative Restructuring Costs Residual Value Premium / Discount to par: (47%) Premium / Discount to par: (27%) Premium / Discount to par: (7%) Certares par value of $270mm(1) |

| 14 – Highly Confidential; For Discussion Purposes Only – Cost of Equity Risk-Free Rate(3) 4.48% Unlevered Beta 1.11 Target Debt / Equity(4) -- Levered Beta 1.11 Historical Risk Premium(5) 7.17% Market Size Premium(5) 7.64% Cost of Equity 20.1% Illustrative WACC Analysis Source: Duff & Phelps Valuation Handbook, company filings and FactSet as of July 23, 2024. Note: Dollars in millions. (1) For each comparable, represents 2-year, weekly adjusted beta, benchmarked against S&P 500. (2) Unlevered beta equals (Levered Beta/(1 + ((1 - Tax Rate) * Debt/Equity)). (3) Current spot US 20-year treasury note yield. (4) Assumes no debt at standalone entity. (5) Historical risk premium and size premium per Duff & Phelps. Weighted Average Cost of Capital WACC Sensitivity Equity Total Debt / Beta Company Value Debt Equity Levered (1) Unlevered (2) Expedia $18,719 $6,256 33% 1.473 1.165 Yelp 2,919 -- -- 1.057 1.057 Telluride 2,815 900 32% 1.140 0.910 Ziff Davis 2,372 1,010 43% 1.329 0.994 Future 1,569 413 26% 1.863 1.536 LegalZoom.com 1,395 -- -- 1.408 1.408 Cars.com 1,395 560 40% 1.011 0.768 Angi 1,280 500 39% 1.577 1.205 Median 33% 1.368 1.111 Illustrative Unlevered Beta 20% 1.01 1.11 1.21 0% 19.4% 20.1% 20.8% Debt / Equity |

