| – Preliminary Working Draft Subject to Material Revision – Project Telluride Discussion Materials September 2024 |

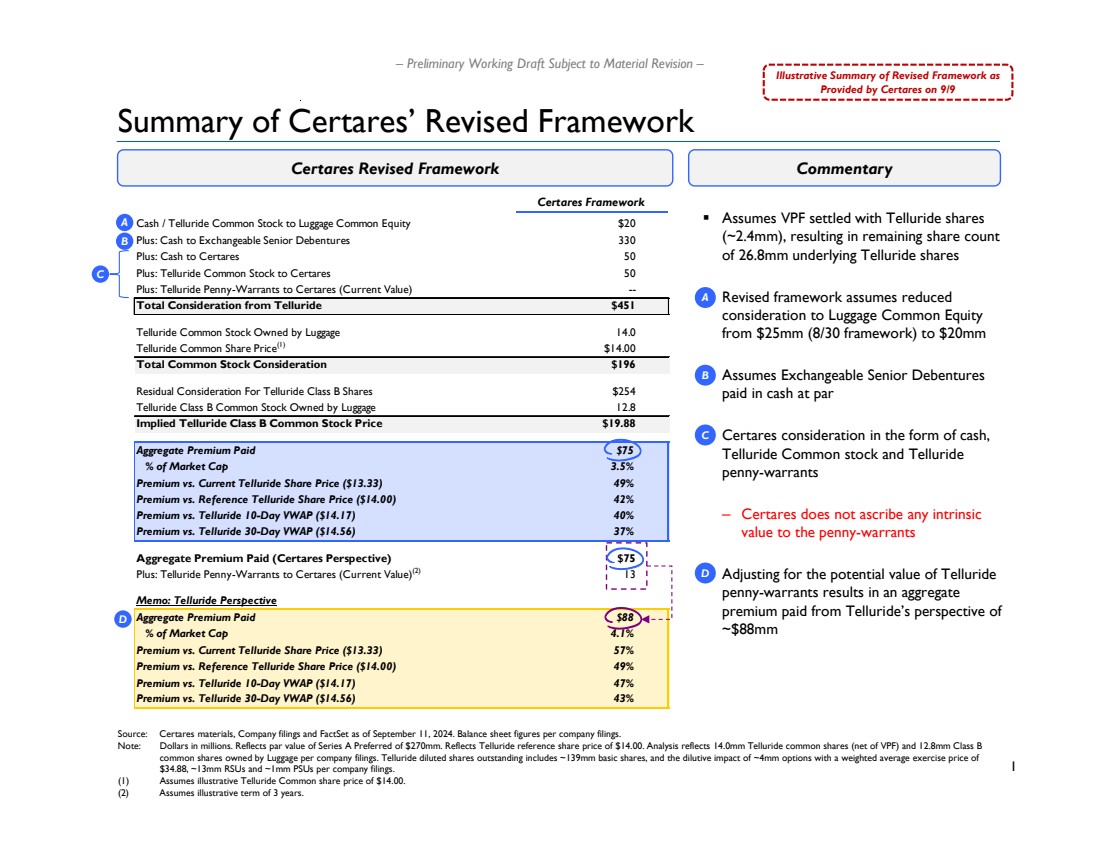

| 1 – Preliminary Working Draft Subject to Material Revision – Certares Framework Cash / Telluride Common Stock to Luggage Common Equity $20 Plus: Cash to Exchangeable Senior Debentures 330 Plus: Cash to Certares 50 Plus: Telluride Common Stock to Certares 50 Plus: Telluride Penny-Warrants to Certares (Current Value) -- Total Consideration from Telluride $451 Telluride Common Stock Owned by Luggage 14.0 Telluride Common Share Price(1) $14.00 Total Common Stock Consideration $196 Residual Consideration For Telluride Class B Shares $254 Telluride Class B Common Stock Owned by Luggage 12.8 Implied Telluride Class B Common Stock Price $19.88 Aggregate Premium Paid $75 % of Market Cap 3.5% Premium vs. Current Telluride Share Price ($13.33) 49% Premium vs. Reference Telluride Share Price ($14.00) 42% Premium vs. Telluride 10-Day VWAP ($14.17) 40% Premium vs. Telluride 30-Day VWAP ($14.56) 37% Aggregate Premium Paid (Certares Perspective) $75 Plus: Telluride Penny-Warrants to Certares (Current Value)(2) 13 Memo: Telluride Perspective Aggregate Premium Paid $88 % of Market Cap 4.1% Premium vs. Current Telluride Share Price ($13.33) 57% Premium vs. Reference Telluride Share Price ($14.00) 49% Premium vs. Telluride 10-Day VWAP ($14.17) 47% Premium vs. Telluride 30-Day VWAP ($14.56) 43% Summary of Certares’ Revised Framework Source: Certares materials, Company filings and FactSet as of September 11, 2024. Balance sheet figures per company filings. Note: Dollars in millions. Reflects par value of Series A Preferred of $270mm. Reflects Telluride reference share price of $14.00. Analysis reflects 14.0mm Telluride common shares (net of VPF) and 12.8mm Class B common shares owned by Luggage per company filings. Telluride diluted shares outstanding includes ~139mm basic shares, and the dilutive impact of ~4mm options with a weighted average exercise price of $34.88, ~13mm RSUs and ~1mm PSUs per company filings. (1) Assumes illustrative Telluride Common share price of $14.00. (2) Assumes illustrative term of 3 years. Certares Revised Framework Commentary Illustrative Summary of Revised Framework as Provided by Certares on 9/9 A B C Assumes VPF settled with Telluride shares (~2.4mm), resulting in remaining share count of 26.8mm underlying Telluride shares Revised framework assumes reduced consideration to Luggage Common Equity from $25mm (8/30 framework) to $20mm Assumes Exchangeable Senior Debentures paid in cash at par Certares consideration in the form of cash, Telluride Common stock and Telluride penny-warrants – Certares does not ascribe any intrinsic value to the penny-warrants Adjusting for the potential value of Telluride penny-warrants results in an aggregate premium paid from Telluride’s perspective of ~$88mm A C B D D |