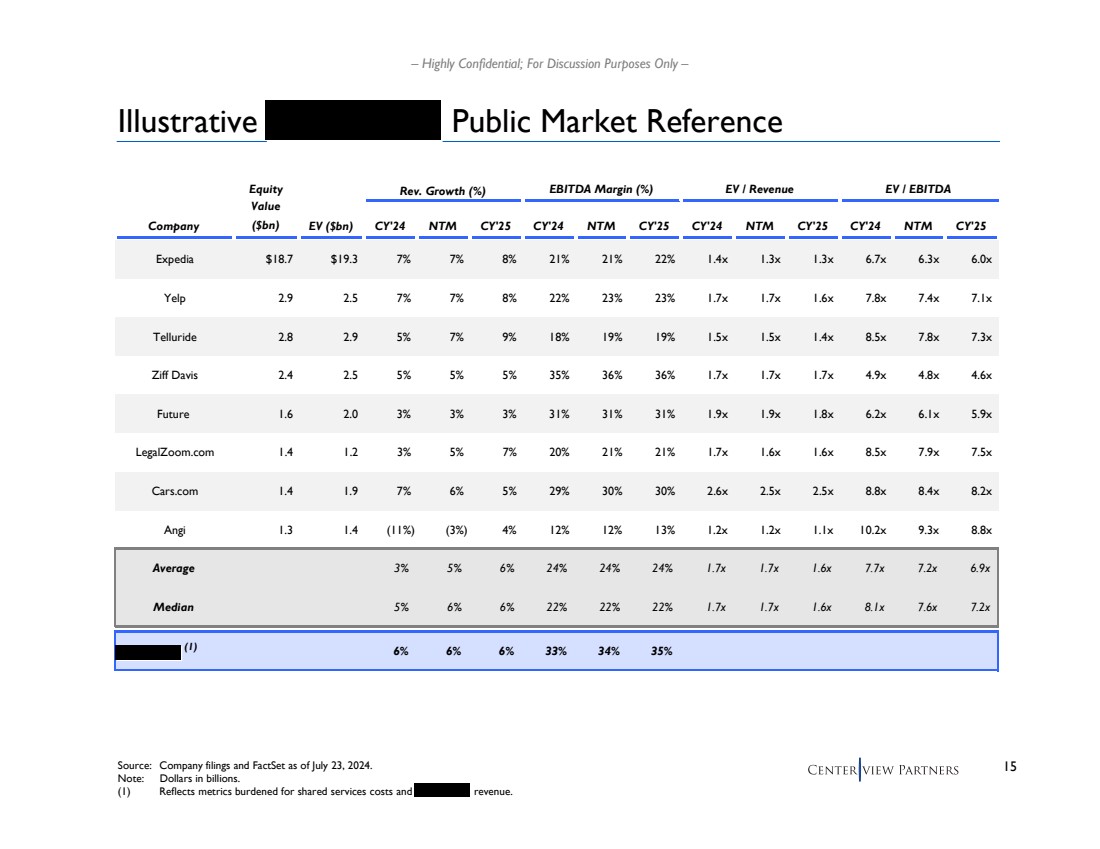

| 15 – Highly Confidential; For Discussion Purposes Only – Illustrative Public Market Reference Equity Rev. Growth (%) EBITDA Margin (%) EV / Revenue EV / EBITDA Company Value ($bn) EV ($bn) CY'24 NTM CY'25 CY'24 NTM CY'25 CY'24 NTM CY'25 CY'24 NTM CY'25 Expedia $18.7 $19.3 7% 7% 8% 21% 21% 22% 1.4x 1.3x 1.3x 6.7x 6.3x 6.0x Yelp 2.9 2.5 7% 7% 8% 22% 23% 23% 1.7x 1.7x 1.6x 7.8x 7.4x 7.1x Telluride 2.8 2.9 5% 7% 9% 18% 19% 19% 1.5x 1.5x 1.4x 8.5x 7.8x 7.3x Ziff Davis 2.4 2.5 5% 5% 5% 35% 36% 36% 1.7x 1.7x 1.7x 4.9x 4.8x 4.6x Future 1.6 2.0 3% 3% 3% 31% 31% 31% 1.9x 1.9x 1.8x 6.2x 6.1x 5.9x LegalZoom.com 1.4 1.2 3% 5% 7% 20% 21% 21% 1.7x 1.6x 1.6x 8.5x 7.9x 7.5x Cars.com 1.4 1.9 7% 6% 5% 29% 30% 30% 2.6x 2.5x 2.5x 8.8x 8.4x 8.2x Angi 1.3 1.4 (11%) (3%) 4% 12% 12% 13% 1.2x 1.2x 1.1x 10.2x 9.3x 8.8x Average 3% 5% 6% 24% 24% 24% 1.7x 1.7x 1.6x 7.7x 7.2x 6.9x Median 5% 6% 6% 22% 22% 22% 1.7x 1.7x 1.6x 8.1x 7.6x 7.2x (1) 6% 6% 6% 33% 34% 35% Source: Company filings and FactSet as of July 23, 2024. Note: Dollars in billions. (1) Reflects metrics burdened for shared services costs and revenue. |