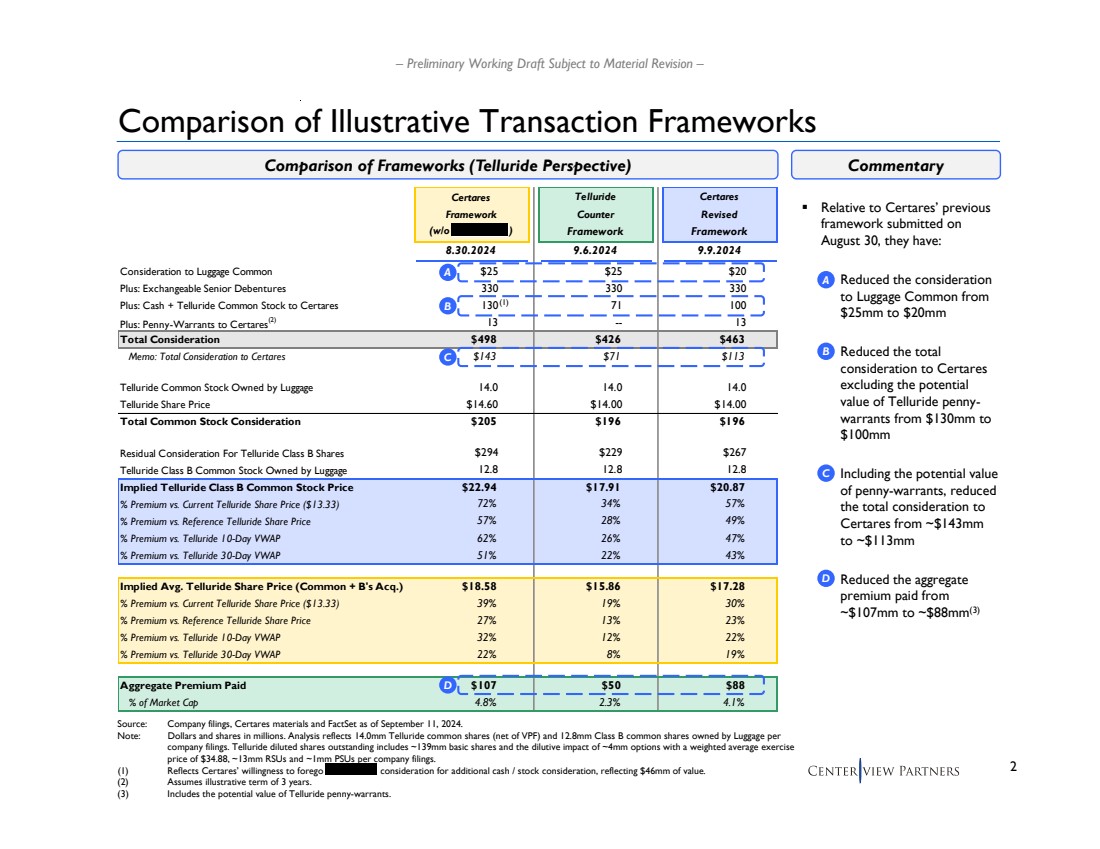

| 2 – Preliminary Working Draft Subject to Material Revision – Telluride Certares Counter Revised Framework Framework 8.30.2024 9.6.2024 9.9.2024 Consideration to Luggage Common $25 $25 $20 Plus: Exchangeable Senior Debentures 330 330 330 Plus: Cash + Telluride Common Stock to Certares 130 71 100 Plus: Penny-Warrants to Certares(2) 13 -- 13 Total Consideration $498 $426 $463 Memo: Total Consideration to Certares $143 $71 $113 Telluride Common Stock Owned by Luggage 14.0 14.0 14.0 Telluride Share Price $14.60 $14.00 $14.00 Total Common Stock Consideration $205 $196 $196 Residual Consideration For Telluride Class B Shares $294 $229 $267 Telluride Class B Common Stock Owned by Luggage 12.8 12.8 12.8 Implied Telluride Class B Common Stock Price $22.94 $17.91 $20.87 % Premium vs. Current Telluride Share Price ($13.33) 72% 34% 57% % Premium vs. Reference Telluride Share Price 57% 28% 49% % Premium vs. Telluride 10-Day VWAP 62% 26% 47% % Premium vs. Telluride 30-Day VWAP 51% 22% 43% Implied Avg. Telluride Share Price (Common + B's Acq.) $18.58 $15.86 $17.28 % Premium vs. Current Telluride Share Price ($13.33) 39% 19% 30% % Premium vs. Reference Telluride Share Price 27% 13% 23% % Premium vs. Telluride 10-Day VWAP 32% 12% 22% % Premium vs. Telluride 30-Day VWAP 22% 8% 19% Aggregate Premium Paid $107 $50 $88 % of Market Cap 4.8% 2.3% 4.1% Certares Framework (w/o ) Comparison of Illustrative Transaction Frameworks Source: Company filings, Certares materials and FactSet as of September 11, 2024. Note: Dollars and shares in millions. Analysis reflects 14.0mm Telluride common shares (net of VPF) and 12.8mm Class B common shares owned by Luggage per company filings. Telluride diluted shares outstanding includes ~139mm basic shares and the dilutive impact of ~4mm options with a weighted average exercise price of $34.88, ~13mm RSUs and ~1mm PSUs per company filings. (1) Reflects Certares’ willingness to forego consideration for additional cash / stock consideration, reflecting $46mm of value. (2) Assumes illustrative term of 3 years. (3) Includes the potential value of Telluride penny-warrants. (1) Comparison of Frameworks (Telluride Perspective) Commentary Relative to Certares’ previous framework submitted on August 30, they have: – Reduced the consideration to Luggage Common from $25mm to $20mm – Reduced the total consideration to Certares excluding the potential value of Telluride penny-warrants from $130mm to $100mm – Including the potential value of penny-warrants, reduced the total consideration to Certares from ~$143mm to ~$113mm – Reduced the aggregate premium paid from ~$107mm to ~$88mm(3) A D B C A B C D |

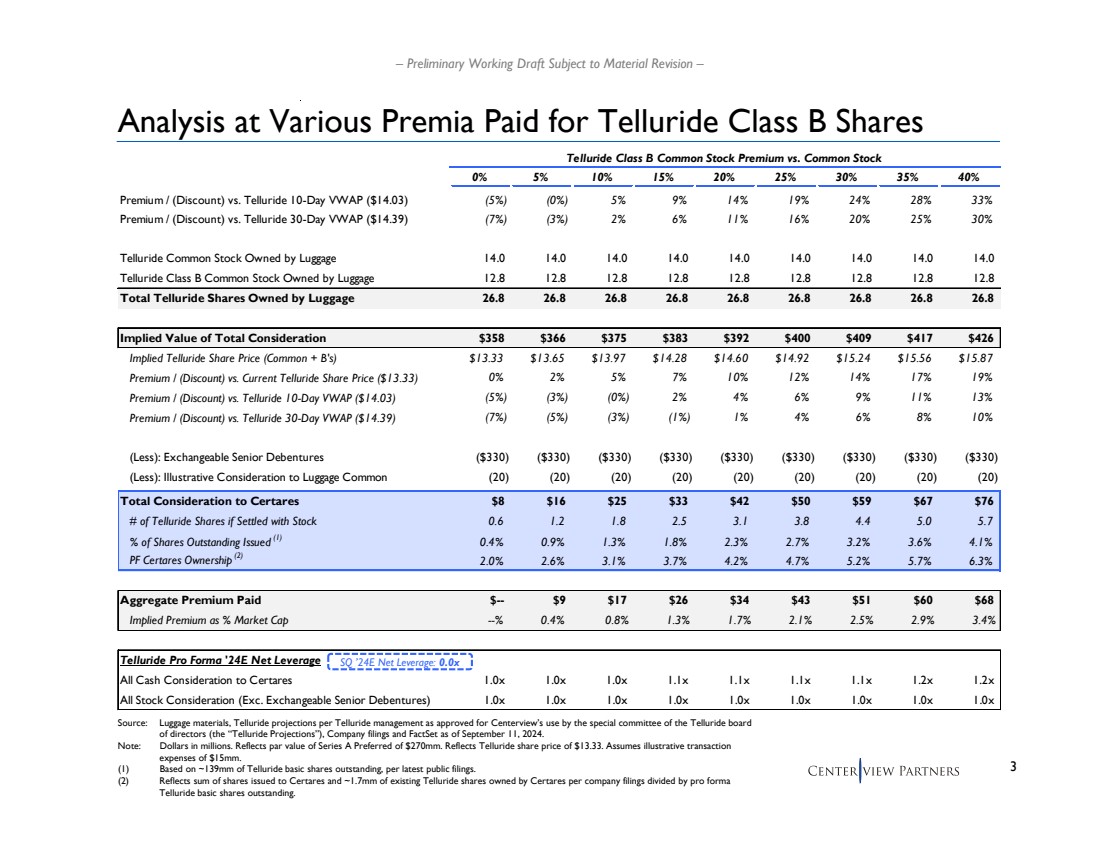

| 3 – Preliminary Working Draft Subject to Material Revision – Telluride Class B Common Stock Premium vs. Common Stock 0% 5% 10% 15% 20% 25% 30% 35% 40% Premium / (Discount) vs. Telluride 10-Day VWAP ($14.03) (5%) (0%) 5% 9% 14% 19% 24% 28% 33% Premium / (Discount) vs. Telluride 30-Day VWAP ($14.39) (7%) (3%) 2% 6% 11% 16% 20% 25% 30% Telluride Common Stock Owned by Luggage 14.0 14.0 14.0 14.0 14.0 14.0 14.0 14.0 14.0 Telluride Class B Common Stock Owned by Luggage 12.8 12.8 12.8 12.8 12.8 12.8 12.8 12.8 12.8 Total Telluride Shares Owned by Luggage 26.8 26.8 26.8 26.8 26.8 26.8 26.8 26.8 26.8 Implied Value of Total Consideration $358 $366 $375 $383 $392 $400 $409 $417 $426 Implied Telluride Share Price (Common + B's) $13.33 $13.65 $13.97 $14.28 $14.60 $14.92 $15.24 $15.56 $15.87 Premium / (Discount) vs. Current Telluride Share Price ($13.33) 0% 2% 5% 7% 10% 12% 14% 17% 19% Premium / (Discount) vs. Telluride 10-Day VWAP ($14.03) (5%) (3%) (0%) 2% 4% 6% 9% 11% 13% Premium / (Discount) vs. Telluride 30-Day VWAP ($14.39) (7%) (5%) (3%) (1%) 1% 4% 6% 8% 10% (Less): Exchangeable Senior Debentures ($330) ($330) ($330) ($330) ($330) ($330) ($330) ($330) ($330) (Less): Illustrative Consideration to Luggage Common (20) (20) (20) (20) (20) (20) (20) (20) (20) Total Consideration to Certares $8 $16 $25 $33 $42 $50 $59 $67 $76 # of Telluride Shares if Settled with Stock 0.6 1.2 1.8 2.5 3.1 3.8 4.4 5.0 5.7 % of Shares Outstanding Issued (1) 0.4% 0.9% 1.3% 1.8% 2.3% 2.7% 3.2% 3.6% 4.1% PF Certares Ownership (2) 2.0% 2.6% 3.1% 3.7% 4.2% 4.7% 5.2% 5.7% 6.3% Aggregate Premium Paid $-- $9 $17 $26 $34 $43 $51 $60 $68 Implied Premium as % Market Cap --% 0.4% 0.8% 1.3% 1.7% 2.1% 2.5% 2.9% 3.4% Telluride Pro Forma '24E Net Leverage All Cash Consideration to Certares 1.0x 1.0x 1.0x 1.1x 1.1x 1.1x 1.1x 1.2x 1.2x All Stock Consideration (Exc. Exchangeable Senior Debentures) 1.0x 1.0x 1.0x 1.0x 1.0x 1.0x 1.0x 1.0x 1.0x Analysis at Various Premia Paid for Telluride Class B Shares Source: Luggage materials, Telluride projections per Telluride management as approved for Centerview’s use by the special committee of the Telluride board of directors (the “Telluride Projections”), Company filings and FactSet as of September 11, 2024. Note: Dollars in millions. Reflects par value of Series A Preferred of $270mm. Reflects Telluride share price of $13.33. Assumes illustrative transaction expenses of $15mm. (1) Based on ~139mm of Telluride basic shares outstanding, per latest public filings. (2) Reflects sum of shares issued to Certares and ~1.7mm of existing Telluride shares owned by Certares per company filings divided by pro forma Telluride basic shares outstanding. SQ ’24E Net Leverage: 0.0x |