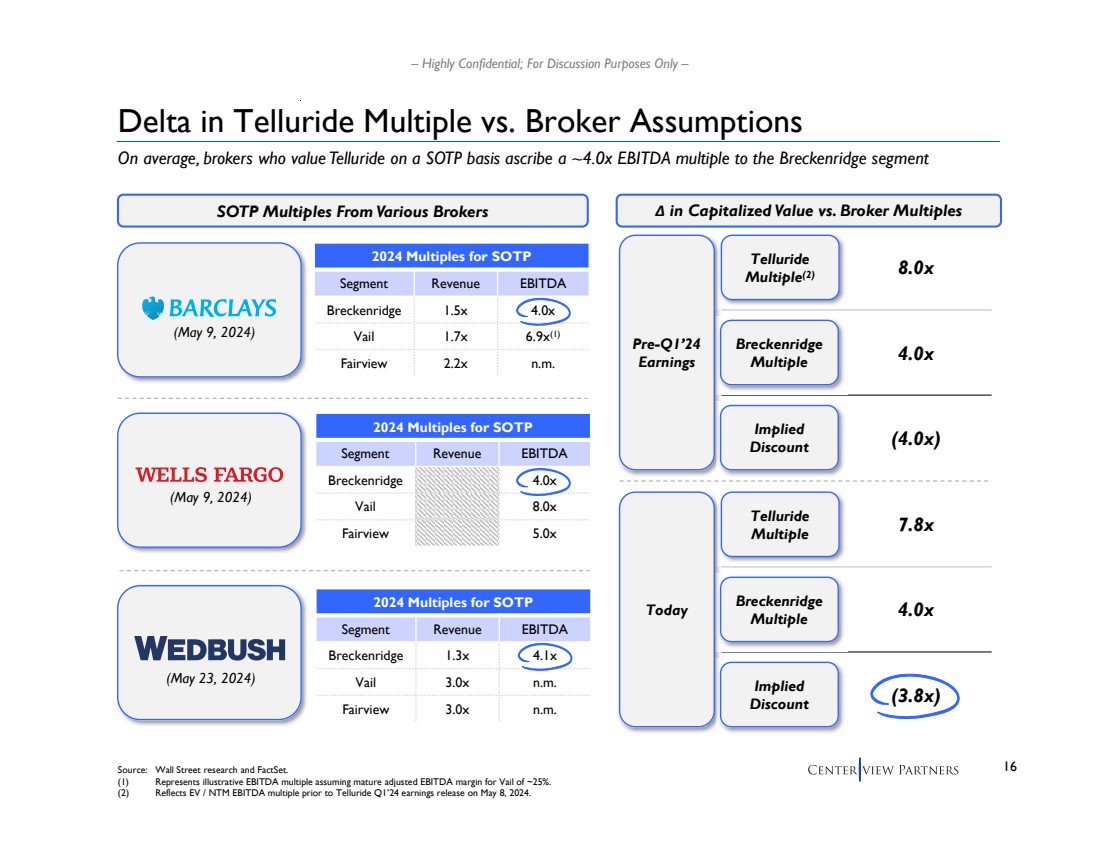

| 16 – Highly Confidential; For Discussion Purposes Only – Delta in Telluride Multiple vs. Broker Assumptions 2024 Multiples for SOTP Segment Revenue EBITDA Breckenridge 1.5x 4.0x Vail 1.7x 6.9x(1) Fairview 2.2x n.m. Source: Wall Street research and FactSet. (1) Represents illustrative EBITDA multiple assuming mature adjusted EBITDA margin for Vail of ~25%. (2) Reflects EV / NTM EBITDA multiple prior to Telluride Q1’24 earnings release on May 8, 2024. 2024 Multiples for SOTP Segment Revenue EBITDA Breckenridge 4.0x Vail 8.0x Fairview 5.0x 2024 Multiples for SOTP Segment Revenue EBITDA Breckenridge 1.3x 4.1x Vail 3.0x n.m. Fairview 3.0x n.m. On average, brokers who value Telluride on a SOTP basis ascribe a ~4.0x EBITDA multiple to the Breckenridge segment SOTP Multiples From Various Brokers Δ in Capitalized Value vs. Broker Multiples Pre-Q1’24 Earnings Telluride Multiple(2) 8.0x Breckenridge Multiple 4.0x Implied Discount (4.0x) Today Telluride Multiple 7.8x Breckenridge Multiple 4.0x Implied Discount (3.8x) (May 9, 2024) (May 9, 2024) (May 23, 2024) |

| 17 – Highly Confidential; For Discussion Purposes Only – Disclaimer This presentation has been prepared by Centerview Partners LLC (“Centerview”) for use solely by the Special Committee of the Board of Directors of Telluride, Inc. (“Telluride” or the “Company”) in connection with its evaluation of proposed strategic alternatives for Telluride and for no other purpose. The information contained herein is based upon information supplied by or on behalf of Telluride and publicly available information, and portions of the information contained herein may be based upon statements, estimates and forecasts provided by Telluride. Centerview has relied upon the accuracy and completeness of the foregoing information, and has not assumed any responsibility for any independent verification of such information or for any independent evaluation or appraisal of any of the assets or liabilities (contingent or otherwise) of Telluride or any other entity, or concerning the solvency or fair value of Telluride or any other entity. The financial analysis in this presentation is complex and is not necessarily susceptible to a partial analysis or summary description. In performing this financial analysis, Centerview has considered the results of its analysis as a whole and did not necessarily attribute a particular weight to any particular portion of the analysis considered. Furthermore, selecting any portion of Centerview’s analysis, without considering the analysis as a whole, would create an incomplete view of the process underlying its financial analysis. Centerview may have deemed various assumptions more or less probable than other assumptions, so the reference ranges resulting from any particular portion of the analysis described above should not be taken to be Centerview’s view of the actual value of Telluride. These materials and the information contained herein are confidential, were not prepared with a view toward public disclosure, and may not be disclosed publicly or made available to third parties without the prior written consent of Centerview. These materials and any other advice, written or oral, rendered by Centerview are intended solely for the benefit and use of the Special Committee of the Board of Directors of Telluride (in its capacity as such) in its consideration of strategic alternatives, and are not for the benefit of, and do not convey any rights or remedies for any holder of securities of Telluride or any other person. Centerview will not be responsible for and has not provided any tax, accounting, actuarial, legal or other specialist advice. These materials are not intended to provide the sole basis for evaluating strategic alternatives, and this presentation does not represent a fairness opinion, recommendation, valuation or opinion of any kind, and is necessarily incomplete and should be viewed solely in conjunction with the oral presentation provided by Centerview. |