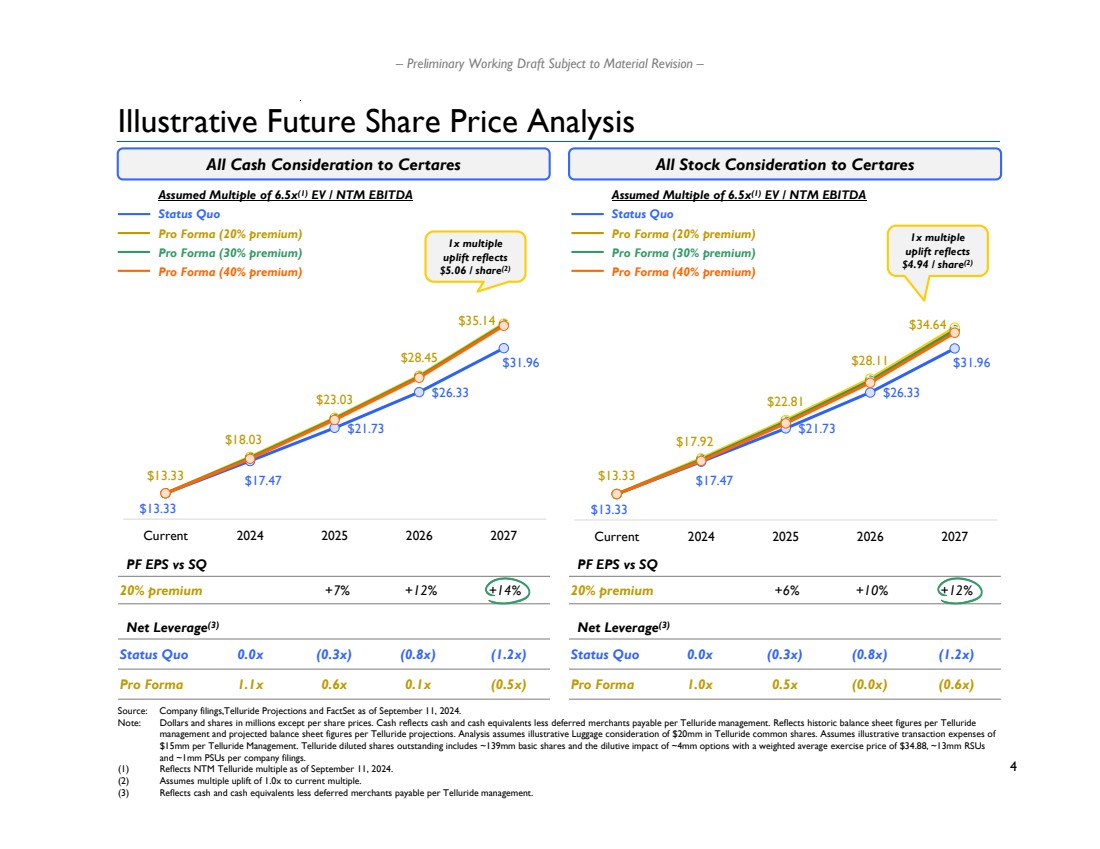

| 4 – Preliminary Working Draft Subject to Material Revision – $13.33 $17.47 $21.73 $26.33 $31.96 $13.33 $18.03 $23.03 $28.45 $35.14 Current 2024 2025 2026 2027 Assumed Multiple of 6.5x(1) EV / NTM EBITDA Status Quo Pro Forma (20% premium) Pro Forma (30% premium) Pro Forma (40% premium) Illustrative Future Share Price Analysis PF EPS vs SQ +7% +12% +14% Net Leverage(3) Status Quo Pro Forma 0.0x (0.3x) (0.8x) 1.1x 0.6x 0.1x Assumed Multiple of 6.5x(1) EV / NTM EBITDA Status Quo Pro Forma (20% premium) Pro Forma (30% premium) Pro Forma (40% premium) 20% premium All Cash Consideration to Certares All Stock Consideration to Certares PF EPS vs SQ +6% +10% +12% Net Leverage(3) Status Quo Pro Forma 0.0x (0.3x) (0.8x) 1.0x 0.5x (0.0x) 20% premium $13.33 $17.47 $21.73 $26.33 $31.96 $13.33 $17.92 $22.81 $28.11 $34.64 Current 2024 2025 2026 2027 (1.2x) (0.5x) (1.2x) (0.6x) 1x multiple uplift reflects $5.06 / share(2) 1x multiple uplift reflects $4.94 / share(2) Source: Company filings,Telluride Projections and FactSet as of September 11, 2024. Note: Dollars and shares in millions except per share prices. Cash reflects cash and cash equivalents less deferred merchants payable per Telluride management. Reflects historic balance sheet figures per Telluride management and projected balance sheet figures per Telluride projections. Analysis assumes illustrative Luggage consideration of $20mm in Telluride common shares. Assumes illustrative transaction expenses of $15mm per Telluride Management. Telluride diluted shares outstanding includes ~139mm basic shares and the dilutive impact of ~4mm options with a weighted average exercise price of $34.88, ~13mm RSUs and ~1mm PSUs per company filings. (1) Reflects NTM Telluride multiple as of September 11, 2024. (2) Assumes multiple uplift of 1.0x to current multiple. (3) Reflects cash and cash equivalents less deferred merchants payable per Telluride management. |

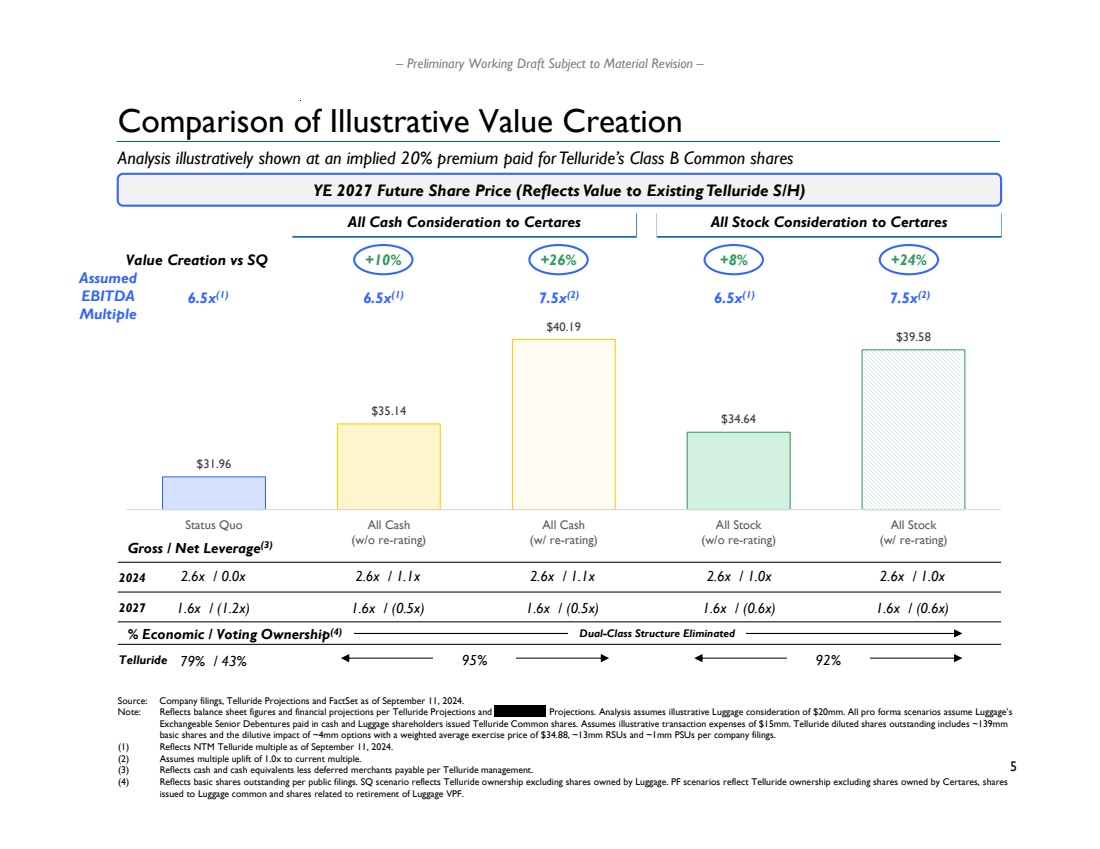

| 5 – Preliminary Working Draft Subject to Material Revision – Value Creation vs SQ +26% Assumed EBITDA Multiple +10% All Cash Consideration to Certares All Stock Consideration to Certares +8% +24% $31.96 $35.14 $40.19 $34.64 $39.58 Status Quo All Cash (w/o re-rating) All Cash (w/ re-rating) All Stock (w/o re-rating) All Stock (w/ re-rating) Comparison of Illustrative Value Creation YE 2027 Future Share Price (Reflects Value to Existing Telluride S/H) % Economic / Voting Ownership(4) Telluride 79% / 43% 95% Dual-Class Structure Eliminated 92% Gross / Net Leverage(3) 2024 2.6x / 0.0x 2027 1.6x / (1.2x) 2.6x / 1.1x 1.6x / (0.5x) 2.6x / 1.1x 1.6x / (0.5x) 2.6x / 1.0x 2.6x / 1.0x 1.6x / (0.6x) 1.6x / (0.6x) Analysis illustratively shown at an implied 20% premium paid for Telluride’s Class B Common shares 6.5x(1) 7.5x(2) 6.5x(1) 7.5x(2) 6.5x(1) Source: Company filings, Telluride Projections and FactSet as of September 11, 2024. Note: Reflects balance sheet figures and financial projections per Telluride Projections and Projections. Analysis assumes illustrative Luggage consideration of $20mm. All pro forma scenarios assume Luggage’s Exchangeable Senior Debentures paid in cash and Luggage shareholders issued Telluride Common shares. Assumes illustrative transaction expenses of $15mm. Telluride diluted shares outstanding includes ~139mm basic shares and the dilutive impact of ~4mm options with a weighted average exercise price of $34.88, ~13mm RSUs and ~1mm PSUs per company filings. (1) Reflects NTM Telluride multiple as of September 11, 2024. (2) Assumes multiple uplift of 1.0x to current multiple. (3) Reflects cash and cash equivalents less deferred merchants payable per Telluride management. (4) Reflects basic shares outstanding per public filings. SQ scenario reflects Telluride ownership excluding shares owned by Luggage. PF scenarios reflect Telluride ownership excluding shares owned by Certares, shares issued to Luggage common and shares related to retirement of Luggage VPF. |

| Supplementary Materials Appendix |

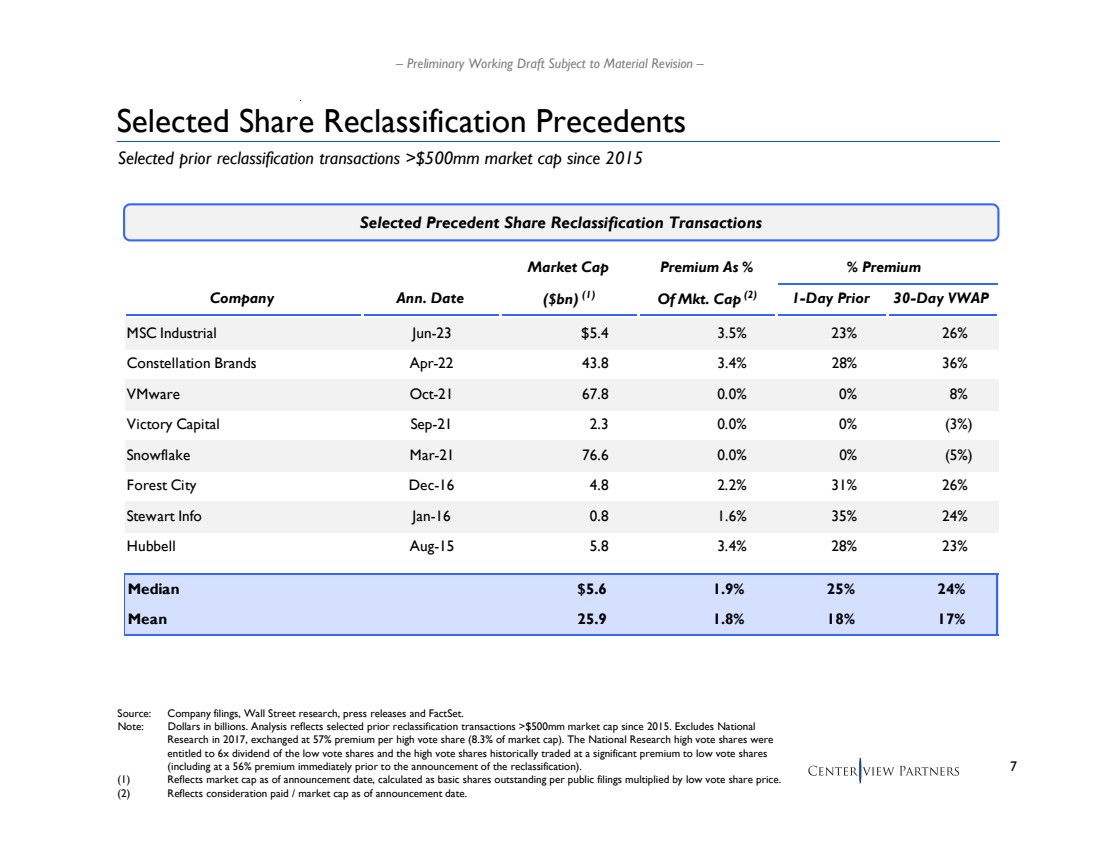

| 7 – Preliminary Working Draft Subject to Material Revision – Selected Share Reclassification Precedents Source: Company filings, Wall Street research, press releases and FactSet. Note: Dollars in billions. Analysis reflects selected prior reclassification transactions >$500mm market cap since 2015. Excludes National Research in 2017, exchanged at 57% premium per high vote share (8.3% of market cap). The National Research high vote shares were entitled to 6x dividend of the low vote shares and the high vote shares historically traded at a significant premium to low vote shares (including at a 56% premium immediately prior to the announcement of the reclassification). (1) Reflects market cap as of announcement date, calculated as basic shares outstanding per public filings multiplied by low vote share price. (2) Reflects consideration paid / market cap as of announcement date. Selected prior reclassification transactions >$500mm market cap since 2015 Selected Precedent Share Reclassification Transactions Market Cap Premium As % % Premium Company Ann. Date ($bn) (1) Of Mkt. Cap (2) 1-Day Prior 30-Day VWAP MSC Industrial Jun-23 $5.4 3.5% 23% 26% Constellation Brands Apr-22 43.8 3.4% 28% 36% VMware Oct-21 67.8 0.0% 0% 8% Victory Capital Sep-21 2.3 0.0% 0% (3%) Snowflake Mar-21 76.6 0.0% 0% (5%) Forest City Dec-16 4.8 2.2% 31% 26% Stewart Info Jan-16 0.8 1.6% 35% 24% Hubbell Aug-15 5.8 3.4% 28% 23% Median $5.6 1.9% 25% 24% Mean 25.9 1.8% 18% 17% |

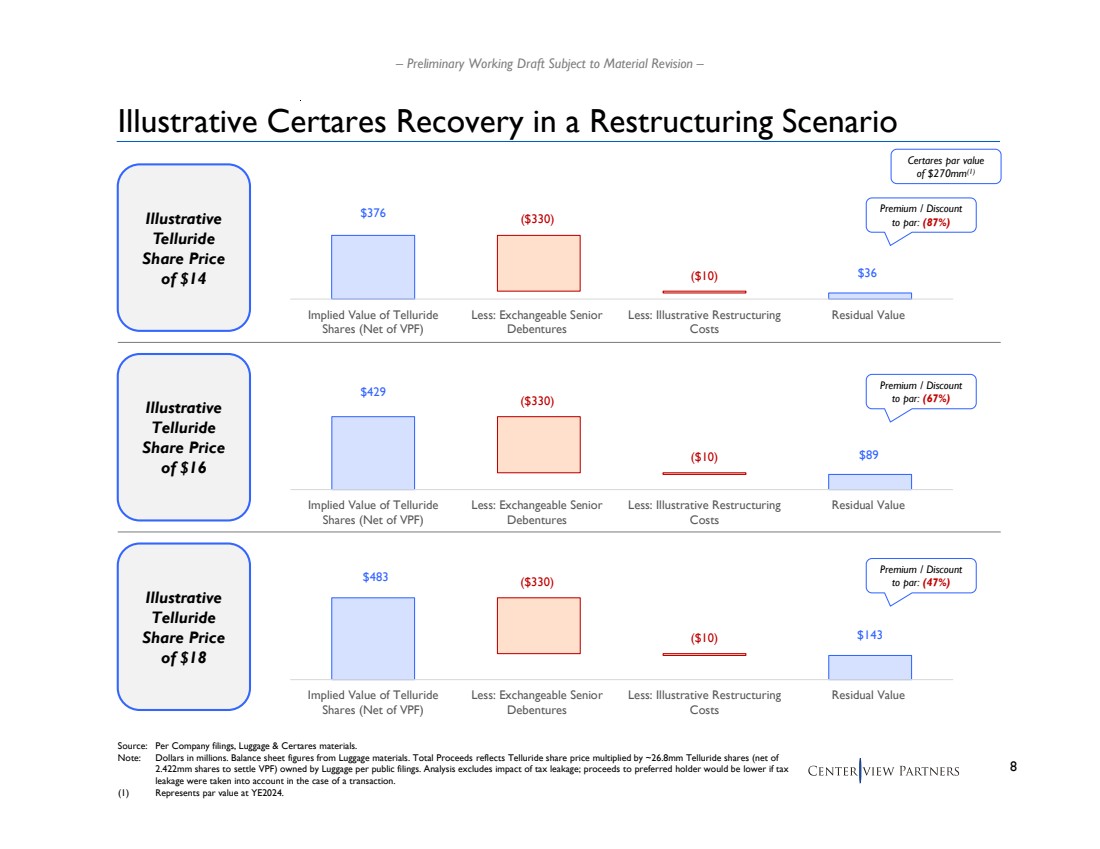

| 8 – Preliminary Working Draft Subject to Material Revision – Illustrative Certares Recovery in a Restructuring Scenario Illustrative Telluride Share Price of $14 Source: Per Company filings, Luggage & Certares materials. Note: Dollars in millions. Balance sheet figures from Luggage materials. Total Proceeds reflects Telluride share price multiplied by ~26.8mm Telluride shares (net of 2.422mm shares to settle VPF) owned by Luggage per public filings. Analysis excludes impact of tax leakage; proceeds to preferred holder would be lower if tax leakage were taken into account in the case of a transaction. (1) Represents par value at YE2024. Illustrative Telluride Share Price of $16 Illustrative Telluride Share Price of $18 $376 $36 ($330) ($10) Implied Value of Telluride Shares (Net of VPF) Less: Exchangeable Senior Debentures Less: Illustrative Restructuring Costs Residual Value $429 $89 ($330) ($10) Implied Value of Telluride Shares (Net of VPF) Less: Exchangeable Senior Debentures Less: Illustrative Restructuring Costs Residual Value $483 $143 ($330) ($10) Implied Value of Telluride Shares (Net of VPF) Less: Exchangeable Senior Debentures Less: Illustrative Restructuring Costs Residual Value Premium / Discount to par: (87%) Premium / Discount to par: (67%) Premium / Discount to par: (47%) Certares par value of $270mm(1) |

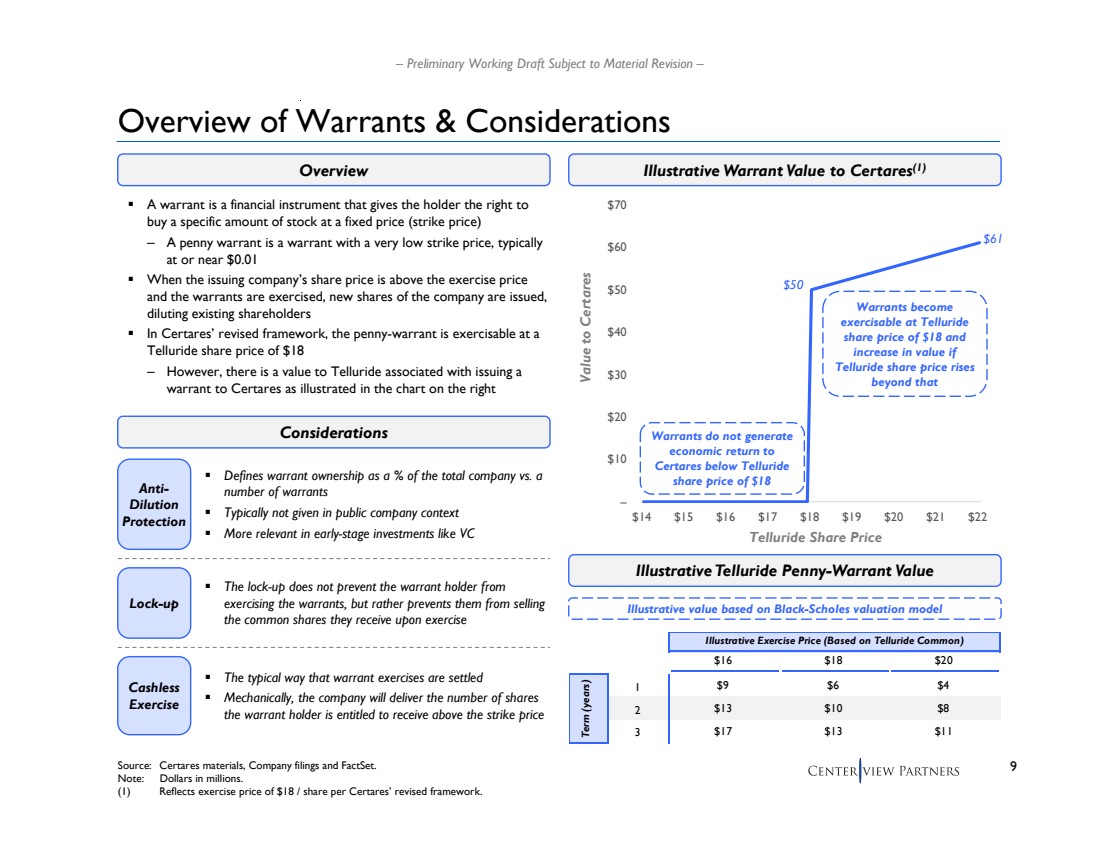

| 9 – Preliminary Working Draft Subject to Material Revision – A warrant is a financial instrument that gives the holder the right to buy a specific amount of stock at a fixed price (strike price) – A penny warrant is a warrant with a very low strike price, typically at or near $0.01 When the issuing company’s share price is above the exercise price and the warrants are exercised, new shares of the company are issued, diluting existing shareholders In Certares’ revised framework, the penny-warrant is exercisable at a Telluride share price of $18 – However, there is a value to Telluride associated with issuing a warrant to Certares as illustrated in the chart on the right Overview of Warrants & Considerations Defines warrant ownership as a % of the total company vs. a number of warrants Typically not given in public company context More relevant in early-stage investments like VC Overview Considerations Source: Certares materials, Company filings and FactSet. Note: Dollars in millions. (1) Reflects exercise price of $18 / share per Certares’ revised framework. Illustrative Warrant Value to Certares(1) – $10 $20 $30 $40 $50 $60 $70 $14 $15 $16 $17 $18 $19 $20 $21 $22 Telluride Share Price Value to Certares $50 $61 Anti-Dilution Protection Lock-up Cashless Exercise The lock-up does not prevent the warrant holder from exercising the warrants, but rather prevents them from selling the common shares they receive upon exercise The typical way that warrant exercises are settled Mechanically, the company will deliver the number of shares the warrant holder is entitled to receive above the strike price Warrants do not generate economic return to Certares below Telluride share price of $18 Warrants become exercisable at Telluride share price of $18 and increase in value if Telluride share price rises beyond that Illustrative value based on Black-Scholes valuation model Illustrative Telluride Penny-Warrant Value Illustrative Exercise Price (Based on Telluride Common) $16 $18 $20 1 $9 $6 $4 2 $13 $10 $8 Term (years) 3 $17 $13 $11 |

| 10 – Preliminary Working Draft Subject to Material Revision – We Are Aligned On A Transaction Framework Exchangeable Senior Debentures Variable Prepaid Forward Luggage Common Equity Cash or Telluride Common shares to help facilitate the Luggage shareholder vote 2.422mm Telluride Common shares to be settled in advance of transaction Assumed by Telluride and repaid at par for $330mm in cash Series A Preferred Stock Cash or Telluride Common shares as an alternative to Luggage Stakeholder Consideration Received Alignment Transaction Expenses Luggage cash on hand used to pay expenses related to wind-up Telluride Illustrative Transaction Framework Delivered to Luggage on 9/6 |

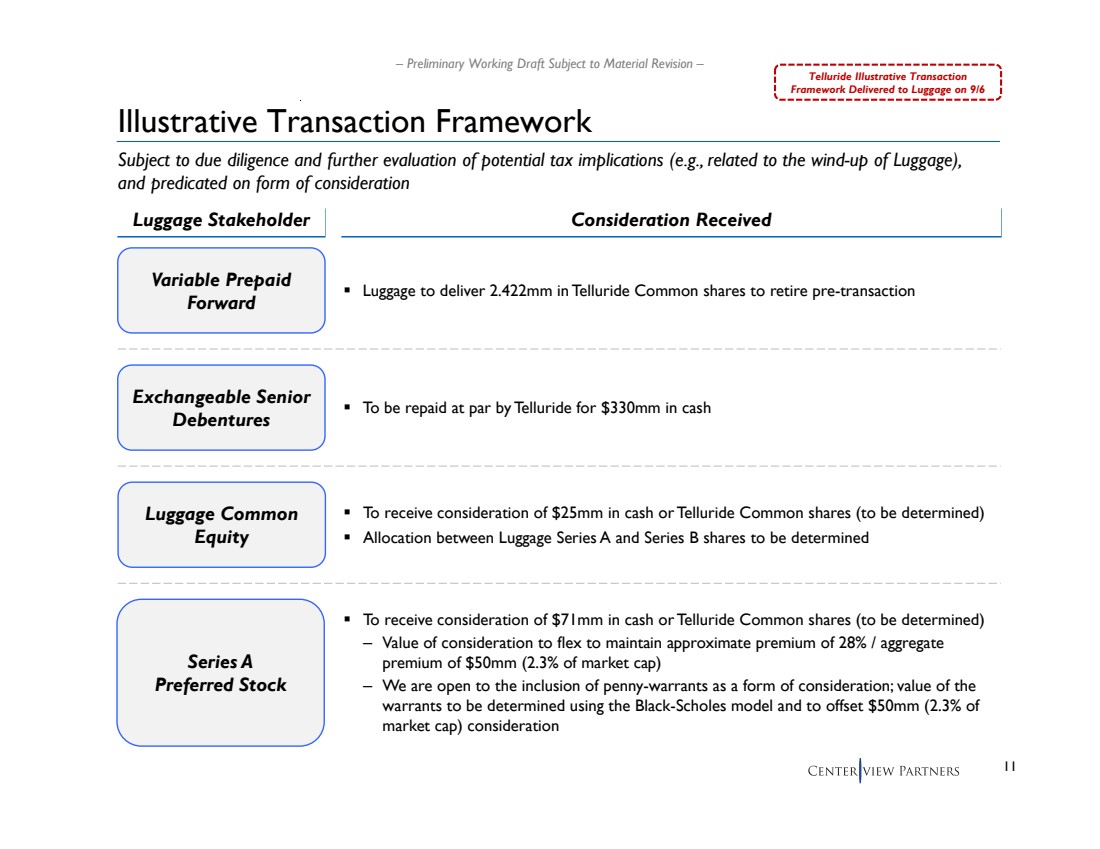

| 11 – Preliminary Working Draft Subject to Material Revision – Illustrative Transaction Framework Consideration Received Luggage Common Equity To receive consideration of $25mm in cash or Telluride Common shares (to be determined) Allocation between Luggage Series A and Series B shares to be determined Exchangeable Senior Debentures To be repaid at par by Telluride for $330mm in cash Variable Prepaid Forward Luggage to deliver 2.422mm in Telluride Common shares to retire pre-transaction Series A Preferred Stock To receive consideration of $71mm in cash or Telluride Common shares (to be determined) – Value of consideration to flex to maintain approximate premium of 28% / aggregate premium of $50mm (2.3% of market cap) – We are open to the inclusion of penny-warrants as a form of consideration; value of the warrants to be determined using the Black-Scholes model and to offset $50mm (2.3% of market cap) consideration Subject to due diligence and further evaluation of potential tax implications (e.g., related to the wind-up of Luggage), and predicated on form of consideration Luggage Stakeholder Telluride Illustrative Transaction Framework Delivered to Luggage on 9/6 |

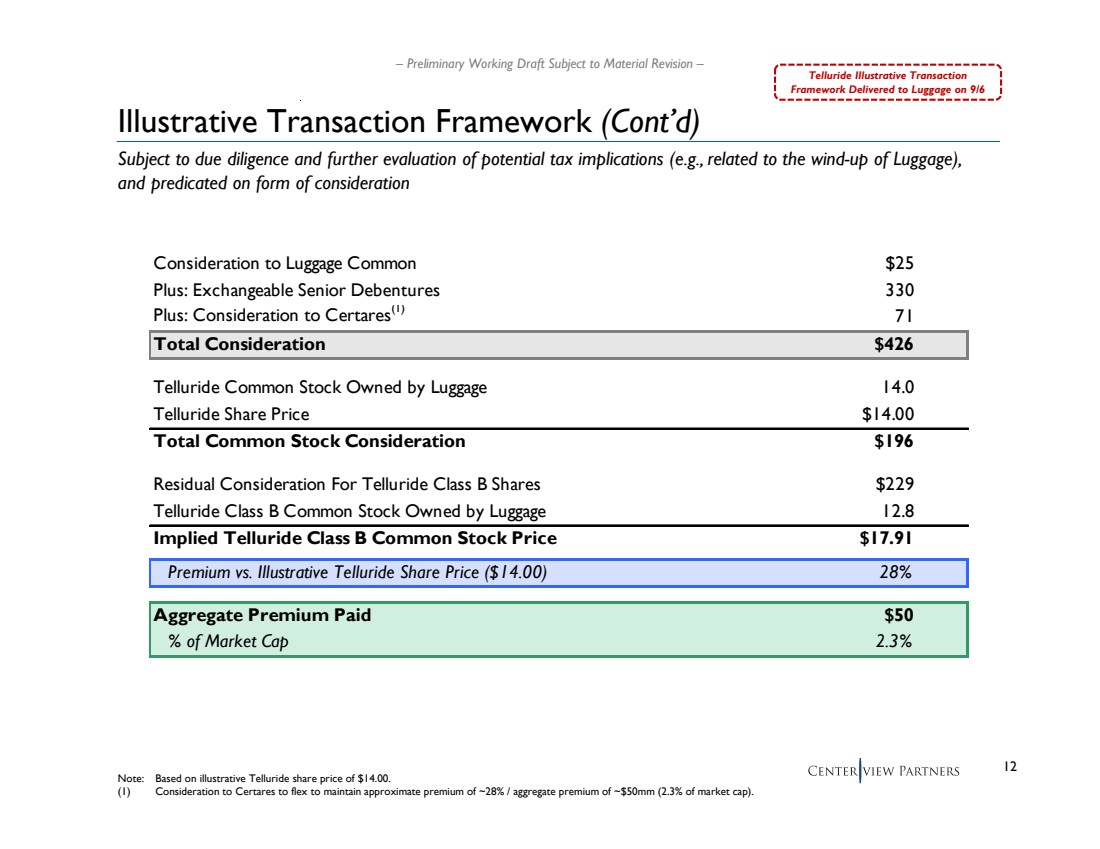

| 12 – Preliminary Working Draft Subject to Material Revision – Illustrative Transaction Framework (Cont’d) Subject to due diligence and further evaluation of potential tax implications (e.g., related to the wind-up of Luggage), and predicated on form of consideration Note: Based on illustrative Telluride share price of $14.00. (1) Consideration to Certares to flex to maintain approximate premium of ~28% / aggregate premium of ~$50mm (2.3% of market cap). Consideration to Luggage Common $25 Plus: Exchangeable Senior Debentures 330 Plus: Consideration to Certares(1) 71 Total Consideration $426 Telluride Common Stock Owned by Luggage 14.0 Telluride Share Price $14.00 Total Common Stock Consideration $196 Residual Consideration For Telluride Class B Shares $229 Telluride Class B Common Stock Owned by Luggage 12.8 Implied Telluride Class B Common Stock Price $17.91 Premium vs. Illustrative Telluride Share Price ($14.00) 28% Aggregate Premium Paid $50 % of Market Cap 2.3% Telluride Illustrative Transaction Framework Delivered to Luggage on 9/6 |

| 13 – Preliminary Working Draft Subject to Material Revision – Disclaimer This presentation has been prepared by Centerview Partners LLC (“Centerview”) for use solely by the Special Committee of the Board of Directors of Telluride, Inc. (“Telluride” or the “Company”) in connection with its evaluation of proposed strategic alternatives for Telluride and for no other purpose. The information contained herein is based upon information supplied by or on behalf of Telluride and publicly available information, and portions of the information contained herein may be based upon statements, estimates and forecasts provided by Telluride. Centerview has relied upon the accuracy and completeness of the foregoing information, and has not assumed any responsibility for any independent verification of such information or for any independent evaluation or appraisal of any of the assets or liabilities (contingent or otherwise) of Telluride or any other entity, or concerning the solvency or fair value of Telluride or any other entity. The financial analysis in this presentation is complex and is not necessarily susceptible to a partial analysis or summary description. In performing this financial analysis, Centerview has considered the results of its analysis as a whole and did not necessarily attribute a particular weight to any particular portion of the analysis considered. Furthermore, selecting any portion of Centerview’s analysis, without considering the analysis as a whole, would create an incomplete view of the process underlying its financial analysis. Centerview may have deemed various assumptions more or less probable than other assumptions, so the reference ranges resulting from any particular portion of the analysis described above should not be taken to be Centerview’s view of the actual value of Telluride. These materials and the information contained herein are confidential, were not prepared with a view toward public disclosure, and may not be disclosed publicly or made available to third parties without the prior written consent of Centerview. These materials and any other advice, written or oral, rendered by Centerview are intended solely for the benefit and use of the Special Committee of the Board of Directors of Telluride (in its capacity as such) in its consideration of strategic alternatives, and are not for the benefit of, and do not convey any rights or remedies for any holder of securities of Telluride or any other person. Centerview will not be responsible for and has not provided any tax, accounting, actuarial, legal or other specialist advice. These materials are not intended to provide the sole basis for evaluating strategic alternatives, and this presentation does not represent a fairness opinion, recommendation, valuation or opinion of any kind, and is necessarily incomplete and should be viewed solely in conjunction with the oral presentation provided by Centerview. |